“Asset values aren’t out of line with historical norms.” -Janet Yellen, 9/21/16

“A reliable way to make people believe in falsehoods is frequent repetition, because familiarity is not easily distinguished from truth. Authoritarian institutions and marketers have always known this fact.” -Daniel Kahneman

Janet Yellen has obviously read Kahneman’s work. That’s the only way I can think of to explain what she said about “asset values” on Wednesday. She hopes that if the Fed, probably the greatest “authoritarian institution” on the planet today, says it enough then people will just take it as fact.

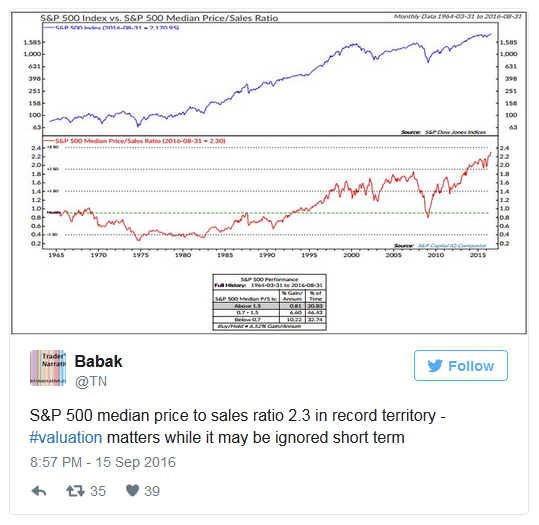

However, the facts are, the median price-to-sales ratio for the S&P 500 has never been higher than it is today. Indeed, it’s never been anywhere near this high.

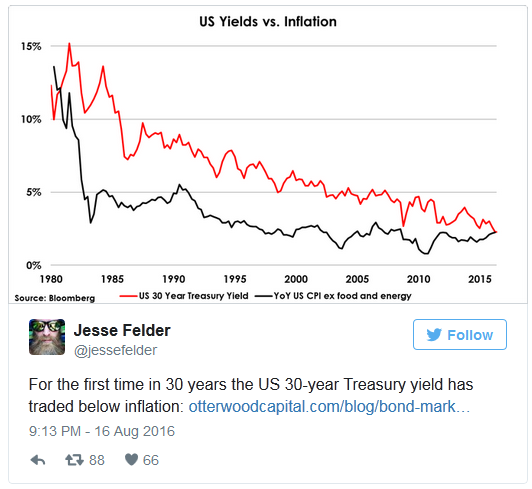

Bond yields have been driven to record lows as a product of massive quantitative easing. In terms of valuation, the 30-Year Treasury bond now yields less than core inflation, a very rare extreme.

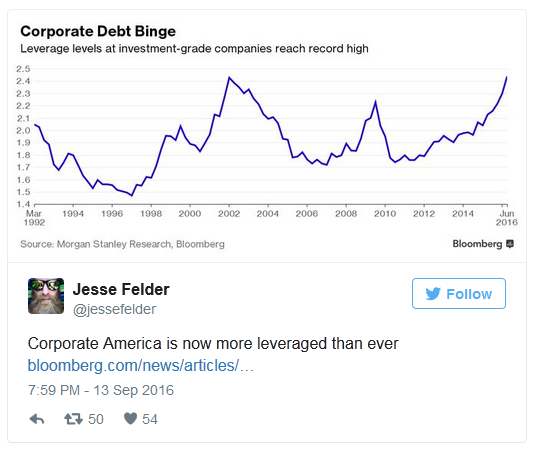

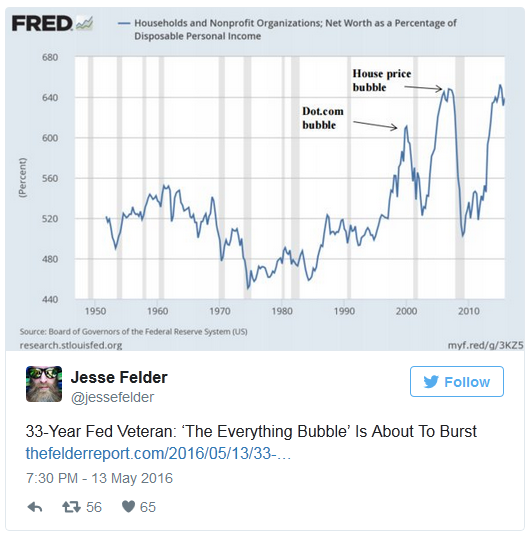

These low rates and the desperate search for yield they have inspired and enabled the greatest surge in corporate leverage ever seen…

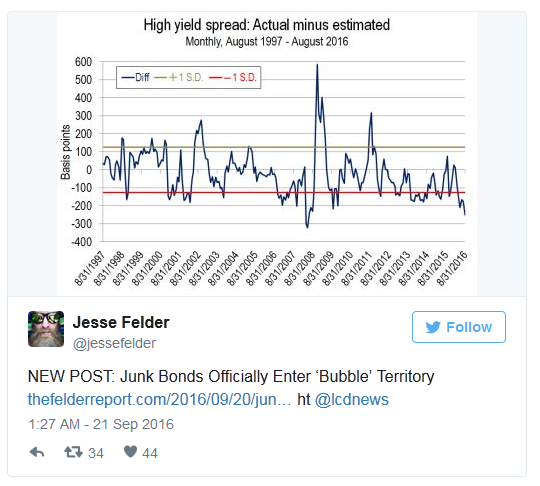

…with the valuations of these bonds recently reaching “bubble” territory.

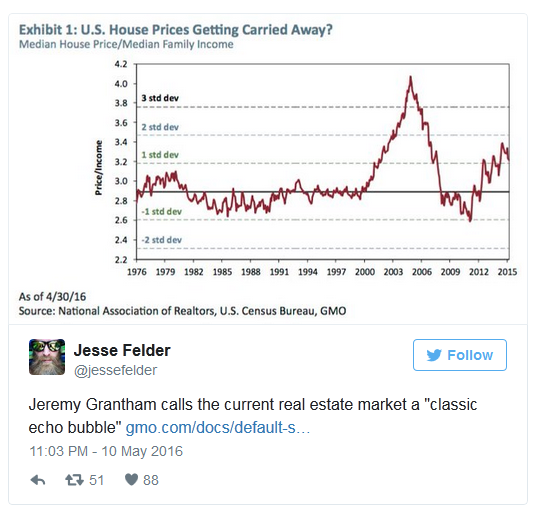

Finally, residential real estate has also become bubbly once again.

If by “historical norms” Ms. Yellen is referring to just the past 20 years of Fed-induced asset bubbles then yes, asset values aren’t necessarily “out of line.”

I think she knows better. The past 20 years are a historical aberration culminating in a financial bubble that is now more pervasive than anything we have ever seen before. It’s not just stocks or bonds or real estate this time; it’s all of the above. I am certain she hopes the Fed can engineer a “permanently high plateau” simply because it’s too difficult to imagine otherwise. But students of history understand that there is no amount of ‘frequent repetition of falsehoods’ that can overcome the truth.