“In the beginning, God created the heavens and the earth” reads the first sentence of the bible. Later in the book of Genesis, God created cycles.

“Then Joseph said to Pharaoh, “Both of these dreams have the same meaning. God is telling you what will happen soon. The seven good cows and the seven good heads of grain are seven good years. And the seven thin, sick-looking cows and the seven thin heads of grain mean that there will be seven years of hunger in this area. These seven bad years will come after the seven good years.“ Genesis 41:25-36

Eons later, famed mathematician Benoit Mandelbrot wrote on the similarity between naturally occurring cycles and market cycles. He used the terms Joseph Effect and Noah Effect to define the good and bad years, respectively.

Despite the sharp decline last year, equity markets are back to record highs, and the Joseph Effect is running strong. But, while investors are enthusiastic, the odds are growing that the Noah Effect may come sooner than most investors fathom. The math is clear that returns over the next ten years will pale in comparison to the last.

In this article, we diverge from the math and appreciate the behavioral traits that allow markets to reach extremes. These qualitative factors will help you make sense of today’s market and better prepare for tomorrow.

Smile, You’re On Candid Camera

From 1960 to 1975, Allen Funt hosted a TV series called Candid Camera. The show secretly filmed people doing peculiar things. In addition to being hilarious, the show highlights how inane behavioral traits drive our actions.

For example, the episode Elevator Psychology exhibits how humans tend to follow the lead of others. In market parlance, this is coined FOMO, or the fear of missing out.

In the first scene of the linked video, a man enters an elevator, followed by Candid Camera actors. The actors entering the elevator all face the rear of the car. Upon seeing this, the puzzled man slowly turns around and faces the rear of the elevator. In the second skit, another man not only follows the actors facing backward but then proceeds to rotate back and forth as the actors do. As the scene goes on, he takes off his hat and puts it back on, following the lead of the actors.

The skits highlight our instinctive need to follow the actions of others, regardless of the logic of such activities. Importantly, they highlight the stupid things we do to battle our fear of not conforming.

FOMO

Financial markets often experience similar behavioral herding. Most investors blindly mimic the behavior of other investors without seeking the rationality behind it.

Investors get gripped by a fear of missing out in the extremes of bull markets, aka FOMO. As asset bubbles grow and valuation metrics get stretched, the FOMO strengthens. Patient investors grow impatient watching neighbors and friends make “easy” money. One by one, reluctant investors join the herd despite their concerns.

“There is nothing so disturbing to one’s well-being and judgment as to see a friend get rich” -Charles Kindleberger: Manias, Panics, and Crashes

Famed investors, Wall Street analysts, and the media prey on ill-equipped investors by justifying ever-higher prices. Their narratives rationalizing steep valuation premiums become widespread. Despite evidence to the contrary and historical precedence, investors always buy the hype. “This time is different,” say the promoters.

This time is rarely different. For a better appreciation of financial bubbles built on false premises and FOMO, we recommend reading “Manias, Panics, and Crashes” by Charles Kindleberger.

Per a recent report, J.P. Morgan had the following to say on bubbles:

“Both begin with a compelling narrative that eventually leads analysts to discard previous valuation yardsticks because “this time is different.” Occasionally times have changed, but often they haven’t.”

Defying Our FOMO

Our investing behaviors are quite different from our consumer behaviors. As consumers of goods, we seek discounts on products we want and shun products we think are too expensive. On the other hand, as investors, we seem to prefer to pay top dollar for stocks and avoid them like the plague when they trade at a deep discount. Dare to employ the logic of your inner consumer, not your average investor.

Markets fluctuate between periods where greed runs rampant such as today and periods of fear. Unfortunately, greed causes many investors to ignore or belittle facts and history.

Fear also prevents us from making intelligent decisions. Investors have a fear of catching the proverbial falling knife, even though a stock may already be discounted significantly.

To be successful investors, we must balance our Jekyll and Hyde personalities and silence the crowd’s din. As hard as it is to resist, we cannot fall prey to periods of grossly unwarranted market optimism, nor should we be shy to invest during periods of deep pessimism. TO repeat, avoiding our instincts, like not turning with the crowd in an elevator, is challenging to put it mildly.

