As unprecedented and historic as this global coronavirus induced shutdown has been, it keeps throwing curveballs at us that only a few weeks ago seemed too absurd to even be worth hypothesizing over.

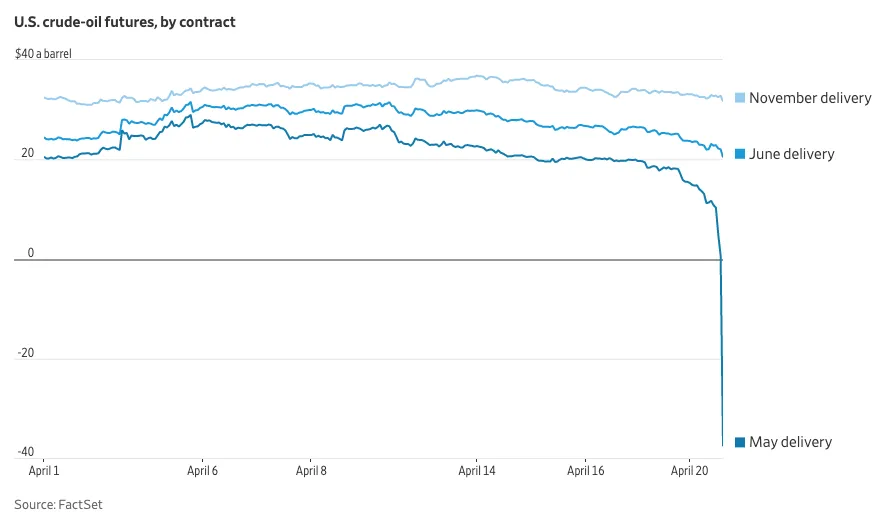

The lastest unprecedented development was the most spectacular collapse in the history of commodity trading. $22 oil was shocking enough. Then we got barrels trading at $8 on the spot market a few days ago. But that was only warming us up for the main event.

People’s jaws were on the floor yesterday afternoon when oil contracts for May delivery fell under one dollar. Fifty cents for 55 gallons of oil? Surely it couldn’t get any worse than that. And moments later, it did exactly that.

Traders were so desperate to avoid taking delivery of physical oil they became willing to pay people to take their oil. That’s just how bad the current situation is. And not just a dollar or two. The day closed with oil trading at minus $37 dollars. That’s right, traders were so desperate to get out of their positions they would pay you $37 for every barrel of oil you take off their hands!

How did one of the most important commodities in the world go from a coveted resource to something akin to raw sewage that requires payment to be disposed of?

But just as shocking as the collapse of May’s oil contract was the stock market’s indifference to it. The neighbor’s house was burning to the ground and the S&P 500 was too busy organizing its sock drawer to even look out the window.

Two months ago, if you told me oil would fall $55 dollars in a single day, I would have expected all financial instruments to be imploding. But not now. Yesterday, it was just another headline the S&P 500 is ignoring.

At this point, we have three options. Argue with the stock market, fall in line, or get out of the way. No one wins an argument with the market, so please don’t do that. For our longer-term investments, buying at these levels still represents a decent discount if we plan on holding for a couple of years. For anything else, get out of the way!

There is a saying in the market, missing the bus is better than getting hit by the bus. If we don’t feel comfortable buying this strength for a long-term investment, there is nothing wrong with sitting this one out and waiting for a better opportunity.

Remember, often the best trade is to not trade. Until the risk/reward lines up in our favor, wait patiently on the sidelines. That means waiting until this rebound is breaking down before shorting it. Or for the less aggressive, buying the next dip. But whatever you do, don’t allow yourself to argue with this strength.