- PCE inflation creeps up unexpectedly, pushing Fed’s terminal rate bets higher

- Yields surge again, dollar hits 7-week high as Wall Street tumbles

- Gold sinks too but pound perks up as Northern Ireland deal with EU eyed

Disinflation doubt after core PCE shock

The run of downside surprises in US inflation data has well and truly come to an end, at least for now, after the latest PCE price figures followed the CPI report in coming in above expectations. The Fed’s favourite inflation tracker – the core PCE price index – rose to 4.7% in January, beating forecasts of 4.3% and up from the prior month’s upwardly revised reading of 4.6%. What was also worrying was the lofty month-on-month gain of 0.6%.

But the strong numbers didn’t stop with the PCE price indices. Personal consumption shot up 1.8% in January, surpassing expectations of a 1.3% increase, and although personal income missed estimates, it was still up a solid 0.6% m/m.

The data not only casts doubt over the Fed’s decision earlier this month to hike rates by only 25 basis points, but also whether there is a genuine case to be made about disinflation taking hold in the US economy.

Chair Powell sparked a market rally as soon as he uttered that word in his post-meeting press conference even as he stressed the need for further rate hikes. But his credibility may be at stake if this uptick in inflation turns out to be more than just a blip.

However, there doesn’t seem to be the appetite within the FOMC to re-accelerate the pace of tightening. Several policymakers who had the opportunity to air their views on Friday after the data release stopped short of calling for a return to 50-bps increments, including the Cleveland Fed’s Loretta Mester.

Wall Street succumbs to higher yields, but selloff eases

Nevertheless, markets were under no illusion this time about the possibility of interest rates peaking even higher than previously anticipated. Fed fund futures for July have edged up to a new cycle high of 5.41% today as investors priced in steady 25-bps rate increases at least through the summer. Rate cut odds have not been completely priced out, but they are diminishing fast.

Sovereign bonds came under pressure globally, pushing yields higher. Most notably, the two-year Treasury yield climbed above 4.8% for the first time since 2007 when excluding November’s spike.

On Wall Street, the S&P 500 ended a bruising week down by about 2.7%, while the Nasdaq Composite lost more than 3%.

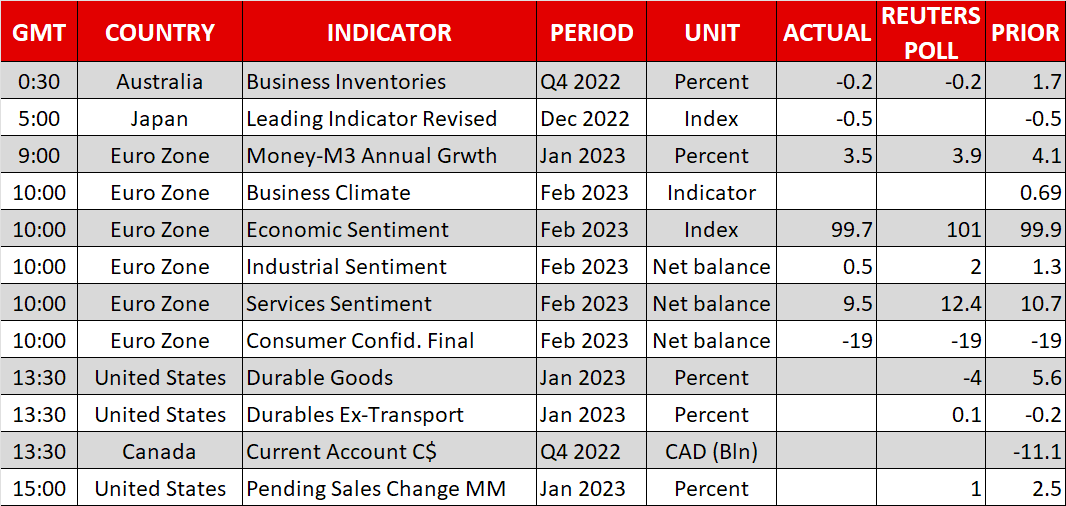

However, the selloff has eased at the start of the new trading week and both US futures and European indices are in positive territory. US durable goods orders will come into focus later today.

Remarks from the heads of the European Central Bank and Bank of Japan may be aiding sentiment. In freshly published comments by President Christine Lagarde from an interview with the Economic Times, the ECB chief left the door open to smaller rate hikes after the expected 50-bps move in March.

Meanwhile, incoming BoJ governor, Kazuo Ueda, appeared to suggest that the Bank might not have to pull the plug completely on monetary stimulus even if inflation were to continue to overshoot the 2% price target in comments to Japan’s upper house of parliament on Monday.

Pound sets sights on new Brexit deal

Another cause of optimism is the growing speculation that the UK and EU are about to reach a long-awaited agreement on improving the Northern Irelan protocol. The much-hated protocol has been an ongoing source of dispute between London and Brussels since the divorce as well as between Republicans and Unionists in Northern Ireland.

A deal could remove barriers for the flow of goods between Britain and the province, paving the way for stronger post-Brexit relations between the UK and EU.

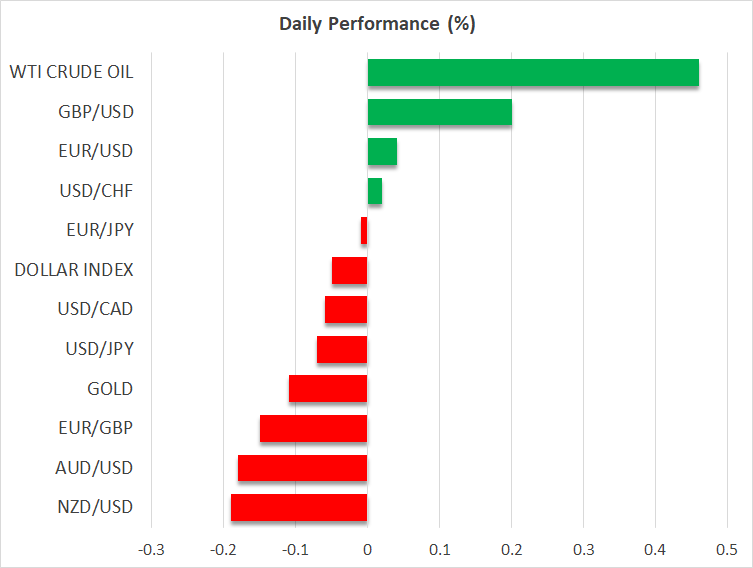

The pound was the strongest performer against the US dollar on Monday, gaining by about 0.25%. The euro was flat while the dollar index was slightly in the red as the greenback also dipped against the yen even though the Japanese safe haven was mixed versus its other peers.

Gold and oil go in opposite directions

In commodities, oil prices were headed for a third straight day of gains, but gold was struggling in the $1,810/oz region. The precious metal has been on a slide since the start of the month, pressured by rising bond yields and firming Fed rate hike expectations. It brushed a two-month low earlier in the session.

Unless US economic indicators begin to deteriorate and Fed bets cool off, it’s unlikely bullion will be able to see much upside in the near term.