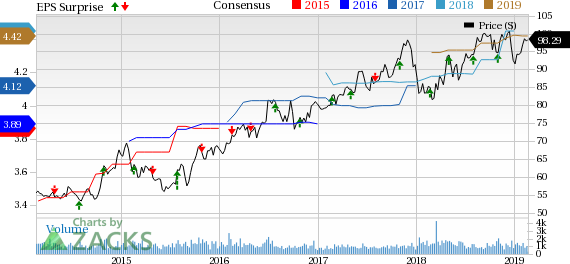

IDACORP, Inc. (NYSE:IDA) delivered fourth-quarter 2018 operating earnings of 52 cents per share, which beat the Zacks Consensus Estimate of 48 cents by 8.3%. However, the figure fell 32.5% from 77 cents in the year-ago quarter.

In 2018, the company generated earnings of $4.49 per share compared with $4.21 in2017.

The full year figure improved owing to consistent strong customer growth in Idaho Power’s service area along with constructive regulatory outcomes and a return to more normal irrigation sales.

Net income fell $12.8 million to $26.1 million in the fourth quarter of 2018, primarily due to lower net income at Idaho Power.

IDACORP, Inc. Price, Consensus and EPS Surprise

Guidance

Management guided 2019 EPS in the range of $4.30-$4.45, whose mid-point of $4.37 is lower than the current Zacks Consensus Estimate of $4.42.

The company expects operating and maintenance expenses related to Idaho Power for 2019 in the range of $350-$360 million.

Zacks Rank

Currently, IDACORP has a Zacks Rank #2 (Buy).

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Other Utility Releases

NextEra Energy, Inc (NYSE:NEE) delivered fourth-quarter 2018 adjusted earnings of $1.49 per share, which lagged the Zacks Consensus Estimate of $1.51 by 1.3%.

American Electric Power Co., Inc (NYSE:AEP) generated fourth-quarter 2018 operating EPS of 72 cents, in line with the Zacks Consensus Estimate.

Xcel Energy Inc (NASDAQ:XEL) posted fourth-quarter 2018 operating earnings of 42 cents per share, in line with the Zacks Consensus Estimate.

Today's Best Stocks from Zacks

Would you like to see the updated picks from our best market-beating strategies? From 2017 through 2018, while the S&P 500 gained +15.8%, five of our screens returned +38.0%, +61.3%, +61.6%, +68.1%, and +98.3%.

This outperformance has not just been a recent phenomenon. From 2000 – 2018, while the S&P averaged +4.8% per year, our top strategies averaged up to +56.2% per year.

See their latest picks free >>

NextEra Energy, Inc. (NEE): Free Stock Analysis Report

Xcel Energy Inc. (XEL): Free Stock Analysis Report

American Electric Power Company, Inc. (AEP): Free Stock Analysis Report

IDACORP, Inc. (IDA): Free Stock Analysis Report

Original post

Zacks Investment Research