Year-to-date, Bitcoin is down by 65% in 2022. Since Bitcoin launched in 2009, it has been a massively profitable investment in all years except for 2014 (-58%) and 2018 (-73%). Does the 2022 downturn portend a new trend, or is it another bear year?

Bitcoin’s Wednesday Rally

From late August to Nov. 7, Bitcoin has largely maintained sideways price action, oscillating between $18k – $21k. After FTX crashed on Nov. 7, Bitcoin entered a new sideways action range, between $15k – $17k.

This event was one of the biggest FUD generators in recent crypto history, dropping Bitcoin’s price by 23%, from $20,643 to $15,840, the lowest since November 2020. As FTX contagion unwinded, resulting in multiple bankruptcies, from BlockFi to Genesis, it appears that everyone who wanted to exit the Bitcoin market did so.

On Wednesday, Bitcoin rallied by a modest 3.4%, heading over the $17k range only to falter. The question is, what is Bitcoin correlating now?

Bitcoin Correlations Post-FTX Crash Turn Soft

The first signal that FTX exerts a heavy influence on Bitcoin was clear after a better-than-expected CPI report of 7.7% had little effect on the crypto market. Moreover, last Wednesday’s FOMC meeting was interpreted as dovish because the Fed confirmed the next expected rate hike of 50 bps in December and 25 bps next year.

Expectedly, S&P 500 rallied by 6.7%, but out of the norm, leaving both BTC and ETH in the FTX mire. Due to Bitcoin’s reduced liquidity and lower market cap, at $322 billion, the dominant cryptocurrency is now less relevant to the market’s beta exposure as exposure to systemic risk.

With a 77% pullback from its ATH, institutional investors are less likely to enter the market. In other words, Bitcoin is in a soft correlation period, which will be confirmed or disconfirmed with the next CPI report on Dec. 13 and the following FOMC meeting a day after.

Bitcoin’s Past Bear Cycles

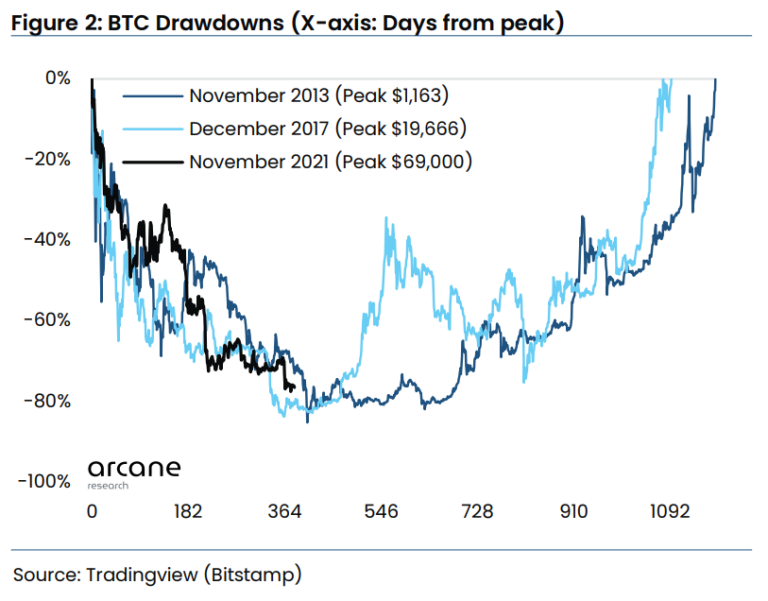

The current bear cycle is comparable to 2014-15 and 2018. In 2014, Bitcoin’s bear cycle, with an 85% ATH pullback, lasted for 407 days. In 2018, the pullback was 84% and lasted for 364 days. The current pullback of 77% has lasted for 377 days, starting from Nov. 10, 2021.

Accordingly, the time periods are comparable to the past two bear cycles but with lower depth this time.

Grayscale Bitcoin Trust and Bitcoin Miner Capitulation

Last week, Grayscale Bitcoin Trust (BTC) (OTC:GBTC) reached a historical discount of 42% against its ample 633.57k BTC holdings. To make things worse, Digital Currency Group, the owner of GBTC, has large liabilities following the liquidity crunch in its other subsidiary, Genesis Global Trading.

If DCG is forced to tap into GBTC’s Bitcoin supply to meet liabilities, Bitcoin could reach new lows, deeper and faster than we have seen before. In the meantime, the selloff pressure continues to come from Bitcoin miners, who also have to meet debt obligations.

Bitcoin’s technical indicator, known as hash ribbons, representing changes in hash rates using daily moving averages, have formed a bearish “death cross.” Historically, this indicated miner capitulation, also indicated by miner BTC outflows.

With these two powerful selloff pressures, DCG (potential) and miners (ongoing), Bitcoin’s sideways action is the best-case scenario for the time being. On the flip side, bullish news should not be discounted.

Bitcoin remains one of the few cryptocurrencies, out of over 20,000, to be regulated as a commodity. Likewise, Fidelity, handling $4.5 trillion AuM, recently launched crypto trading through its Fidelity Crypto division for retail investors. Lastly, the dollar strength index (DXY) has also taken a downturn, at -3.78% over the month.

At the same time, the euro and British pound are down considerably year-to-date, at -8.13% and -10.90%, respectively. As a currency debasement hedge, Bitcoin may yet find new buyers.