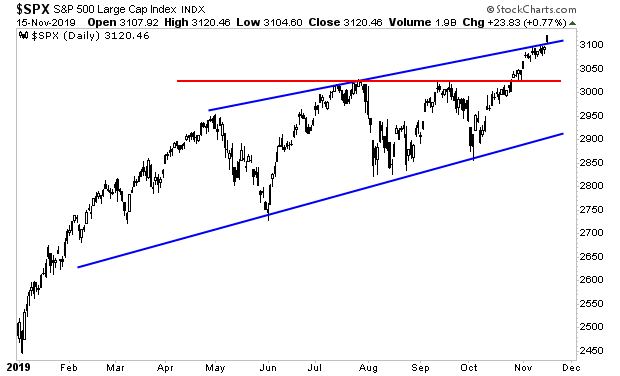

Stocks touched 3,100 last week and then gapped even higher into the low 3100s.

We’ve now broken the bullish channel that has outlined most of 2019’s price action (blue lines in the chart below). And while the odds continue to favor a pullback in the near future (possibly to support at the red line), the momentum is UP.

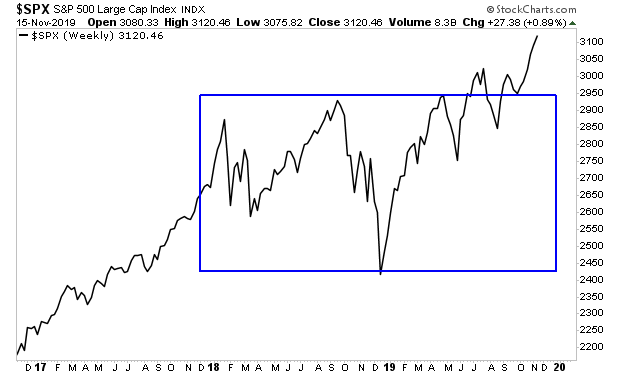

Big picture, stocks have entered a new bull market, The argument for months has been that stocks have effectively gone nowhere since early 2018 (blue rectangle in the chart below). That argument has now been invalidated.

The door is now open to a major market meltup.

Investors are currently sitting on $3.4 trillion in cash. This might be the single most hated market rally in history.

What happens if even $1 trillion of that $3.4 trillion in cash finally figures out that a recession is not in the cards and stocks are in a new bull market?

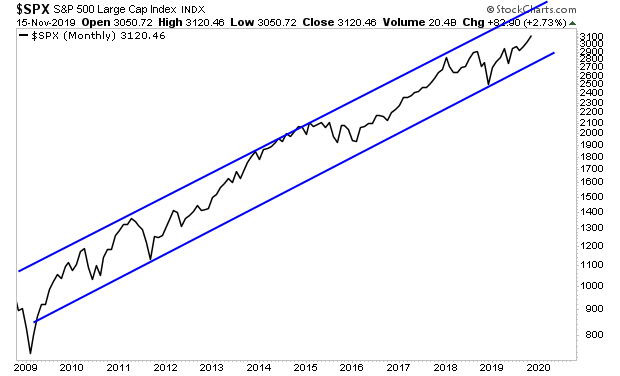

We go to 4,000, if not 5,000 on the S&P 500 easily. The bull channel from the 2009 low makes this a real possibility.