The current conflict in Ukraine has brought such uncertainty back to global markets that long-term bets seem to be off the table for now. Investors had already been managing a general rotation away from risk before the specter of an Eastern European war was on the table. This involved the pricing-in of higher rates in the future and the removal of accommodation in a persistently inflationary environment.

US Stocks Near Bear Market

All major US indices are now well into correction territory with the Russell 2000 and NASDAQ edging ever closer to all-out bear market terrain (down 15% and 16.5%, respectively, from their highs at the time of writing). Meanwhile, gold, the US dollar, and real yields are all breaking to new local highs as volatility returns to levels last seen at the start of 2021. All while crypto assets, which had been faithfully tracking US growth stocks for the better part of last year, have now briefly decoupled and appear to be bouncing.

The above are all indications of how turbulent the current situation is. But perhaps there is still some order to be found in all this uncertainty. The two questions investors could be asking themselves now are: what were the dominant trends before our certainties were removed? And, how does the current conflict in Ukraine exacerbate those trends or contradict them?

This Is An Inflation Story

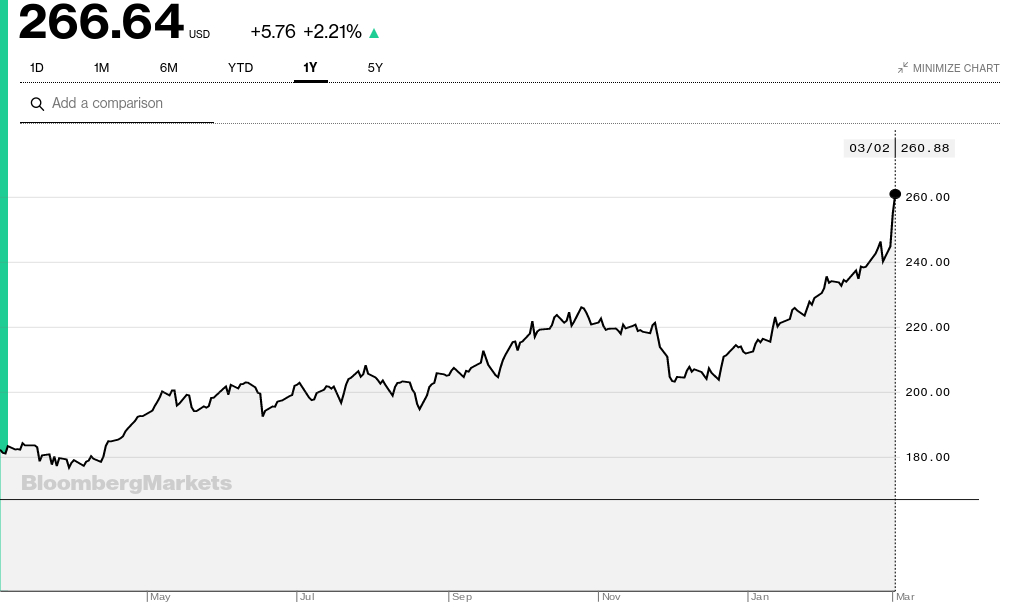

You’ll recall that the commodity boom was already well underway before the conflict started, with commodities across the board in backwardation at the end of the year. At the end of January, Bloomberg’s Commodity Total Return (Bloomberg Commodity TR) Index broke to new highs, surpassing the previous high of October 2021 at 226; it is currently above 266.

As far as markets are concerned, this appears to be an inflation story that was already unfolding before Russia made moves into Ukraine, and can only be made worse by the ongoing conflict. There are echoes of the Yom Kippur war of 1973 in just how bad (economically speaking) the timing of this conflict is. Just like the current situation, we have a rapid escalation that throws oil supplies into question at a time when inflation is a problem and commodities are incredibly tight. Higher energy prices directly translate to higher prices in grains, metals, and so on.

Gold Just Getting Started?

This may go some way to explaining how gold's recent performance may be something more long-lasting than just a headline-driven move. Recent events have exacerbated a massive rotation that had already begun. You only have to look at US equity sectors to confirm this.

