“Is $1 million enough to retire on?”

Paul Katzeff of Investor’s Business Daily asked me earlier this month. He was especially keen on high-paying ETFs that would throw off enough dividends to fund a nice retirement.

For example, we chatted about the Global X NASDAQ 100 Covered Call ETF (QYLD), which sells covered calls on the NASDAQ index itself to create cash flow.

QYLD’s trailing yield is a sweet 11.8%, which means million-dollar positions would have generated $118,000 in dividend income alone. Plus, the principal grew, too, thanks to price gains. The NASDAQ has been on a tear since last year, helping QYLD to 21.2% total returns (including dividends) over the past twelve months.

As neat as this retirement play was, it wasn’t the best thing to buy this time last year. With stocks seasonally weak in September and October, the real payout party typically happens in the closed-end fund (CEF) space.

The reason CEFs are the ultimate retirement investment is largely due to their under-the-radar nature. These “Rodney Dangerfield” funds get no respect from big investors. As a result, they can (and do) often trade below their net asset values (NAVs), which are the values of their underlying portfolios.

For example, one year ago Gabelli Dividend & Income Closed Fund (NYSE:GDV) traded 15% below its NAV. This fund run by legendary investor Mario Gabelli was selling for just $0.85 on the dollar. An investor paid 85 cents to buy a dollar of assets!

GDV doesn’t do anything fancy. Gabelli and his team carefully select high-quality dividend stocks. The “edge” we get from buying this CEF comes from our ability to buy it at a discount.

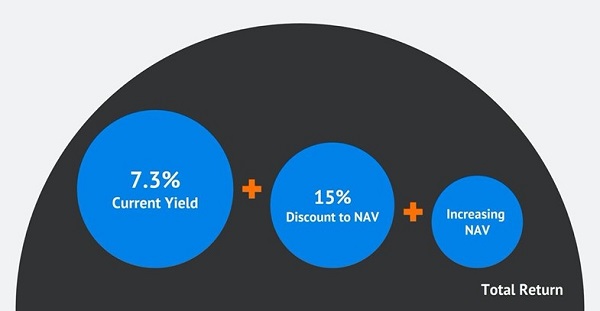

When we discussed GDV in these pages one year ago (and added it to our Contrarian Income Report portfolio), the fund gave us three ways to win:

- First, GDV was yielding a fat 7.3%,

- Plus, it was trading at a 15% discount to its intrinsic value (NAV), and

- Its NAV was likely to increase as the market rallied (a play on the Federal Reserve’s prolific money printing).

GDV Flashback: Three Ways to Profit

CIR readers will fondly remember that we also saw compelling value in the Eaton Vance Tax-Managed Global Diversified Equity Fund (Eaton Vance (NYSE:EV) Tax-Managed Global Diversified Equity Income Closed Fund (NYSE:EXG))around the same time. EXG is a CEF that is closer in flavor to QYLD. But better.

QYLD only writes call options on the Nasdaq index itself. That’s a simple strategy but, to be honest, a lazy one that leaves cash on the table. The call premiums on an index don’t measure up to those paid by individual stocks.

EXG goes the extra mile to buy high-quality stocks like Amazon (NASDAQ:AMZN) and Alphabet (NASDAQ:GOOGL) and writes covered calls on them to generate income. It doesn’t pay the stated yield of QYLD, but it’s a better investment for total return when we can buy it at a discount.

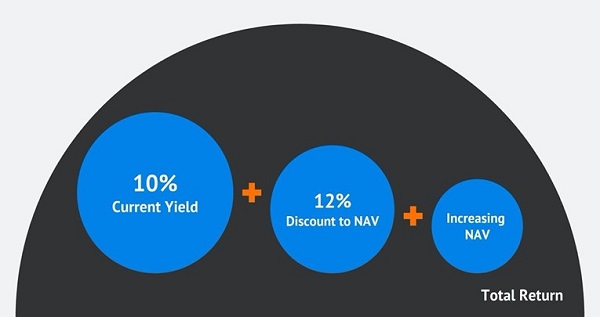

This time last year, EXG was yielding a fat 10% while trading at a 12% discount to its NAV. Like GDV, it presented us with a trifecta of profit opportunities:

EXG Flashback: Three Ways to Profit

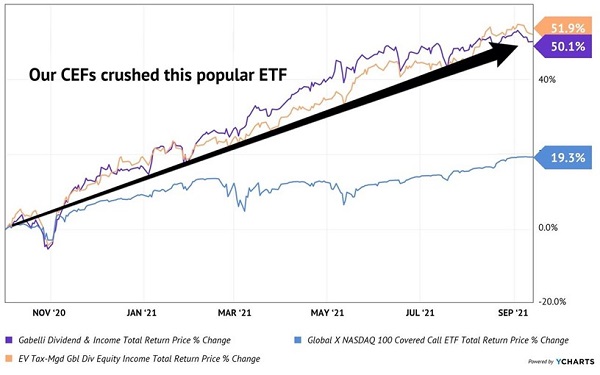

How’d it play out in reality? More lucrative than IBD reported in its newspaper!

A million bucks spread between GDV and EXG would have returned $510,000 since our October ’20 issue of CIR. Now that’s how we retire in style.

How to Make a Fast $510,000 on $1 Million

These CEF opportunities only come around once or twice per year, so when they appear, we must be ready.

Disclosure: Brett Owens and Michael Foster are contrarian income investors who look for undervalued stocks/funds across the U.S. markets. Click here to learn how to profit from their strategies in the latest report, "7 Great Dividend Growth Stocks for a Secure Retirement."