There is no denying it... 2015 was a roller coaster. And August was the wildest part of the ride.

The S&P 500 lost more than 11% from August 17 to August 25.

But even with that sudden drop, it looks like we will end up right where we started the year.

How will stocks do in 2016? No one really knows.

Or do they?

It’s the time of year when everyone on Wall Street weighs in with their predictions. And one sector that keeps showing up is housing and real estate.

It should come as no surprise. Housing is stable, wages are improving and interest rates are low.

Consumers can borrow again - even if they do have to contend with the Fed’s decision to boost its benchmark rate by 0.25% - and that could be good news for mortgage lenders.

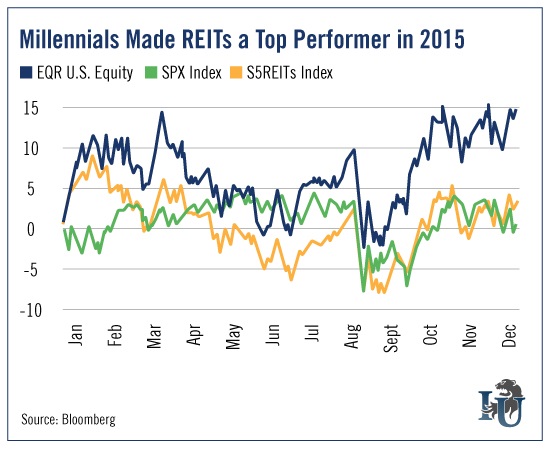

But the real winners in this sector will likely be real estate investment trusts (REITs). In fact, as you can see in this week’s chart, they’ve overtaken the S&P 500 in recent weeks.

And 2016 should continue this trend. Millennials are a big reason why.

Unlike their parents, millennials show little interest in setting down roots. Instead, they seem to enjoy the mobility that comes with renting.

Property management companies make this an easy decision. Many new apartment complexes deliver luxurious amenities like pools, gyms and private theaters to young renters.

These communities aren’t just appealing to millennials, either. Many in the hospitality and civil service sectors - teachers, police officers, government workers and healthcare employees - need affordable housing in notoriously expensive locales.

Apartments offer the affordable housing they are looking for. And one company, in particular, is already taking full advantage...

Equity Residential (NYSE: N:EQR) engages in the acquisition, development and management of multifamily properties.

With units in hot markets such as Manhattan, Boston, San Francisco, Seattle and L.A. (among others), the company should see no shortage of tenants anytime soon.

Equity Residential has been part of The Oxford Communiqué’s All-Star Portfolio for years. And since December 2013, it’s returned more than 50%.

In 2016, we’re expecting more of the same. But that’s not all we have lined up for the new year...