The Metals & Mining sector has broken multi-year resistance levels, trading up 25% in February alone and up a further 8% in March so far. The dollar index is also breaking out as investors take some of last year’s profits off the table in preparation for a different market regime in 2022 and everyone expects rates to rise. All of the above are reflected in the four charts below.

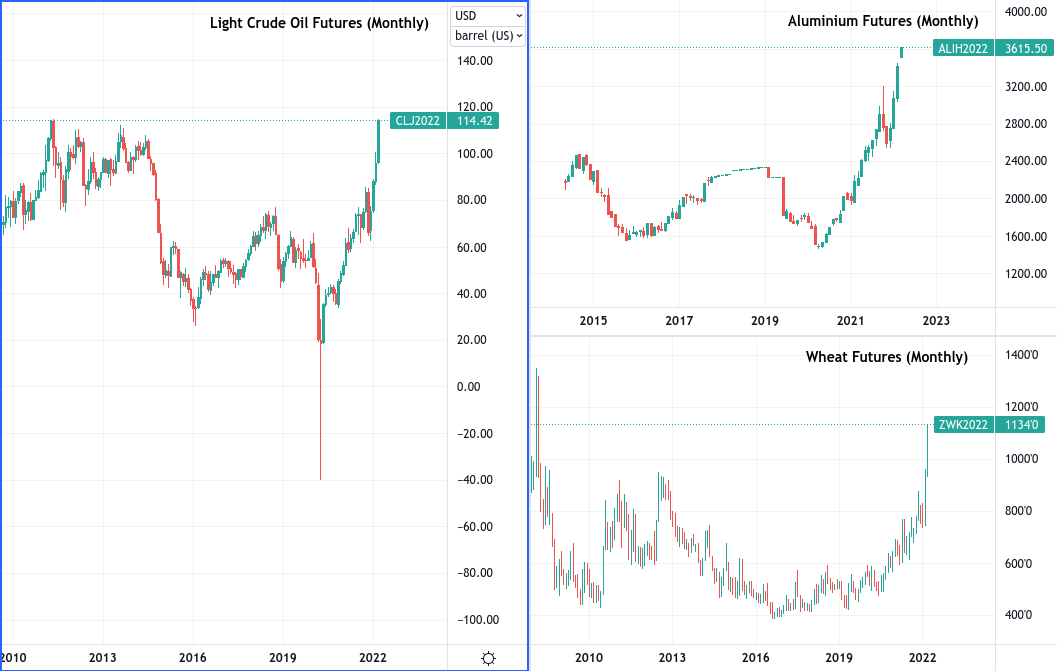

The situation is even clearer when looking at how individual commodity markets are faring. Oil is currently so tight and future supplies so uncertain that Light Sweet Crude Futures have broken $110 per barrel for the first time since 2013.

Aluminium futures have just smashed through their all-time highs, currently trading more than 25% above last October’s monthly high. Wheat futures have also broken all previous levels. Only a two-month period at the beginning of 2008 saw them trading higher than they currently are.

Next Move?

This is entirely dependent on how you’re already positioned. Investors that have ridden commodities up to these levels may wish to take some profits to have some cash on the sidelines. This will be useful because volatility is on the rise. Given the gravity of what’s currently unfolding in Ukraine, we can expect the swings in both directions to be disorderly.

Gold and copper are notable in that they have already significantly outperformed over the past couple of years. They have been tightening up in preparation for a break one way or another. The impetus is certainly with the bulls currently. Copper broke above its consolidation pattern on February 2, leaving gold to challenge that all-important $2000 level.

For now, tech stock investing appears to be off the table for all but the most adventurous dip-buyers. More broadly, on the weekly and daily timeframes, any bounces currently taking place in the US equity indices and individual sectors (barring Metals & Mining and Energy) are still lower highs and don’t challenge the prevailing bearish trend.

Bitcoin may be a little more interesting, seeing as it appears to be catching a slight safe-haven bid and markets are in the process of trying to figure out if it still acts as a commodity. Bitcoin is on the verge of setting a weekly higher-high relative to January’s $43,000 level.

There are indications that some of this could be attributable to capital flight from Russia as the rest of the world attempts to isolate the country economically. A weekly close above $43,000 with some volume behind it and some follow-through will bring $50k back in play. As always, caution is advised; this is not the time to be chasing anything.