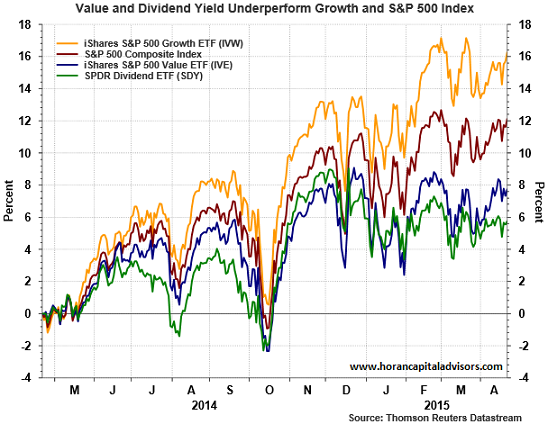

One interesting aspect of the recent equity-market advance has been the investor focus on higher quality dividend-growth equities. A result of investors' search for yield is many of these higher yielding equities are trading at the higher end of their historical valuation range. Also, given the heightened focus on yield, one would expect the higher quality dividend growth equities to have outperformed the market over the past year. However, as the below chart shows, the SPDR S&P Dividend (NYSE:SDY) has generated the worst 1-year return versus the other three comparison investments. The second-worst performer is the S&P 500 Barra Value Index.

Although investors have pursued higher yielding investments in this low-yield environment, the higher demand has not resulted in higher returns. The underperformance of higher quality and higher-yielding investments may be a shorter-term phenomenon, but investors simply need to be aware that pursuing higher-yield/higher-quality strategies can result in lagging performance if only in the short run. On the other hand, in a market correction higher quality and higher yield equities tend to outperform the overall market.