The tech stocks are likely to have either a final blow-off rally into early 2020 or a bigger correction followed by a final rally to new highs into mid-2020. So, what’s the best way to play that?

Everyone’s been buying the FAANGs or leading tech stocks (Facebook (NASDAQ:FB), Amazon (NASDAQ:AMZN), Apple (NASDAQ:AAPL), Netflix (NASDAQ:NFLX), and Google (NASDAQ:GOOGL), or simpler, just buying the QQQ comprised of the largest Nasdaq 100 stocks.

But there is a better way to play this finale – and, even more so, to play the next tech and global boom from 2023 or so into 2036-37: ARK Innovation (NYSE:ARKK).

ARK Innovation is an ETF that started in late 2015 by star venture investor Cathie Wood. She is already a proven new venture investor in the technologies destined will lead the next technology cycle.

Here’s her criteria for what she chooses to invest in during the most tricky and risky early stages – more in the 0.1% to 1% phase of the S-Curve currently:

I have been saying that blockchain technologies are Internet 2.0 – or, as some, like Mark Yusco at our IES conference, put it: “The Internet of Money.” That means the digitization of all financial assets. And yes, that fits all three of Wood’s criteria.

Here are Wood’s five sectors of focus:

- DNA sequencing

- Collaborative robots

- Energy Storage, aka electric autos, solar roofs

- AI – artificial intelligence

- Blockchain technologies

You can see why she invested heavily in Tesla (NASDAQ:TSLA), not as a car company.

The good news is that ARKK now has a 4-year track record and has traded at a healthy average volume of 260,000 a day in the last 65 days. In the last 3 years. it has averaged 33% a year vs. 13% for the S&P 500.

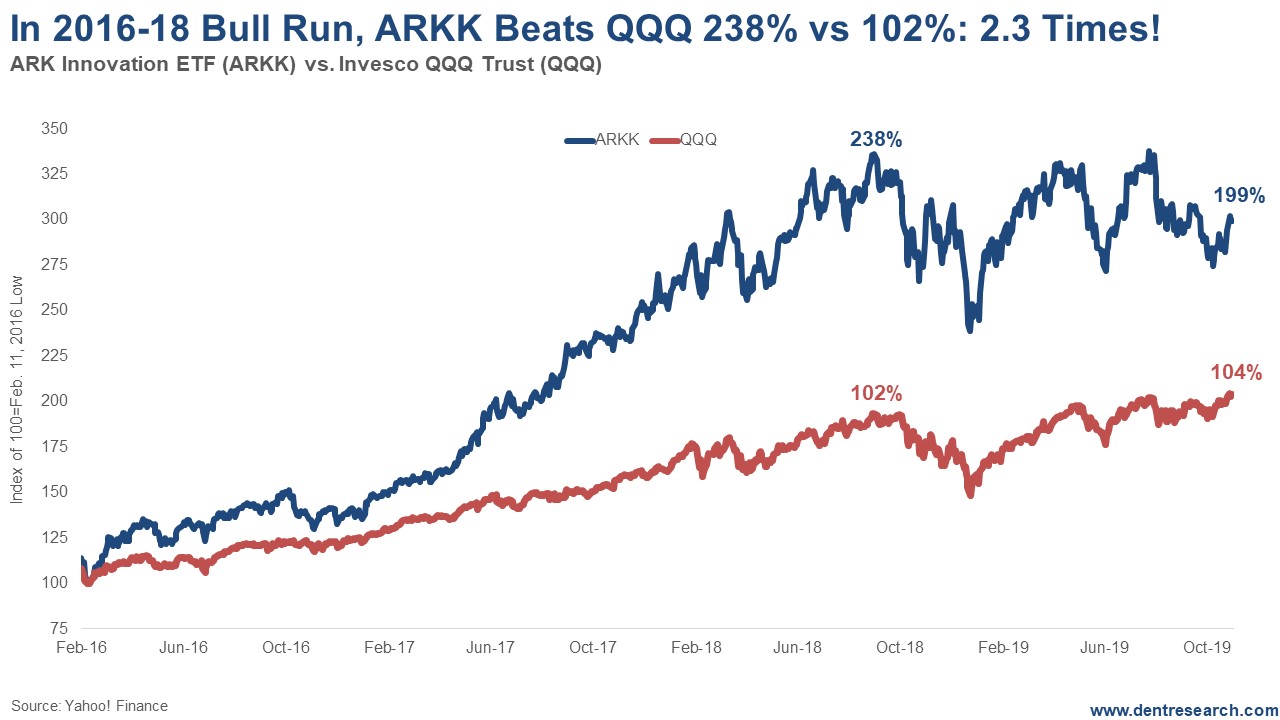

Here’s how it has performed vs. the QQQ in the last bull run from the early 2016 bottom.

The fund does not perform quite as well on the downside, but to date is still at 199% vs. 104% since early 2016. That’s why I’m not recommending it until we either see a clear upside break or that larger downside correction first I have been anticipating.

It pays to be in the earlier stages of technology – but only if you have someone like Cathie who knows what she is doing. It is the most risky stage.

I’ll continue to watch and recommend this fund once this finale becomes clearer – and that’s likely to be soon.