The Household Appliances industry covers a broad range of products including electrical and mechanical devices that facilitate the household chores. Companies in this industry manufacture big as well as small household appliances like refrigerators, washing machines, water coolers, microwave ovens, toasters and coffee makers.

Let’s have a look at the industry’s three major themes:

- Rise in disposable and per capita income coupled with improving housing and construction activities are the key catalysts for the household appliances industry. Notably, this multi-billion dollar industry is well poised to grow over the coming years as consumers continue to look for ease in managing household chores. The Global Home Appliances Market is expected to reach $203.37 billion by the end of 2023, a CAGR of 2.6% in the 2018-2023 time period.

- In the era of automation, technology is playing a significant role in the field of electronics. Home appliances are now becoming high-tech, embedded with smart sensors and the Internet of things (IoT) enabled technology to meet the needs of tech-savvy consumers. The industry has witnessed increased demand for devices that can be controlled and monitored remotely through mobile applications. As a result, industry players are largely investing in innovation and Research & Development (R&D) to make differentiated products. These companies remain committed toward producing appliances offering one-stop solutions for major household functions such as, cooking, vacuuming and laundry. Additionally, appliance makers are installing smart grids, thermostats, digital inverter compressors and other monitoring sensors to make devices energy efficient.

- On the flip side, higher cost of investments in product innovation and technology are weighing on the margins of companies in this space. Raw material cost inflation is another headwind. Volatility in the prices of raw materials including steel, oil, plastic, resin, aluminum, copper, zinc and nickel, have been negatively impacting the companies’ operating performances. Additionally, higher tariffs on steel, which forms a key raw material, have increased operational costs. These factors have been denting margins and overall profitability. Evidently, leading home appliances maker, Whirlpool Corporation (NYSE:WHR) (WHR) has been witnessing higher input costs due to volatile steel and resin prices. However, companies are resorting to higher pricing and cost-productivity programs via cost-based price increments and cost-reduction initiatives to boost margins.

Zacks Industry Rank Indicates Bright Prospects

The Household Appliances industry is housed within the broader Zacks Consumer Discretionary sector. It carries a Zacks Industry Rank #73, which places it at the Top 29% of more than 250 Zacks industries.

The group’s Zacks Industry Rank, which is basically the average of the Zacks Rank of all the member stocks, indicates bleak near-term prospects. Our research shows that the top 50% of the Zacks-ranked industries outperforms the bottom 50% by a factor of more than 2 to 1.

The industry’s positioning in the top 50% of the Zacks-ranked industries is a result of positive earnings outlook for the constituent companies in aggregate. Looking at the aggregate earnings estimate revisions, it appears that analysts are gradually becoming optimistic about this group’s earnings growth potential.

Before we present a few stocks that you may want to consider for your portfolio, let’s take a look at the industry’s recent stock-market performance and valuation picture.

Industry Lags in Terms of Shareholder Returns

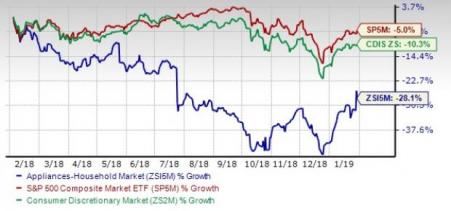

The Zacks Household Appliances industry has underperformed the broader Consumer Discretionary sector and the S&P 500 index over the past year.

While the stocks in this industry have collectively lost 28.1%, the Consumer Discretionary and the S&P 500 Composite have declined 10.3% and 5%, respectively.

One-Year Price Performance

Household Appliances Industry’s Valuation

On the basis of forward 12-month price-to-earnings (P/E) ratio, a commonly used multiple for valuing Consumer Discretionary stocks, the industry is currently trading at 7.75X compared with the S&P 500’s 16.3X. Further, the sector’s forward 12-month P/E ratio stands at 17.39X.

Over the last five years, the industry has traded as high as 13.34X, as low as 6.37X and at the median of 10.47X as the chart below shows.

Price-to-Earnings Ratio (Past 5 Years)

Bottom Line

Healthy economic prospects and higher disposable income might boost the demand for household devices. Moreover, product launches and innovations as well as technological advancements act as key catalysts for the industry. However, higher spending and increased raw material expenses remain concerns. Notwithstanding these headwinds, cost-containment efforts by players might help in minimizing the impact of rising raw material costs, thus cushioning margins and profitability.

While none of the stocks in the Household Appliances industry currently sports a Zacks Rank #1 (Strong Buy), there is one stock that has a Zacks Rank #2 (Buy). We have also suggested holding on to two other stocks that carry a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank stocks here.

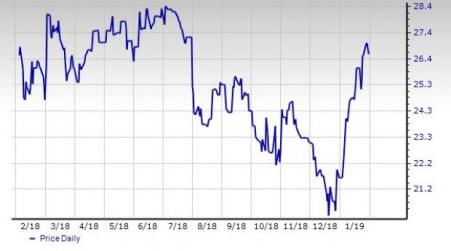

Hamilton Beach Brands Holding Company (HBB): This Glen Allen, VA-based designer and marketer of small branded electric household has gained 2.2% over the past year. The Zacks Consensus Estimate for 2019 earnings remained stable over the past 30 days for this Zacks #2 Ranked company.

Price and Consensus: HBB

Howden Joinery Group Plc (HWDJY): The consensus EPS estimate for this London-based company moved up nearly 0.6% for the current year over the last 60 days. This Zacks Rank #3 company has gained 9% in the past three months.

Price and Consensus: HWDJY

Libbey Inc. (LBY): This Toledo, OH-based producer of glass tableware in the United States and Canada has gained 30.7% in a month’s time. The Zacks Consensus Estimate for the current year EPS has been stable over the past 30 days. It has a Zacks Rank of 3.

Price and Consensus: LBY

Looking for Stocks with Skyrocketing Upside?

Zacks has just released a Special Report on the booming investment opportunities of legal marijuana.

Ignited by new referendums and legislation, this industry is expected to blast from an already robust $6.7 billion to $20.2 billion in 2021. Early investors stand to make a killing, but you have to be ready to act and know just where to look.

See the pot trades we're targeting>>

Whirlpool Corporation (WHR): Free Stock Analysis Report

Libbey, Inc. (LBY): Get Free Report

HOWDEN JOINERY (HWDJY): Free Stock Analysis Report

Hamilton Beach Brands Holding Company (HBB): Get Free Report

Original post

Zacks Investment Research