Last week, the dollar fell and equities tread water after central banks globally signaled a more accommodative stance, the U.S. put a band-aid over the partial government shutdown and the overall theme at Davos showed that most leaders or key executives are concerned that political and economic uncertainty will drive down growth momentum in 2019. This week is highlighted by tech earnings, votes on key amendments in U.K. Parliament on Tuesday, Super Wednesday with a FOMC decision and U.S.-China trade talks and the non-farm payroll report on Friday.

USD

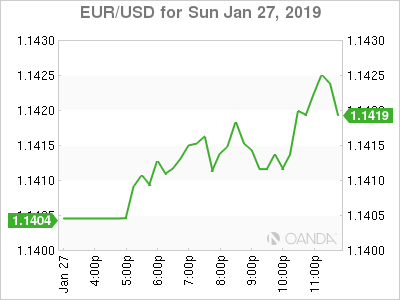

The U.S. dollar fell against its major trading partners after the Wall Street Journal’s report that they are considering an earlier than expected end to the bond portfolio runoff. The Fed is currently tightening via interest rate hikes and shrinking the balance sheet, so the possible signal that the Fed is closer to ending the balance sheet runoff along with expectations the Fed will not consider its next hike until September could be bullish for U.S. stocks and high-beta currencies. The Fed was not the only central bank with a dovish message, both the ECB and the BOJ signaled dovishness and concerns for slower growth. The BOJ cut their inflation outlook for the next three years and see GDP remaining around the 1.0% level. The ECB also acknowledged the weaker round of data and noted that the economic outlook has moved to the downside, a downgrade from the prior stance of “broadly balanced”.

The FOMC rate decision on Wednesday will closely be watched for further details on the Fed’s take on the balance sheet. We’ve come along way from the automatic pilot comment and will look to see if they signal a reduction in the $50 billion monthly amount or a target on when they will stop.

The Nonfarm payrolls are also due on Friday and is expected to show 165,000 new jobs created in January, down from the 312,000 seen in December. The U.S. labor remains the strongest part of the U.S. economy, but we should not be expected if we see a miss with the January report as contract workers were heavily under pressure due to the shutdown.

Shutdown Timeout

The record-long government shutdown ended on Friday when President Trump signed a short-term spending bill to re-open the government. While Democrats appeared to have one this battle, the government is only opened until February 15th, and this band-aid will have trouble leading to a permanent solution as both sides are nowhere near a bending on positions on border wall funding and a path to citizenship for Dreamers.

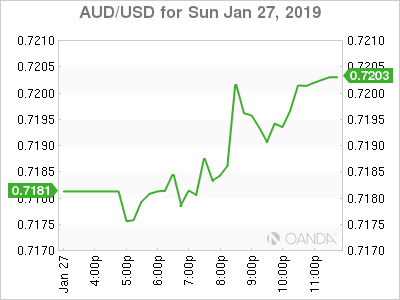

AUD

The Australian dollar will likely take a cue from the latest round of trade talks between China and U.S. Chinese Vice Premier Liu He will have talks in Washington DC from January 30th to 31st, about 5-weeks away from the deadline where we could see the escalation of tariffs on Chinese goods. Some progress has been made, but trade talks could get tougher here and we may see more political posturing until we get closer to the deadline. It is unlikely to see key progress this week on the issue of intellectual property theft and force technology transfers and that could weigh on Asian markets.

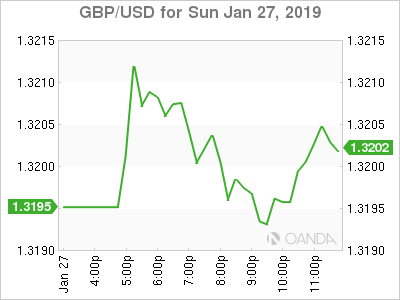

GBP

The Sun reported that British Prime Minister Theresa May explained to cabinet ministers that she will not take the U.K. out of the EU without a deal and that she will not disclose that a no-deal scenario is off the table, as she would lose bargaining power with the EU. Last week’s rally in the Cable was primarily driven on expectations the U.K. will not go through a hard exit. The story in the Sun pretty confirms what everyone was thinking. The focus this week falls on Tuesday’s House of Commons Brexit debate and vote on amendments. PM May lose flexibility in how she handles the last couple months of Brexit. Votes preventing a no-deal Brexit, could have her lose a big bargaining chip and the amendment from Yvette Cooper’s allowing the Commons to pass a bill that would force PM May to seek an article 50 extension if she cannot get her deal passed.

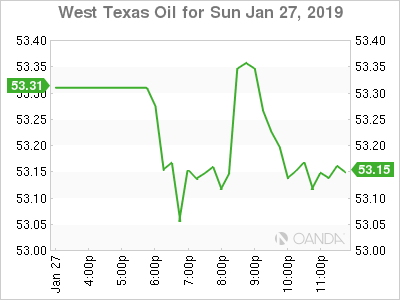

OIL

Crude prices rallied last week to a 2-month high as political turmoil in Venezuela raised expectations we could see even more oil come off the market. Venezuela is the owner of the biggest oil reserves and some analysts could see production falling by a third in 2019. Over the weekend, Venezuelan dictator Nicolas Maduro rebuffed international pressure to call elections within eight days. The pressure from the U.S. sanctions could deliver deeper economic pain to a very vulnerable Venezuela. Currently, most of Latin America and the U.S. recognized opposition leader Juan Guiado as Venezuela’s interim president. Maduro appears to have support from Russia, China and Turkey. Further escalation in sanction action could keep oil prices bid as Venezuela production continues to fall.

TECH WEEK

Tech giants will report this week. Results are expected from Apple (NASDAQ:AAPL), Amazon (NASDAQ:AMZN), Microsoft (NASDAQ:MSFT) and Facebook (NASDAQ:FB). Apple delivered the blow that sent the technology sector crashing on January 2nd after they slashed their revenue forecast for Q1, their first cut since 2002. The iPhone maker will report earnings on Tuesday and many will look for updates on their sales in China and see if they are successfully growing their services business to compensate for the declining trend in smartphone sales.

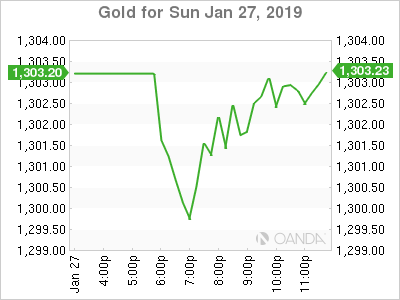

GOLD

Gold prices broke out above $1,300 level, supported by news that the Fed could be ending their balance sheet runoff sooner than they originally expected. The precious metal was also supported by downbeat growth concerns from Davos and dovish ECB, that now sees risks tilted to the downside. The battered tech sector is also reporting earnings this week, and if technology delivers weaker forecast than what is already priced in, we could see safe-havens have another leg higher.