When I was a teenager, I spent a considerable amount of time at the mall. It was a great place to hang out with friends and basically, just be out of the house.

That’s less true today. Teenagers don’t hang out at the mall like my generation did. And they don’t spend nearly as much money at the mall as previous generations.

This may seem like a small trend, but it’s anything but. Teen spending habits are forcing a reshuffling of the entire retail landscape.

Between 1956, when the first enclosed mall opened, and 2005, more than 1,500 malls were built in the U.S. During the 1980s and 1990s, we had “The Great Malling of America.” There were years that saw the construction of 100 malls.

But, by 1998, that kind of construction tapered off dramatically.

Today, malls are dying. There hasn’t been a new enclosed mall built since 2006. Instead, they’re being abandoned and torn down.

We’ve all heard the massive number of store closings and layoffs announced by Macy’s (NYSE:M), Kohl’s (NYSE:KSS), The Limited and Sears (NASDAQ:SHLD) over the last couple weeks.

It’s projected that in the next decade, half of all enclosed malls in this country will be gone. Some companies -- and their investors -- will suffer. Others, as I’ll show you below, will thrive.

A Crumbling Foundation

This chart fills me with mixed emotions...

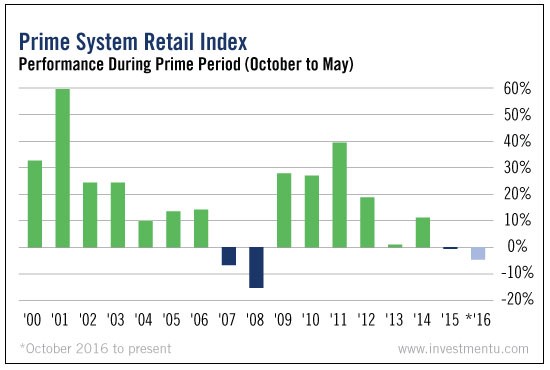

This is my Prime System Retail Index, or PSR for short. It’s comprised of more than two dozen retailers.

For the past 17 years, the PSR has tracked the performance of these companies during Prime Periods (times you want to own shares) and Non-Prime Periods (times you want to avoid them). The chart above shows the Prime Period for members of the index -- October through May.

So far, the PSR is down 4.43% for the current period. In fact, 15 components are down 10% or more since the start of October. And four of them are down more than 20%.

On one hand, that bothers me. But on the other, the PSR was designed to reflect seasonal spending habits of consumers. There’s a mixture of big-box, online, stand-alone, luxury, discount, accessory, apparel and mall-based retailers.

As a result, it also shows the winners and losers by segment.

I can tell you that right now, accessories are far and away the best performers. These companies largely target the female consumer, and they’re generally high-end brands.

The second-best performers are big-box stores.

But what’s dragging down the PSR is discount and, not surprisingly, mall-based retailers. Of the 15 components down 10% or more since October, these two groups account for 12 of them.

Sales at traditional mall anchors fell more than 30% from 2005 to 2015. This is a revenue decline from $87.46 billion to $60.65 billion. Clearly, traditional enclosed malls can’t compete against online and mobile retailers.

Online and mobile shopping is still increasing at eye-popping paces. Black Friday alone saw online sales increase 33%. And this is obviously creating a boon for online retailers.

For example, shares of Wayfair (NYSE:W) hit a 52-week low in October. They’re up 37% from that point, as the online home furnishing company has seen quarterly revenue increase more than 30% year over year. Annual revenue is expected to be up nearly 50% this year.

Shares of Overstock.com (NASDAQ:OSTK) are up more than 50% in the past year. Meanwhile, shares of Etsy (NASDAQ:ETSY) are up more than 60%, as quarterly revenue increased more than 20%.

All three of these are in the top 10 holdings of the Amplify Online Retail ETF (NASDAQ:IBUY). It’s an exchange-traded fund that focuses on companies that get at least 70% of their revenue from e-commerce.

Traditional malls are also being undercut by outlets. Tanger Factory Outlet Centers (NYSE:SKT) and Simon Property Group (NYSE:SPG) are seeing strong revenue growth.

A Welcomed Demise

Last June, I wrote about the decline of malls in America. This murder is being perpetrated by millennials. And, as I see it, it’s a necessary death. Malls are outdated constructs -- remnants of a world that no longer exists.

We can’t stop the transition that’s underway in the retail space. Maybe you don’t conduct the majority of your purchases online. But that doesn’t mean this shift isn’t happening. It means only that you’re becoming part of a minority.

Once older generations start adopting online shopping en masse -- and they’ll be forced to - e-commerce and mobile sales will account for almost a quarter of total retail sales in the next decade.

As investors, we can profit. Just know that you’re not going to find a lot of opportunities in traditional mall staples... at least, not until they wise up and push into the e-commerce space.

Of course, the sad truth is... for most of these companies, it’s already too late.

Good investing,

Which stock should you buy in your very next trade?

AI computing powers are changing the stock market. Investing.com's ProPicks AI includes 6 winning stock portfolios chosen by our advanced AI. In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. Which stock will be the next to soar?

Unlock ProPicks AI