Bitcoin is back in the news in a big way. The world’s largest cryptocurrency neared $10,000 last week, meeting strong 200-day moving average resistance of around $9,800. Also last week, the 17 millionth bitcoin was mined. Remember, the crypto was originally designed to have a limited supply of “only” 21 million, an attractive feature that should continue to burnish its value as we get ever closer to that ceiling.

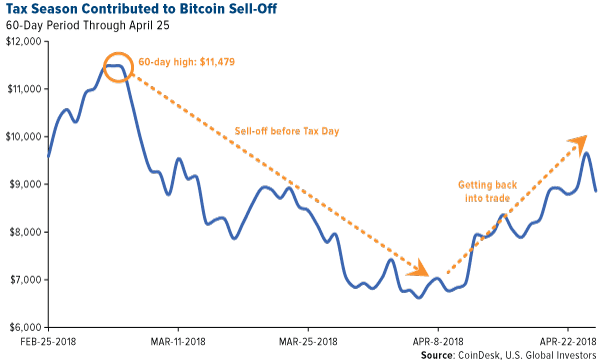

It’s no coincidence that the rally we’re seeing right now began soon after Tax Day. Many bitcoin and altcoin investors likely liquidated some of their holdings ahead of the filing deadline to cover capital gains taxes from last year and are now getting back into the trade. Month-to-date as of April 27, bitcoin was up more than 33 percent.

Also moving prices is news that Goldman Sachs (NYSE:GS) and Barclays (LON:BARC) are both rumored to be working on introducing cryptocurrency trading desks. Similarly, Nasdaq CEO Adena Friedman told CNBC last week that Nasdaq “would consider becoming a crypto exchange over time,” and that “digital currencies will continue to persist.”

As I see it, these are huge steps for the crypto market to take on its path to full maturation and acceptance as an asset class. We’re still in the very early stages, and recent calls that “bitcoin is dead,” not to mention general negativity toward bitcoin in the media, are strikingly premature.

I’m bullish, but I don’t expect bitcoin to test $20,000 again in the short term, especially before July. That’s when G20 finance ministers are scheduled to present their recommendations on how cryptocurrencies should be regulated.

More and More Smart Money Flowing into Cryptocurrency and Blockchain Tech

As I’ve said before, I don’t necessarily see regulation as a major headwind to cryptocurrencies, so long as it’s fair and reasonable. Such rules might even spur some investors, who until now have been watching from the sidelines, to participate.

That includes hedge funds, financial firms and other large institutional investors. A recent Thomson Reuters survey found that one in five firms are planning to trade altcoins this year. Of those, about 70 percent said they would do so in the next three to six months. Clearly, an increasing number of big investors see cryptocurrencies as an opportunity too good to pass up.

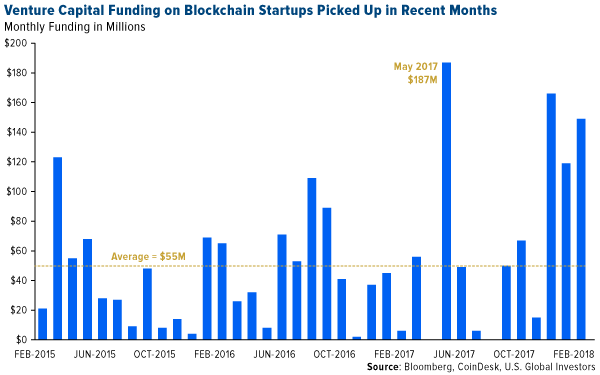

More and more money from venture capital firms is also being plowed into startups focused on cryptocurrency and blockchain technology. In the three months through February, the amount of capital flowing into blockchain businesses far exceeded the monthly average of $55 million for the three-year period. Momentum is building.

And it’s not just “dumb money” making these bets. Bloomberg reports that successful venture capital firm Venrock Associates is ready to start speculating in the space. Venrock, a compound of “Venture” and “Rockefeller,” was founded in 1969 by members of the wealthy Rockefeller family, and it has a stellar track record for investing early in wildly profitable companies, including Apple (NASDAQ:AAPL) and Intel (NASDAQ:INTC).

Bitcoin To Meet Growing Demand For Alternative Payment Systems

One of the most bullish crypto participants right now is venture capitalist Tim Draper, an early investor in Hotmail (since acquired by Microsoft (NASDAQ:MSFT) and renamed Outlook), Skype (also purchased by Microsoft) and Tesla (NASDAQ:TSLA) (not currently owned by Microsoft, as far as I know). At a recent Intelligence Squared debate in New York, Draper made the bold claim that bitcoin is bigger than those three ventures combined.“Bigger than the Industrial Revolution,” he said.

