The good-bye kiss of the line connecting the early June highs indeed meant no farewell at all. The S&P rose in the run-up to the Fed, and extended gains in its aftermath. Are the signs that made me merely cautiously optimistic about the bullish resolution, gone now?

The technical picture certainly cleared up with the credit markets moving higher and technology not having a really bad day either. Will its consolidation make it through the earnings report batch later today? Semiconductors hint at a rather constructive outcome, and my sectoral observations yesterday remain true also today:

"(…) Technology is holding up, semiconductors aren't weakening relatively to the sector, and the rotation into healthcare, materials, and industrials is very much on. The defensives (utilities and consumer staples) are also improving their posture. Consumer discretionaries are firm, and financials are getting better relative to the index."

Let's check the other building blocks in the outlook assessment.

S&P 500 In The Short-Run

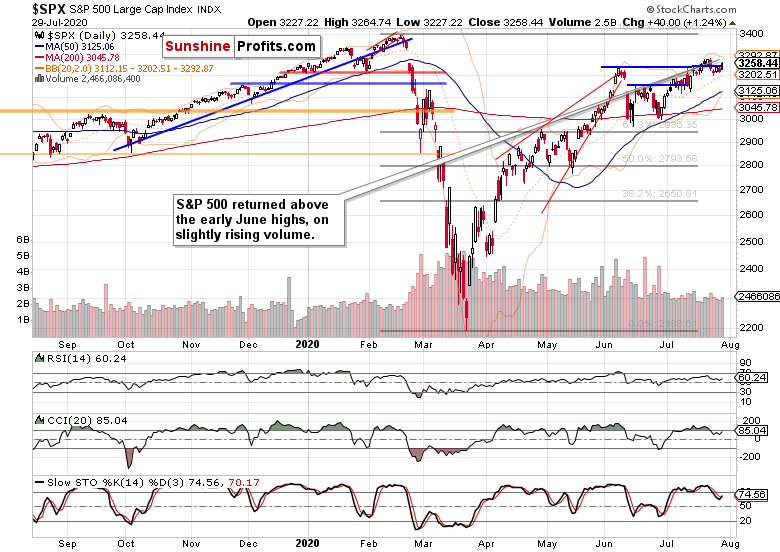

I’ll start with the daily chart perspective (charts courtesy of http://stockcharts.com ):

Yesterday's close above the early June highs on rising volume is a bullish turn of events as stocks continue their chop around the horizontal blue line. The Fed didn't really surprise yesterday, and stocks liked the message of continued support—in line with the dynamic I mentioned yesterday:

"(…) Regardless of the real action in precious metals (canary in the coal mine), the Fed would err on the side of not fighting inflation too soon. And thus far fighting the deflationary corona effects, the stimulus is winning and being embraced with open arms by stocks."

So, I think that the bears would be getting ahead of themselves expecting a lasting downturn right now—I treat the consolidation as one with a higher likelihood of a bullish resolution than a bearish one.

Today's frightening advance Q2 GDP and poor unemployment data are likely to be brushed aside during the regular session's trading—I see the focus as being rather on the upcoming stimulus details and tech earnings.

Let's check the credit market performance.

