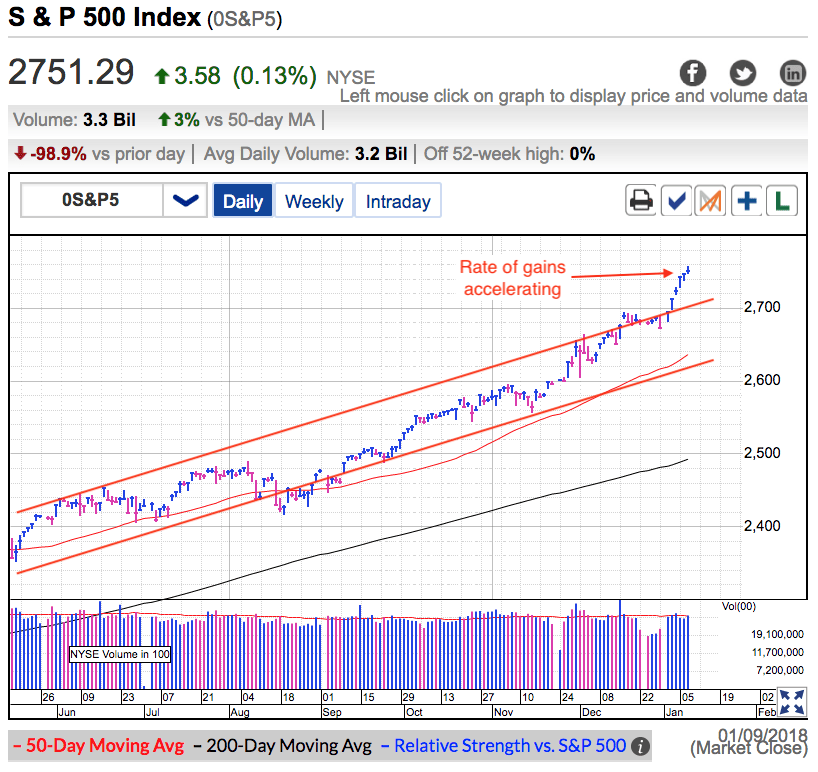

The S&P 500 closed higher for the 6th day in a row and extends 2018’s breakout. Volume was average and tells us most traders are back at work following the holiday layoff. There were no clear headlines driving today’s price-action and this is simply a continuation of the positive feelings that fueled this week’s breakout and last year’s rally.

No matter which sentiment measure you look at, bullishness is at extreme levels. The latest AAII survey is 60% bullish versus 16% bearish. Stocktwits’ SPDR S&P 500 (NYSE:SPY) stream it 78% bullish. Put/Call ratios and newsletter writers are all at frothy levels. Yet prices keep going higher.

The thing to remember about sentiment is it is a secondary indicator, meaning that while useful, it cannot be used by itself to time trades. It tells us when to be careful or aggressive, but it doesn’t tell us when to trade. What this means is the stock market can keep going higher over the near-term, but these extreme bullish sentiment levels are warning us to be extremely careful.

The problem with most “overly bullish” markets is all the bulls are already fully invested. Once they dump all of their savings into the market, from that point forward they lost the ability to push the market higher. The best they can do is convince their friends, relatives, neighbors, and coworkers to dump all their savings into the market too. Attracting new investors how bullish levels can stay elevated for extended periods of time while the market continues to rally. Everyone in the market is fully invested, but non-investors keep streaming into the market and are the fuel that keeps pushing prices higher. This new money is why these extreme bullishness levels have not resulted in a more typical dip back to support.

As long as bulls are able to convince everyone they know to invest in the stock market, prices will continue climbing. The problems is these investing rookies typically get to the party just before it ends. They show up just as smart money starts leaving.

Over the near-term the market looks great and momentum will likely keep us drifting higher. But the market has been far too easy for way too long and that makes me nervous. Something will come along at some point that will remind everyone the stock market is most definitely not easy. No one knows what that will be and when it will happen, but it is a virtual certainty that something will upset this apple cart. Those of us that are paying attention will be able to collect our profits and get out of the way just before bullishness turns ugly.

Keep doing what has been working, and that is sticking with your favorite buy-and-hold stocks. But stay close to the door. The question isn’t if, but when.