Greetings from Long Beach, California. For those of you who might swoon with envy about the prospect of hanging out on a California “beach”, allow me to share with you the view from my 10th floor hotel window:

So, yeah, it’s like hanging out at the Port of Oakland, but with less charm. All the same, duty calls, and you can probably guess why I’m here.

That won’t prevent me from sharing a few quick thoughts on quiet holiday market action, though. Most important is the ES, which has been down about 6 points all night long. My fervent wish, of course, is that the red horizontal pretty much holds, and we don’t have any breakout above this level based on some misguided belief in Trumponomics. A disappointed retreat would be a stride in my step.

Crude oil, likewise, has been softening. The OPEC/NOPEC surges are a distant memory, and even at this early date there appears to be some splintering in the “historic” cartel agreement.

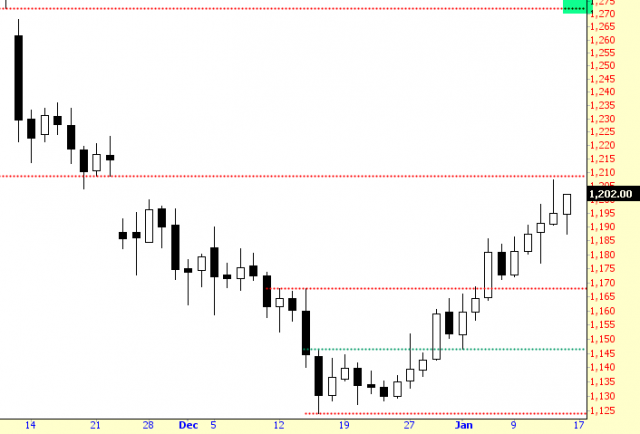

One worrisome spot for me is gold. I covered my GDX (NYSE:GDX) and GLD (NYSE:GLD) shorts late last week at a profit, but I’ve held on to my DUST (NYSE:DUST) long. If we push past 1210, forget about it. The next gap (tinted in green) is a long way off.

Lastly, the pound is getting pounded, falling to depths only seen during the “flash crash” (circled on the left). Apparently it’s a big shocking surprise that the BREXIT actually means a British Exit from the failed euro experiment. People sure are weird, aren’t they?

I’ll close with this story from the cover of the lamentable USA Today money section. Apparently this brain trust wants you to know that the NASDAQ is red-hot because the profit margins of Amazon (NASDAQ:AMZN) and Facebook (NASDAQ:FB) are high. So there’s your hot inside scoop. If you and Gomer want to keep bidding prices up, be my guest. I’ll be steadfastly on the other side, in spite of what the luminaries at USA Today have to proffer.