Further, he doubled down on his bullish call of $250,000 per coin in the next four years, and predicted that fiat currency will disappear much faster than expected.

“In five years, you are going to try to go buy coffee with fiat currency and they’re going to laugh at you because you’re not using crypto,” he said.

No doubt some of you reading this are laughing at Draper’s hyperbolic claims. But as I’ve written before (here and here), there’s already a global war on cash, incited by some central banks, economists and policymakers.

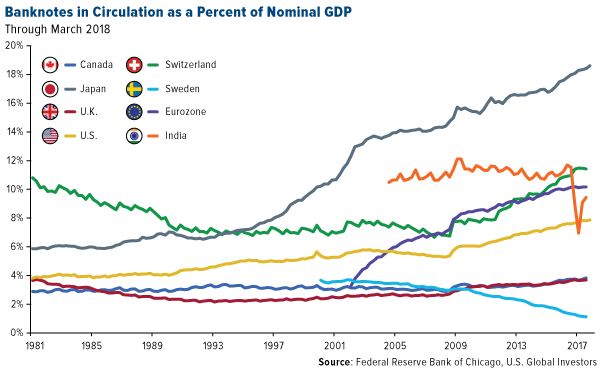

To try to prevent terrorism financing and drug trafficking, the eurozone has already scrapped the 500 euro note. India did the same with its 500 and 1,000 rupee notes to combat corruption. (See the dramatic dip in the chart below.) And Sweden, one of the first countries to experiment with paper currency, could soon become the first to eliminate it altogether and rely exclusively on electronic payment systems. (Again, notice Sweden’s steady slope toward 0 percent of GDP.)

Here in the U.S., the $100 bill’s days might be numbered, which would affect not only America but also many countries where Benjamins are still in high demand. In fact, more than three quarters of all $100 bills in circulation today live outside the U.S., according to the Federal Reserve Bank of Chicago.

Banning large denomination banknotes might be well intended, but ultimately it debases people’s economic freedom. This becomes especially true when low to negative interest rates are also introduced, as they are in Japan. (Today, in fact, the Bank of Japan announced it would keep its short-term rate at minus 0.1 percent.)

The demand for other liquid assets and “alternative technologies for making payments,” as the Chicago Fed puts it, is therefore surging, and I expect digital currencies such as bitcoin and Ethereum to fill that need. Today, U.S. currency in circulation stands at $1.59 trillion. According to one estimate by the Chicago Fed, that figure could sink to as low as $501 billion within 10 years as altcoins become more widely used to make transactions.

In a report for the second quarter, the St. Louis Fed likewise predicts a rapid transition from cash to cryptos:

In the near future, a close cash substitute will be developed that will rapidly drive out cash as a means of payment. A contender is Bitcoin or some other cryptocurrency. While cryptocurrencies still have many drawbacks… these issues could rapidly disappear with the emergence of large-scale off-chain payment networks (e.g., Bitcoin’s lightning networks) and other scaling solutions.

Maybe Tim Draper is onto something!

Frank Talk Turns 11 Years Old!

On a final note, I’d like to give a huge thanks to all of my readers, new and old, who’ve made my Frank Talk blog such a pleasure to write these past 11 years. If you’re still not a subscriber, you can sign up here and join thousands of other curious investors from around the world.

I also invite you to subscribe to the U.S. Global YouTube page, where we regularly share the latest episodes of Frank Talk Live, Gold Game Film and much more.

----------------------------------

All opinions expressed and data provided are subject to change without notice. Some of these opinions may not be appropriate to every investor. By clicking the link(s) above, you will be directed to a third-party website(s). U.S. Global Investors does not endorse all information supplied by this/these website(s) and is not responsible for its/their content.

The MVIS CryptoCompare Digital Assets 10 Index is a modified market cap-weighted index which tracks the performance of the 10 largest and most liquid digital assets.

The Bloomberg Commodity Index is made up of 22 exchange-traded futures on physical commodities. The index represents 20 commodities, which are weighted to account for economic significance and market liquidity.

MSCI World Index is a capitalization weighted index that monitors the performance of stocks from around the world.

The Bloomberg Barclays Global Aggregate Bond Index is a flagship measure of global investment grade debt from twenty-four local currency markets.

U.S. Global Investors, Inc. is an investment adviser registered with the Securities and Exchange Commission ("SEC"). This does not mean that we are sponsored, recommended, or approved by the SEC, or that our abilities or qualifications in any respect have been passed upon by the SEC or any officer of the SEC.

This commentary should not be considered a solicitation or offering of any investment product.

Certain materials in this commentary may contain dated information. The information provided was current at the time of publication.