Per Business Insider, Honda Motor Company (NYSE:HMC) plans to launch two fully-electric vehicles in 2018. Of which, one will be unveiled in China and the other in Europe.

In June, Honda announced the upcoming model launch for the Chinese market, the world’s largest market for electric vehicles. With the expected number of electric-vehicle sales in China to exceed 4 million by 2025, these vehicle launches will help Honda strengthen presence in the country.

Further good news is that the company will be launching Urban EV Concept, the first electric-vehicle to woo European customers.

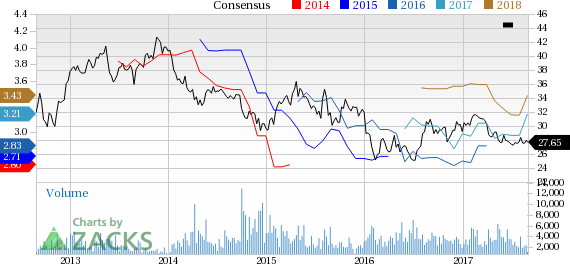

Honda Motor Company, Ltd. Price and Consensus

These electric-vehicle introductions are in line with Honda’s Vision 2030 strategy plan, which announced an increasing research and development effort for electric vehicles and self-driving technology. Further, the company is also aiming to electrify two-third of its automobiles by 2030.

Currently, the company sells all-electric Clarity cars in the United States with a range of 89 miles per charge.

The strict regulations to check air pollution in China lie in favor of electric-vehicles, thus making it an ideal market for sale of such cars. Apart from Honda, many major automakers are rolling out their electric-cars in the country. Recently, the Renault-Nissan partnership has decided to manufacture battery-powered cars. (Read more: Renault-Nissan to Manufacture Battery-Powered Cars in China).

Price Performance

Shares of Toyota have lost 4.5% year to date, marginally underperforming the industry’s 3.4% decline.

Zacks Rank & Other Key Picks

Honda currently flaunts a Zacks Rank #1 (Strong Buy).

A few other automobile stocks with the same bullish rank are Allison Transmission Holdings Inc. (NYSE:ALSN) , Renault (PA:RENA) SA (OTC:RNLSY) and Toyota Motor Corporation (NYSE:TM) . You can see the complete list of today’s Zacks #1 Rank stocks here.

Allison Transmission has a long-term growth rate of 11%.

Renault has a long-term growth rate of 4.6%.

Toyota Motor Corporation has a long-term growth rate of 7%.

One Simple Trading Idea

Since 1988, the Zacks system has more than doubled the S&P 500 with an average gain of +25% per year. With compounding, rebalancing, and exclusive of fees, it can turn thousands into millions of dollars.

This proven stock-picking system is grounded on a single big idea that can be fortune shaping and life changing. You can apply it to your portfolio starting today.

Learn more >>

Honda Motor Company, Ltd. (HMC): Free Stock Analysis Report

Toyota Motor Corp Ltd Ord (TM): Free Stock Analysis Report

RENAULT SA (RNLSY): Free Stock Analysis Report

Allison Transmission Holdings, Inc. (ALSN): Free Stock Analysis Report

Original post

Zacks Investment Research