International Business Machines Corporation (NYSE:IBM) recently announced that IBM Cloud will be utilized by RemoteMyApp, a game streaming startup based out of Poland.

IBM Cloud will aid RemoteMyApp to expand global market reach and enhance its flagship gaming platform, Vortex.

Vortex was introduced in 2017, and has approximately 6 million users. Monthly subscription plans of Vortex offers players access to approximately 100 games with gameplay of almost 100 hours.

IBM’s robust data servers will enable Vortex to deliver low latency, high efficiency and enhanced performance gaming services in a secure cloud infrastructure.

Increasing number of gamers and growing clout of mobile devices is fueling the demand for robust cloud platforms to streamline online gaming services.

We believe this deal win to be a positive given the increasing allegiance of major hyperscale cloud service providers (CSPs) like Microsoft (NASDAQ:MSFT) and, Amazon (NASDAQ:AMZN) , in gaming domain.

In the recent past, Firemonkeys, an Electronic Arts (NASDAQ:EA) studio, focused on providing immersive entertainment experiences to mobile gamers, adopted IBM Cloud. Notably, other gaming wins include Exit Games and LiquidSky.

What’s Favoring IBM Cloud Adoption?

IBM's strength in automation, cognitive and optimization capabilities enable enterprises to run business processes efficiently in a cloud infrastructure. This is one of the key drivers behind increasing deal wins.

Moreover, IBM’s cloud capabilities and synergies from RedHat acquisition (pending) are anticipated to aid the company in winning more cloud deals.

As players seek real-time end-to-end updates, dynamic improvement in machine learning (ML) and edge computing is revolutionizing gaming. Per latest IHS Markit data, “consumer spending on cloud gaming content subscriptions reached $234 million in 2018 and is forecast to grow to $1.5 billion by 2023.”

The robust growth in cloud gaming market and increasing focus on video game streaming platforms presents significant growth opportunity for IBM.

Also, IBM cloud is witnessing increasing adoption across businesses based in Europe as evident from this deal. Notably, IBM Cloud offers local EU-based support to its clientele by which access can be confined to solely EU-based IBM employees. These factors are aiding the tech giant expand foothold in Europe.

According to latest fourth-quarter data from Synergy Research, IBM is a “strong leader in the hosted private cloud services segment of the market.”

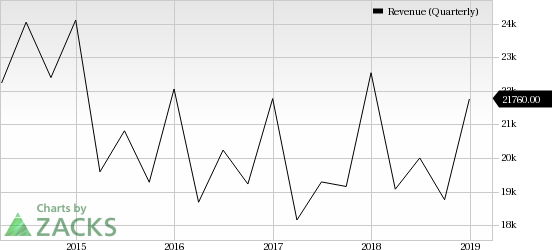

In the fourth quarter of fiscal 2018, IBM reported cloud revenues of $19.2 billion on a trailing 12-month basis, increasing 12% year over year. The annual run rate for cloud as-a-service revenue increased 21% at constant currency (cc) on a year-over-year basis to $12.2 billion. Increasing adoption of the company's cloud platform is likely to boost cloud revenues further, going forward.

Wrapping Up

IBM is introducing several initiatives to bolster experience of the entities involved in sports leagues, from players, coaches, fans to management. The sturdy artificial intelligence (AI) capabilities of IBM positions it well to facilitate digital overhaul of various gaming companies, sports organizations and clubs with enhanced player and fan engagement.

Notable alliances include US Open, Wimbledon, and Corinthians Paulista, to mention a few. These are expected to have a positive impact on the company’s top line and position it well to capitalize on the growth prospects in the overall gaming domain.

However, IBM’s time consuming transition to cloud, weakness in traditional businesses and ballooning debt levels are major headwinds.

Zacks Rank

IBM carries a Zacks Rank #3 (Hold).

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Today's Best Stocks from Zacks

Would you like to see the updated picks from our best market-beating strategies? From 2017 through 2018, while the S&P 500 gained +15.8%, five of our screens returned +38.0%, +61.3%, +61.6%, +68.1%, and +98.3%.

This outperformance has not just been a recent phenomenon. From 2000 – 2018, while the S&P averaged +4.8% per year, our top strategies averaged up to +56.2% per year.

See their latest picks free >>

International Business Machines Corporation (IBM): Free Stock Analysis Report

Amazon.com, Inc. (AMZN): Free Stock Analysis Report

Microsoft Corporation (MSFT): Free Stock Analysis Report

Electronic Arts Inc. (EA): Free Stock Analysis Report

Original post

Zacks Investment Research