There’s a growing gap between the “haves” and the “have nots”.

I’m not talking about the divide between the top 10% of income earners in the U.S. and the bottom 90%. (Though the impact is very much the same.) I’m talking about sectors that have adopted and embraced modern technology, and those that haven’t.

We live in an era where companies that were born digital -- Amazon.com (NASDAQ:AMZN), Netflix (NASDAQ:NFLX), Facebook (NASDAQ:FB), Square (NYSE:SQ), Uber and Snapchat -- have an advantage over their older peers.

These disruptors have higher growth rates and can adapt more quickly.

But that doesn’t mean old-school blue chips can’t or aren’t adapting. General Electric (NYSE:GE) and Nike (NYSE:NKE) have implemented digital strategies and are seeing success.

Unfortunately, there’s a huge disparity in fortunes for companies that are in the top 10% of digital advancement and those that are in the bottom 90%.

As the technology gap widens, the laggards are going to be left behind to rust.

The Great Digital Divide

Over the past 20 years, the top-performing sectors increased their digital advancement by fourfold. And a lot of that took place in the past decade.

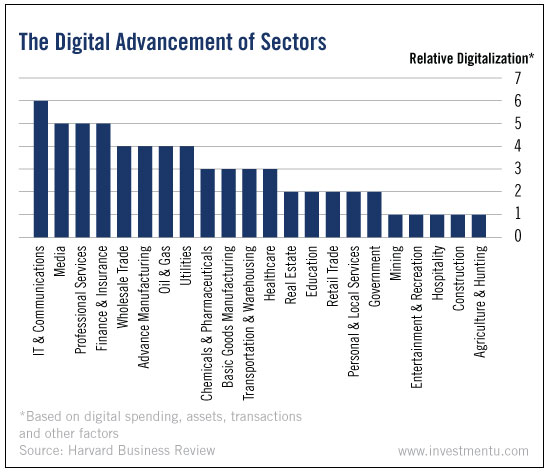

The sectors that are the most digitally advanced are not surprising.

The industries at the far left of the chart are leading in revenue growth and productivity.

Obviously, IT and Communications is the top dog.

Media, Professional Services and Finance aren’t shockers. The way we consume television and news has completely changed. Plus, digital transactions, interactions and processes have all increased five-fold during the past 15 years.

Where we see room for improvement is Agriculture, Construction, Mining and Hospitality. Real Estate and Retail are also low in terms of digitalization, stuck at the same level as government.

A study by Capgemini found that digitally mature companies, as well as those with higher digital intensity, far outperformed their peers. Of the 184 publicly traded companies looked at, the most digitally advanced firms saw:

- 9% higher revenue generation

- 26% higher profitability

- And market valuations 12% higher than those of their peers.

The E-Economy

Across the entire economy, digital assets doubled during the past 15 years. Going forward, we’ll witness a continued boom.

Sectors that have fallen behind in the digital realm must play catch-up. Companies that can “get with the times” should do more than just survive - they’ll thrive. After all, technology can lower costs and boost efficiencies.

Pushing forward with a digital agenda creates momentum.

The McKinsey Global Institute found that the U.S. currently operates at just 18% of its digital potential. That means there’s a lot of room to grow.

And there are enormous economic benefits to be had over the next decade by going digital. Big data analytics (which I covered last week), the Internet of Things (IoT) and online talent platforms are three areas that should see massive future growth.

In the next few years, tens of billions of devices will come online. We’re not just talking about tablets, smartphones or computers, either. I’m referring to internet-connected appliances, cars and industrial machines.

The potential impact on the U.S. economy from just these three digital arenas is as much as $2.2 trillion by 2025.

Technology has already reshaped our world. It’s impacted every aspect of our daily lives. And many of those companies that have fully embraced the digital world are now market leaders. The laggards are going to have their work cut out for them as they play catch-up.

The good news for investors is that both groups should provide attractive near-term opportunities.

Good investing,