The mainstream financial media narrative? Trump or Biden would be great for the stock market.

Biden would be great for stocks because direct government stimulus should power consumers until the economy heals on its own. On the flip side, Trump would be great for stocks because business-friendly policies (e.g., tax cuts, regulation rollbacks, etc.) should benefit corporate profitability.

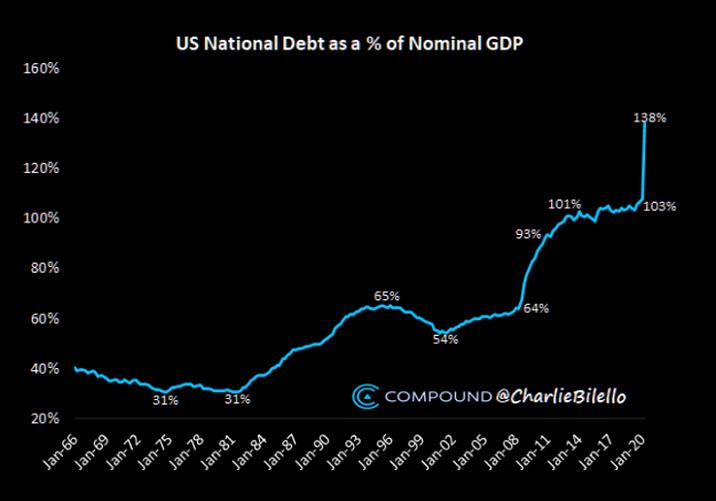

What few in the mainstream financial media talk about is the debt required to pay for our so called well-being. At the federal level, we’ve already jumped the proverbial shark.

Some will tell you, government debt and deficits do not matter. We print the money. We can create more of the stuff anytime we’d like.

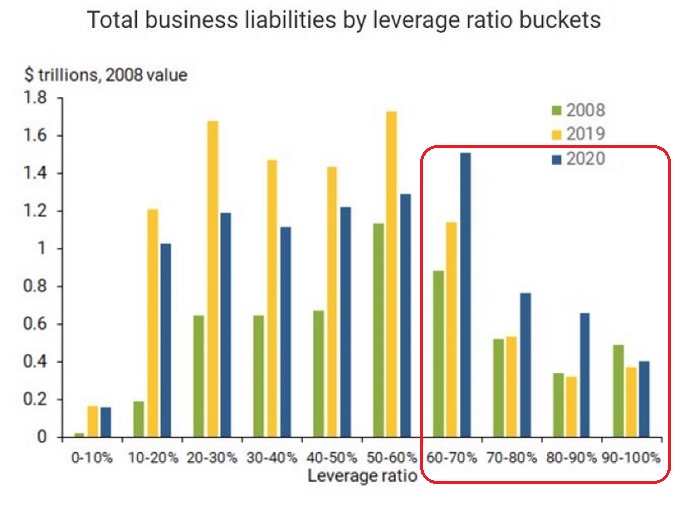

Businesses, however, do not have the luxury of printing money. When debts as a percentage of earnings increase dramatically, it becomes more and more difficult to service the interest. High credit risk corporations (a.k.a. “high yield”) can find themselves stuck in a spiral of credit downgrades, higher interest costs and eventual insolvency.

Not surprisingly, the most heavily leveraged corporations have added trillions more to the liability side of their respective ledgers in 2020. Does that sound like a net positive?

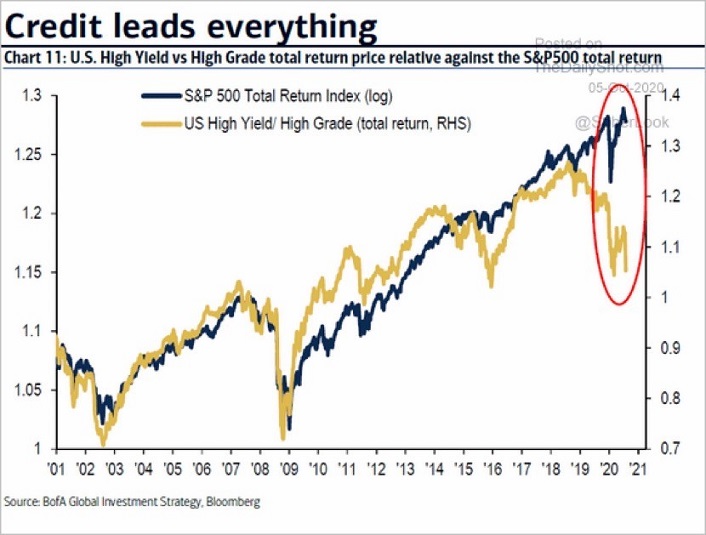

Investors continue to funnel money into stocks. Yet they’re becoming noticeably shy about high yield corporate debt. In particular, the iShares High Yield Bond ETF (NYSE:HYG) has not recovered its February highs the way that the S&P 500 (SPY) has.

In a similar vein, the high yield/investment grade ratio (total return) has been heading lower. Typically, stocks will follow.

Then again, few things have been typical about the 2020 stock bubble. “Risk On” has been the name of the game since March.