The “Greatest Economy in History” Stumbles

“This is the greatest economy in the history of our country”, Donald Trump opined just a few months ago.

Alas, recently there is growing evidence of an economic slowdown.

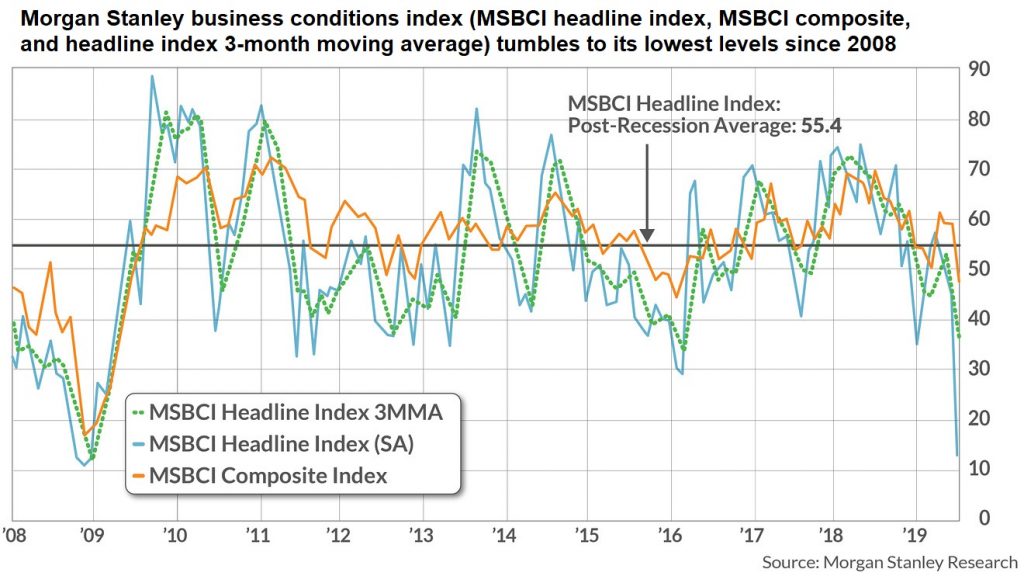

The Morgan Stanley (NYSE:MS) MS MSBCI business conditions gauge plummets to its lowest level since 2008, as recent economic data releases ominously persist in disappointing. [PT]

This has fueled speculation of imminent rate cuts by the Fed. You may therefore wonder: how do stock prices typically respond to rate cuts by the central bank?

The Fed Does Have an Effect on Stock Prices

The effect of rate cuts can be examined with the help of the Seasonax app. Its charting tool provides the quickest way of studying the impact of exogenous events on all kinds of asset prices.

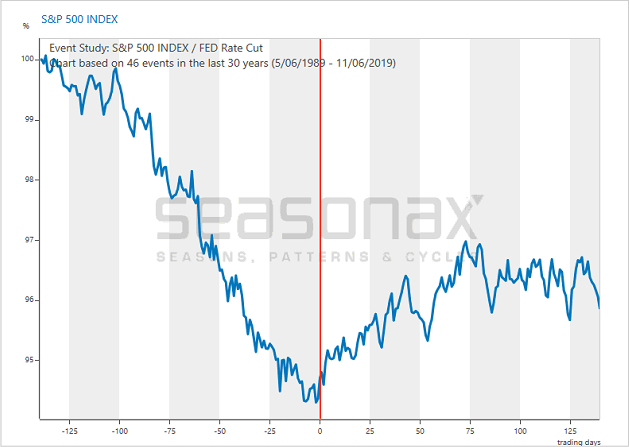

The chart below shows the average move of the S&P 500 Index in the 140 days before and after US rate cuts were implemented. The average was calculated over the past 30 years, in which rates were altogether lowered 46 times.

The horizontal scale shows the number of days before and after the event, the vertical scale the average price change in percent. The time of the rate cut is highlighted in orange in the middle of the chart.

Average move of the S&P 500 Index 140 days before and after rate cuts by the Fed (1989 – 2019). Rate cuts have typically stabilized stock prices in the short term [PT]

It can be seen right away that stocks typically decline in the months preceding rate cuts, but turn around immediately thereafter. Then they tend to rise moderately for approximately two and half months before the recovery stalls out again.

In short, Fed rate cuts have a significant effect on stock prices. Administered interest rates are typically lowered during bear markets, which explains why prices typically decline ahead of rate cuts. As soon as the Fed becomes active, it stabilizes prices for a while and a counter-trend move ensues.

The Fed’s Actions Also Affect Other Markets

In the past, these counter-trend moves were on average definitely large enough to suggest that it would make sense to close out short positions and perhaps even venture into a small long position.

However, the Fed’s actions not only have an impact on stock markets but on many other markets as well. In the next issue of Seasonal Insights I will examine the Fed’s influence on foreign exchange rates.

Moreover, there are of course a great many more events and cyclical factors that influence asset prices.