You’ve heard us say it before: Asset allocation is responsible for up to 90% of your long-term investment returns.

To get the most out of your portfolio, you need to sensibly divide it between U.S. stocks, foreign stocks, bonds, precious metals and other asset classes.

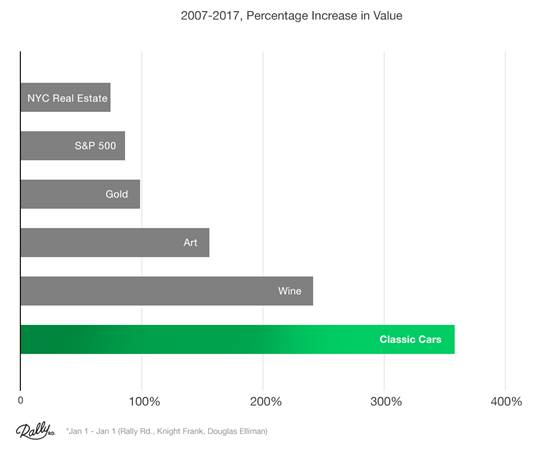

And as you can see from this week’s chart, classic cars are an unexpectedly good way to diversify your investments. In fact, they’ve beaten the S&P 500’s returns over the last decade.

How Classic Car Investing Works

A classic car is an example of a rare tangible asset - that’s a physical investment with aesthetic or collectible value.

Many cars have seen their resale values increase fivefold in the last decade. The internet has caused an explosion of activity in this obscure market. Once-isolated car nuts are able to join together to swap information... and rides.

Granted, not every old car is worth a lot of money. The investment car market tends to favor European coupes and sedans from the ‘50s and ‘60s. And collectors typically have strong preferences about condition and mileage.

Why Buy the Whole Thing?

As with any asset class, investing in classic cars has its downsides - especially if you’re buying and maintaining whole cars by yourself.

For obvious reasons, the classic car market generally has a very high cost of entry. Buying into the market will probably cost you at least $20,000. And that doesn’t include any maintenance or security costs you may incur over the course of your investment.

Plus, just like in the stock market, there are good purchases and bad purchases. Unless you’re rich enough to diversify your car portfolio across several classic models, this can be a risky market.

But a software company called Rally Rd. has developed an interesting solution to these problems. Its app (available only on iPhone at the moment) allows you to buy shares of these sweet old rides for as little as $40. Click here to learn more.