How We Keep our Investment Zen

One way to find comfort in both booms and busts is to have well-thought-out investment strategies and risk limits. A good plan should encourage steady, long-term returns and employ active strategies. The plan should ensure you stay current with potential risks, technical setups, and market valuations. These measures help keep us mindful and vigilant.

As of writing this, we are nearly fully invested in equities. Make no mistake, we are keenly aware current valuations portend poor and likely negative returns for the upcoming ten-year period. What we do not know is the path of returns for the next ten years. Will the market fall 70% tomorrow and rally back over the next nine years? Will it continue rallying to even greater valuations and tumble in a few years? The iterations are endless.

Given the current risks, we actively manage our exposure. If our shorter-term technical models indicate weakness, we reduce exposure and or add hedges. If they signal strength, we may add exposure. Of course, we always have a finger on the sell trigger.

The Coming Noah Effect

Hearing the crowd and sensing the palpable enthusiasm is easy. But, listening to the lessons of the math and history books is difficult. The graphs below are two examples of data and history that provide sobriety to help counter the pull of FOMO.

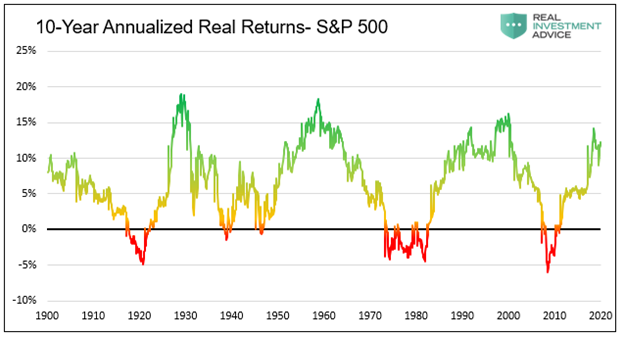

The first graph shows that the S&P 500 cycles between periods of strong returns and weak returns. Currently, returns for the last ten years are at the upper end of the range, portending weak forward returns.

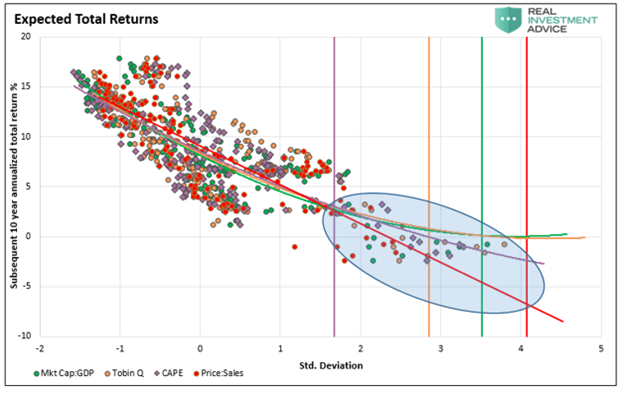

The following graph uses four valuation techniques to highlight that returns are likely to be flat to negative over the next ten years.

The following quote is from our article Zen and the Art of Risk Management:

“When markets are frothy and grossly overvalued, greed takes over, leading to lofty performance expectations and excessive risk stances. Equally tricky is buying when fear grips the markets.”

“In both extremes and all points in between, we must maintain investor Zen. The best way to accomplish such mindfulness and awareness of market surroundings is to understand the risks and rewards present in markets. Zen-like awareness allows us to run with the bulls and hide from the bears.”

Summary

TINA is another popular acronym – “There Is No Alternative.” Despite popular logic today, there are alternatives to blindly employing passive strategies that will fully partake in the upside but leave investors facing significant downside risks.

As a steward of our client’s wealth, we take special care at market junctures like the present to understand the risks. Timing the market is impossible, but full-time awareness of the long-term goals will help our clients avoid the pitfalls that inevitably set investors back years.

Equally damaging for passive investors when the tables turn is the inability to take advantage of the multitude of opportunities that emerge when fear reigns market sentiment.