Who is Kevin Hassett? Wolfe looks at the Trump ally tipped to become Fed Chair.

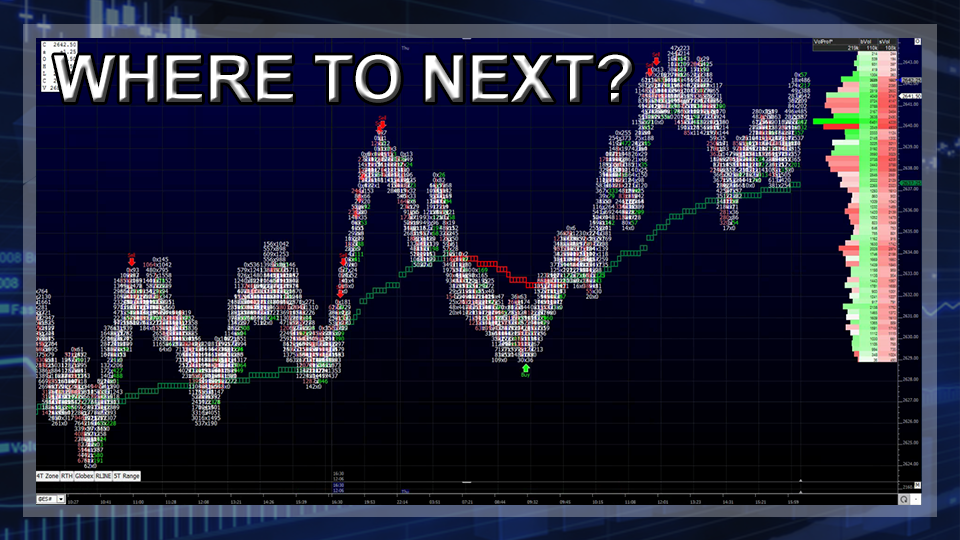

The S&P goes up, and the S&P goes down… But it mostly goes up, and that’s what it did yesterday. After making an overnight high at 2639.75 the ES pulled back all the way down to 2629.00 around 8:15 CT, after the Asian markets finished mostly higher, the European Stoxx 600 was flat, and Bitcoin topped $15,000.

The ES opened mostly flat and started to move up right away. The first print off the 8:30 futures open was 2630.50, and it never really looked back. By 12:00 pm CT, a high had been established at 2643.75, which would hold for the rest of the day. After that, there was a pullback down to 2635.25 then, then another move higher would finish out the day.

It was all buy stops and buy programs. Total volume in the front month ESH was a total ‘joke’. At 12:15 CT only 133.000 contracts had traded. At 2:22 the MiM was showing sell $650 million to sell, as the ES traded back up to the 2641.00 level, and the NQ rallied back up to the 6340.50 level. The actual MOC came out sell $728 million, and the ES dipped back down to the vwap at 2637.25 before trading back up to 2640.00. On the 3:00 cash close the ES traded 2640.25, up 8.75 handles, or up 0.34%. On the 3:15 futures close the ESH closed out at 2642.50, up 11 handles on the day, or 0.42%, just 5 ticks off the high of the day.

Well, yesterday’s switch day did not only move to the March contract, it also switched directions. As we said, the buy stops were building up and the rollover creates a thin to win type trade, and that’s exactly what traders got. In the end the S&P 500 futures (ESH17:CME) settled at 2642.25, up +10.25 handles, or +0.38%; the Dow Jones futures (YMH17:CBT) settled at 24,246, up +76 points, or +0.31%; the Nasdaq 100 futures (NQH17:CME) settled at 6341.75, up +30.00 points, or +0.47%; and the Russell 2000 (RTYH17:CME) settled at 1523.80, up +12.60 points or +0.82% on the day.

As always, please use protective buy and sell stops when trading futures and options.