Investing.com’s stocks of the week

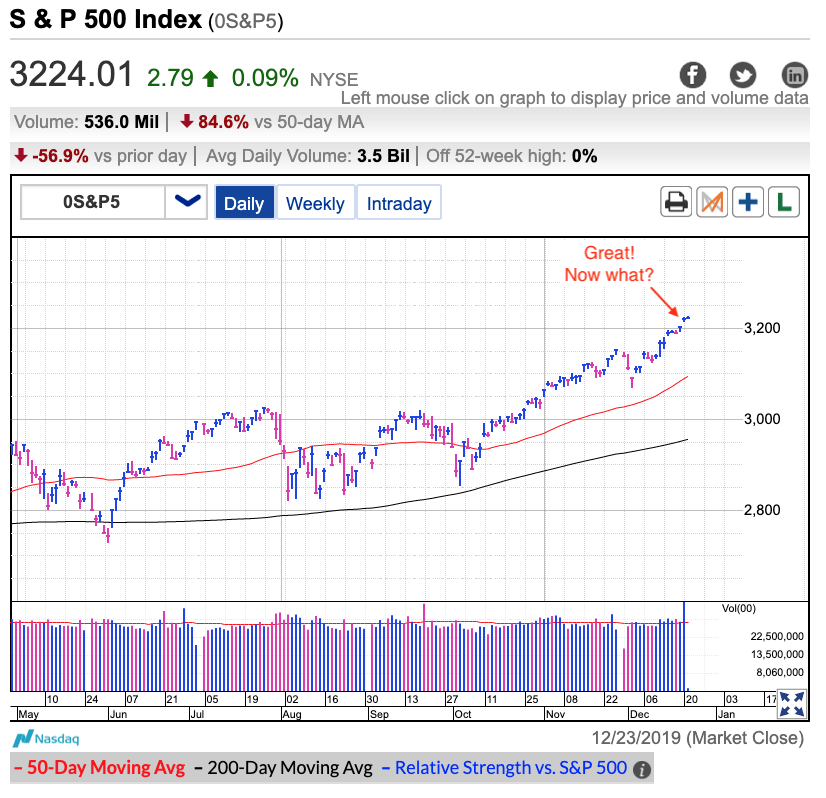

As expected, the S&P 500 continues drifting higher into year-end. All of the nasty headlines are behind us and for the most part things turned out far less bad than feared. This return of optimism allowed stocks to rally to record highs. That said, this post is less about the market and more about what we should be doing this time of the year.

All too often it is easy to obsess over the market, and many times that distracts us from the things that really matter. Borrowing a well-used cliche, we should trade to live, not live to trade. If all you can think about is how well your positions are doing, or sometimes how poorly, you are missing out on all of the things going on around you.

As we approach the Christmas holiday, it often makes a lot of sense to unplug for a few days. For some people, that means liquidating everything and being fully present with their friends and family. For other people, this simply means lightening up on some of your biggest winners to the point you no longer feel the need to watch the market’s every move. For longer viewed investors, skip a few days of financial headlines and don’t open your stock app. Don’t worry, everything will still be there next week.

The above recommendations are doubly important if things are not going well. Sometimes we get stuck and have a hard time letting go of a losing trade. Forcing yourself to sell that bad trade for a few days might just be the thing you need to clear your head and come back with a fresh set of eyes. If you still like that trade next week, you can always get back in. But more often than not, we would rather avoid putting ourselves in that situation again. If that’s the case, chalk it up to “experience” and start looking for another opportunity.

No matter what happens over the next two weeks, don’t worry about it. There will be plenty of new trading opportunities next month, and the month after that, and the month after that…