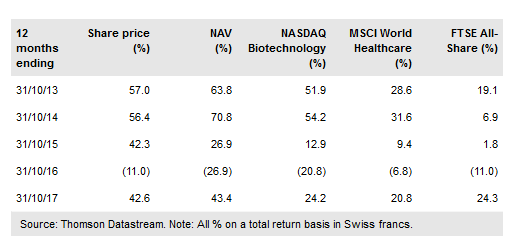

BB Biotech (SIX:BION) is a long-established (since 1993), Switzerland-based global investor in the innovative area of biotechnology. It is differentiated from peers by its short list of stocks (typically 30-35) and high-conviction approach, with five to eight core holdings accounting for half to two-thirds of the portfolio. While the fund can be vulnerable to short-term sentiment dips (such as in the period immediately before and after the US presidential election in 2016), its performance record is impressive in both absolute and relative terms, with a NAV total return of c 270% over five years, and NAV and share price outperformance of the benchmark NASDAQ Biotechnology index over three, six and 12 months, and three, five and 10 years to 31 October 2017 (all in Swiss franc terms). A high distribution policy of 5.0% underpins the current dividend yield of 4.3%.

Investment strategy: Concentrated biotech portfolio

BION is managed by a six-strong team with various medical specializations. They build the high-conviction portfolio of 20-35 stocks (typically 30-35) by filtering a global universe of c 800 companies, looking at industry dynamics, clinical developments, management strength, company financials and return potential. The portfolio is global and diversified by market cap, although there is a preference for companies that are already generating above-average sales and profits. Concentration in the portfolio is high, with five to eight core holdings accounting for c 50-65% of assets.

To read the entire report Please click on the pdf File Below: