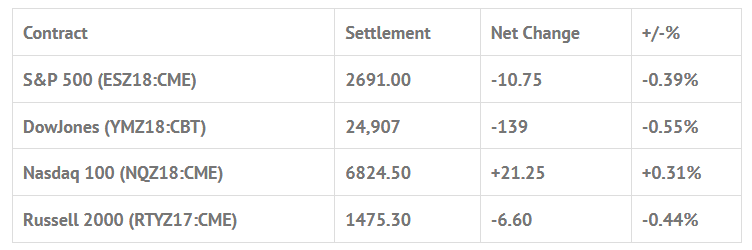

Index Futures Net Changes and Settlements:

Foreign Markets, Fair Value and Volume:

- In Asia 7 out of 11 markets closed higher: Shanghai Comp +0.03%, Hang Seng -0.35%, Nikkei +0.82%

- In Europe 12 out of 13 markets are trading higher: CAC +1.33%, DAX +0.56%, FTSE +1.28%

- Fair Value: S&P +0.71, NASDAQ +3.39, Dow +20.41

- Total Volume: 3.30mil ESZ & 549 SPZ traded in the pit

As of 8:00 AM EST

Today’s Economic Calendar:

Today’s economic calendar includes the Employment Situation 8:30 AM ET, Consumer Sentiment 10:00 AM ET, Wholesale Trade 10:00 AM ET, EIA Natural Gas Report 10:30 AM ET, Lael Brainard Speaks 12:15 PM ET, Baker-Hughes Rig Count 1:00 PM ET, and Consumer Credit 3:00 PM ET.

S&P 500 Futures: Financial Sector At The Lowest Since 2011

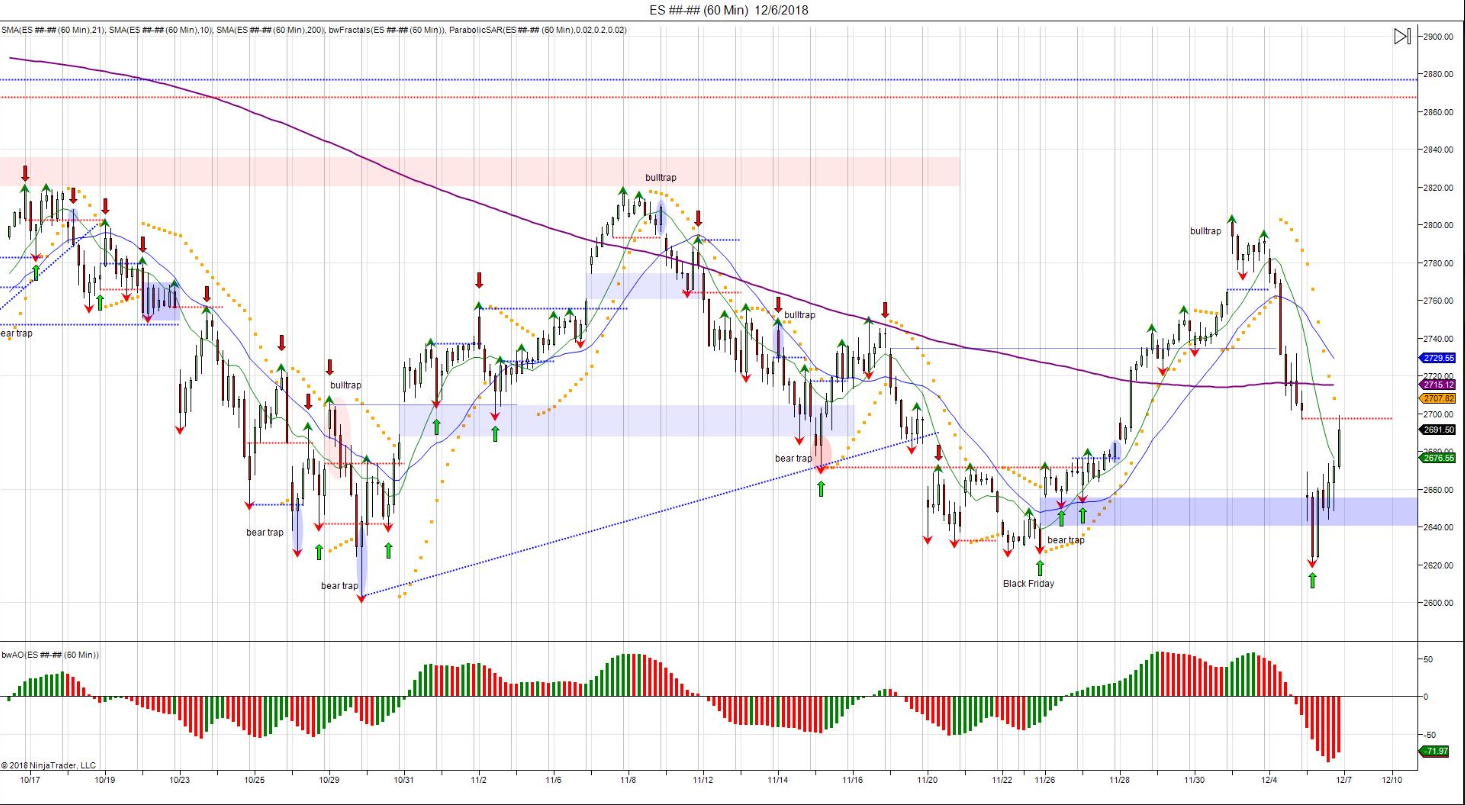

Chart courtesy of @Chicagostock – $ES_F “Rise from the dead” Friday: Cash open >2700 needed to keep shorts from Thurs on hook for buyers to get another shot at 2730. Open <2670 negative, trapping Thursday’s closing buyers for another shot at testing Thurs low.

After selling off on Wednesday’s globex open, and maintaining a lid on any rallies through the overnight, the S&P 500 futures opened yesterday’s regular session at 2656.75. The first move after the bell was a quick break down to early morning low at 2648.50, before quickly pushing higher to what would be the high of day at 2669.25 just 10 minutes later. From there, offers hit the tape pulling the ES down to 2643.50 going into the 9:00 hour, and after a 15.25 handle rally, the futures once again turned negative, making their way down to a late morning low of 2621.25.

The afternoon saw a 23.75 handle pullback, but a series of higher lows, that in turn lead to higher highs, helped the ES retrace much of the day’s losses. The benchmark futures made a late day high of 2699.25 as the MOC reveal turned out to be $1.1 billion to buy. The ES went on to print 2696.25 on the 3:00 cash close, before settling the day at 2691.50, down -10.50 handles or -0.38%.

In the end, the CME saved the day by delaying orders Wednesday night during the sharp drop and not executing market orders, effectively shutting down the sell side algos. This helped buyers win the day, as the S&P’s were near able to come back to unchanged.

Disclaimer: Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involves substantial risk of loss and is not suitable for all investors. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. Any decision to purchase or sell as a result of the opinions expressed in the forum will be the full responsibility of the person(s) authorizing such transaction(s). BE ADVISED TO ALWAYS USE PROTECTIVE STOP LOSSES AND ALLOW FOR SLIPPAGE TO MANAGE YOUR TRADE(S) AS AN INVESTOR COULD LOSE ALL OR MORE THAN THEIR INITIAL INVESTMENT. PAST PERFORMANCE IS NOT INDICATIVE OF FUTURE RESULTS.