IBM Corp. (NYSE:IBM) recently announced that it has added four new global data center facilities. Two of these are located in London, England, one in San Jose, CA and the other in Sydney, Australia.

The recent additions take the tally of IBM’s global data centers to 60 across 19 countries. The new data centers are equipped with the required cloud infrastructure to help clients develop cognitive artificial intelligence (AI) and Internet of Things (IoT) solutions and Blockchain applications.

IBM had opened four data centers in April this year, two in Dallas, TX and two in Washington, D.C. The company is spending on its cloud offerings and data centers and we believe the segment will help the company to post a turnaround.

Notably, the company has underperformed the S&P 500 on a year-to-date basis. While the index gained 12.1%, the stock lost 9.5% over the same time frame.

IBM’s Cloud Performance

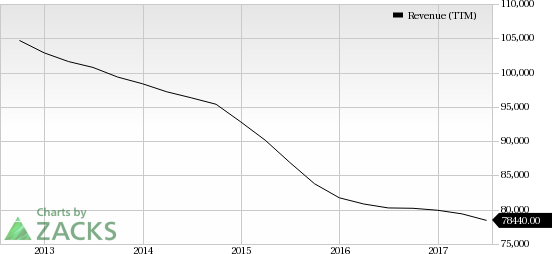

IBM has been shifting from its traditional businesses to cloud and data analytics. In the recently reported second-quarter 2017 results, cloud revenues increased 17% to $3.9 billion. The annual run rate for cloud as-a-service revenues increased 30% (up 32% at cc) on a year-over-year basis to $8.8 billion. Cloud revenues, on a trailing 12-month basis, are now over $15 billion, almost 20% of the company’s total revenue.

The company is also pushing into the hybrid cloud segment, which is a combination of private and public cloud infrastructure. Llyods Bank and American Airlines chose IBM’s hybrid cloud services in the second quarter.

In a recent article, Forbes quoted Bain & Company stating that global cloud information technology market revenues are expected to increase from $180 billion in 2015 to $390 billion in 2020, at a compound annual growth rate (CAGR) of 17%. Per Gartner, by 2020, 90% of organizations will adopt hybrid infrastructure.

We believe IBM is slowly establishing its footprint in the cloud services market with the addition of new data centers, introduction of services like cloud container services in Australia datacenters and deployment of solutions like BlockChain and Watson on its cloud platform. These will eventually assist the company to compete against the likes of Microsoft (NASDAQ:MSFT) , Amazon (NASDAQ:AMZN) and Salesforce (NYSE:CRM) .

Zacks Rank

IBM currently has a Zacks Rank #3 (Hold).

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

3 Top Picks to Ride the Hottest Tech Trend

Zacks just released a Special Report to guide you through a space that has already begun to transform our entire economy...

Last year, it was generating $8 billion in global revenues. By 2020, it's predicted to blast through the roof to $47 billion. Famed investor Mark Cuban says it will produce "the world's first trillionaires," but that should still leave plenty of money for those who make the right trades early.

Download Report with 3 Top Tech Stocks >>

International Business Machines Corporation (IBM): Free Stock Analysis Report

Amazon.com, Inc. (AMZN): Free Stock Analysis Report

Microsoft Corporation (MSFT): Free Stock Analysis Report

Salesforce.com Inc (CRM): Free Stock Analysis Report

Original post

Zacks Investment Research