The Credit Markets’ Point Of View

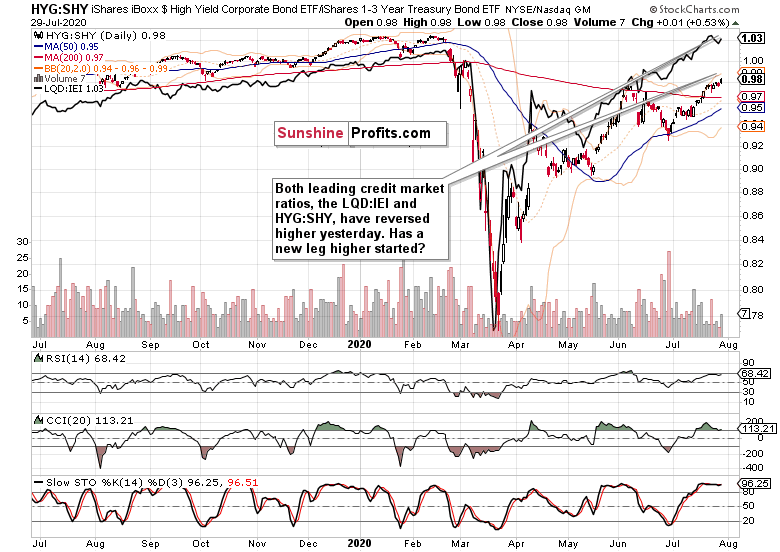

High yield corporate bonds (HYG ETF) regained ground yesterday, and on promising volume (please see this and many more charts at my home site). The Fed didn't disappoint, and the sideways consolidation has indeed been resolved with an upswing. The move higher is confirmed by rising investment grade corporate bonds (LQD ETF). The pre-Fed gyrations appear to be over, and with the settling dust, I look for a renewed uptrend.

Both the leading credit market ratios—high yield corporate bonds to short-term Treasuries (HYG:SHY) and investment grade corporate bonds to longer-dated Treasuries (LQD:IEI)—are moving in lockstep again. The short-term weakness is about to give way to another advance in my opinion.

The overlaid S&P 500 closing prices (black line) reveal the extent of stocks taking the cue from the HYG:SHY ratio. The 500-strong index is recovering from its recent soft patch, and is ready to extend gains in case HYG:SHY moves up again. And the ratio's upcoming rise isn't a far-fetched idea. The similarity to its early July chop is again being resolved with an upswing.

Smallcaps, Emerging Markets AndS&P 500 Market Breadth

The Russell 2000 (IWM ETF) is trading with solidly bullish undertones. Yesterday's rising volume brought its closing prices farther away from the 200-day moving average, and smallcaps continue trading closer to their early July highs than the S&P 500. Such a very short-term outperformance can turn into more than a few days' affair, benefitting the stock bulls broadly.

Mirroring the technology consolidation in a way, the emerging markets (EEM ETF) aren't going pretty much anywhere. The fact that they aren't selling off though, points to a floor below stock prices these days.

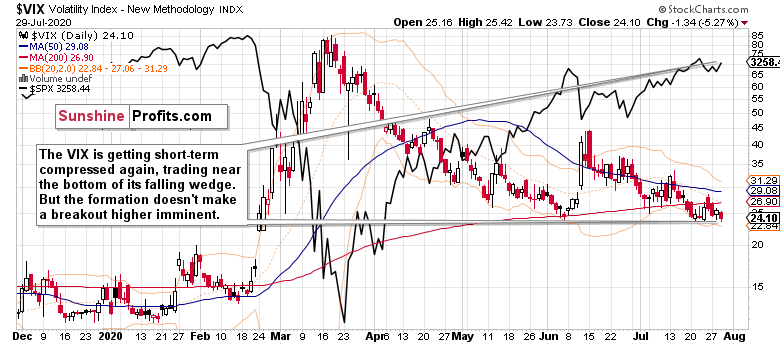

Volatility $VIX has moved to the lower border of its falling wedge, and doesn't scream that an upside breakout is knocking on the door. As a result, it won't likely influence the prevailing direction in stocks much. And that points to the S&P 500 upswing continuation.

Summary

Summing up, yesterday's S&P 500 rebound rekindled the bullish spirits, and the credit market posture coupled with market breadth improvements (both the advance-decline line and advance-decline volume are encouraging) reflect that precisely. Expecting the stimulus details, stocks are likely to shake off yesterday-mentioned fundamental risks and leave the effects of stalling job market and horrific GDP decline in the rear view mirror. With the Fed perceived as having the markets' back, the path of least resistance still remains chiefly higher. Today's tech heavyweights' earnings will be THE bellwether speaking with a decisive tone, and I keep being cautiously optimistic.