Options Traders Have Been Bullish The Past 2 Weeks

Home Depot (NYSE:HD) is one of three Dow names slated to report this week, with the company's second-quarter earnings scheduled to surface before the market opens, tomorrow, Aug. 14. Below, we will take a look at how the blue chip has been faring on the charts, and dive into what the options market is pricing in for the stock's post-earnings move.

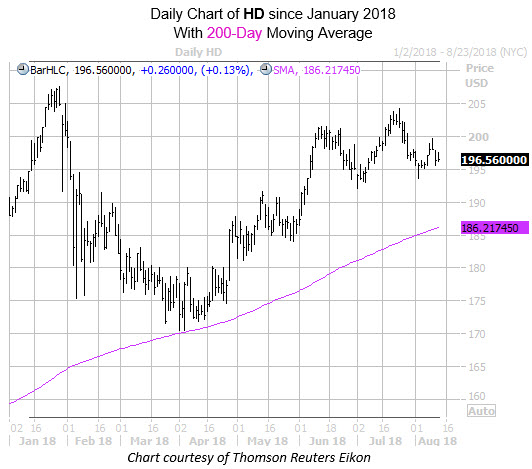

Last seen slightly higher at $196.56, HD has been moving higher on the charts since bottoming out near $170 and the 200-day moving average in early April. More, recently, the stock has been moving sideways, stuck between $204 and a floor of support near $194, right above the year-to-date breakeven point.

Digging into HD's earnings history, the stock has closed lower the day after the company reports in five of the last eight quarters, including a 2.7% drop this time last year. Looking back eight quarters, the shares have moved 1.4% the day after earnings, on average, regardless of direction. This time around, however, the options market is pricing in a much-bigger 6% move for tomorrow's trading.

In terms of options data, traders have been heavily bullish toward HD. This is per the stock's 10-day call/put volume ratio of 2.93 at the International Securities Exchange (ISE), Chicago Board Options Exchange (CBOE), and NASDAQ OMX PHLX (PHLX), which ranks in the 97th annual percentile. In other words, during the past two weeks, calls have been purchased over puts at pace of nearly 3-to-1.

Analysts have also been showing optimism toward Home Depot. Of the 26 firms in coverage, only five carry tepid "hold" ratings. Plus, the home improvement stock's average 12-month price target of $213.07 comes in at an 8.4% premium to current levels.