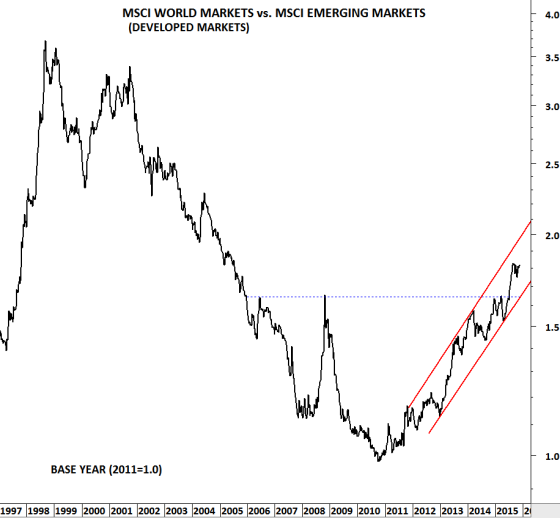

Since the beginning of 2011, developed market equities have been performing better than emerging markets. This trend is still intact.

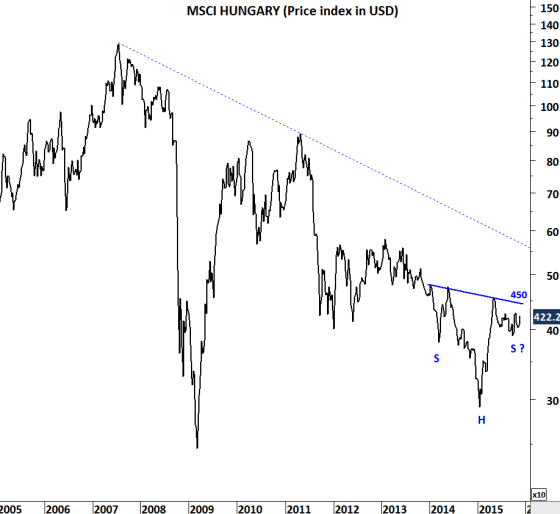

Though there is one emerging European equity market that is showing clear strength against its peers. That is Hungary. Budapest SE is ready for another upward leg, after an initial breakout followed by a pullback.

Since the beginning of the year, MSCI Hungary has been outperforming MSCI Emerging Markets index. Also, a major reversal chart pattern; head and shoulder bottom, might be developing on the MSCI Hungary price index. These are bullish sign for the emerging European country.

Two charts from the constituents of Budapest SE index have positive technical outlook:

OTP Bank (BU:OTPB) formed a flag (or symmetrical triangle) continuation chart pattern.

Richter Gedeon (BU:GDRB) formed a massive bullish ascending triangle.

Breakouts from these chart patterns should resume existing uptrends.