Meat and food products company, Hormel Foods Corporation (NYSE:HRL) reported weaker-than-expected results for third-quarter fiscal 2017 (ended Jul 31, 2017).

Quarterly adjusted earnings came in at 34 cents per share, missing the Zacks Consensus Estimate of 37 cents. The bottom line also came in lower than the year-ago tally of 36 cents per share.

Inside the Headlines

In the fiscal third quarter, Hormel Foods generated net sales of $2,207.4 million, missing the Zacks Consensus Estimate of $2,237 million. In addition, the top line came in 4.1% lower than the prior-year tally.

Hormel Foods’ cost of sales was down 3.9% year over year to $1,755 million. Gross margin contracted 10 basis points (bps) to 20.5%.

Quarterly selling, general and administrative expenses were $176.7 million, down from $206.9 million recorded in the comparable period last year.

The company’s operating margin was 12.7% compared to 11.9% recorded in the year-ago quarter.

Segment Details

In the reported quarter, revenues from Grocery Products improved 5.7% to $422 million.

Revenues at the Jennie-O Turkey Store segment jumped 8.6% to $369.1 million.

The company’s Refrigerated Foods segment generated revenues of $1,086.5 million, down 6% year over year.

International & Other revenues inched up 1% to $132.9 million.

However, Specialty Foods revenues were down 7.2% to $196.9 million.

Other Financial Particulars

Exiting the fiscal third quarter, Hormel Foods had cash and cash equivalents of $633.3 million, up from $415.1 million as of Oct 30, 2016. However, the company’s long-term debt of $250 million (excluding current maturities) remained mostly unchanged.

For the first nine months of fiscal 2017, Hormel Foods generated cash of $511.5 million from operating activities, marginally down 17.7% year over year. Capital expenditure on purchase of property and plant totaled $116 million compared to $163.2 million incurred in the year-earlier period.

The company paid its 356th consecutive quarterly dividend at an annualized rate of 68 cents, effective Aug 15, 2017.

Outlook

Hormel Foods lowered its fiscal 2017 earnings guidance to the $1.54-$1.58 per share range from the prior projection of $1.65-$1.71 per share. This Zacks Rank #3 (Hold) company noted that cost inflation for inputs such as pork trim and beef trim will continue to thwart its near-term profitability.

Furthermore, the Jennie-O Turkey Store business segment is expected to face persistent challenges, as the industry has yet not secured the required turkey production levels.

Stocks to Consider

A few better-ranked stocks in the industry are listed below:

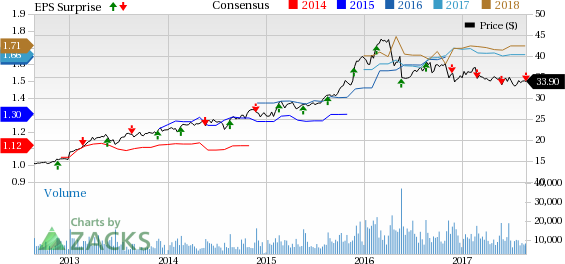

Nu Skin Enterprises, Inc. (NYSE:NUS) has an average positive earnings surprise of 10.83% for the last four quarters and currently carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

The New York Times Company (NYSE:NYT) holds a Zacks Rank #2 and has an average positive earnings surprise of 43.06% for the trailing four quarters.

Inter Parfums, Inc. (NASDAQ:IPAR) also holds a Zacks Rank #2 and has an average positive earnings surprise of 18.08% for the same time frame.

One Simple Trading Idea

Since 1988, the Zacks system has more than doubled the S&P 500 with an average gain of +25% per year. With compounding, rebalancing, and exclusive of fees, it can turn thousands into millions of dollars.

This proven stock-picking system is grounded on a single big idea that can be fortune shaping and life changing. You can apply it to your portfolio starting today.

Inter Parfums, Inc. (IPAR): Free Stock Analysis Report

Nu Skin Enterprises, Inc. (NUS): Free Stock Analysis Report

Hormel Foods Corporation (HRL): Free Stock Analysis Report

New York Times Company (The) (NYT): Free Stock Analysis Report

Original post

Zacks Investment Research