Just two weeks ago I wrote an article focusing on investment risk and market corrections, Incurring Investment Risk Near A Market Correction. The "correction" thinking seems to remain high on many investors' and strategists' minds. From a contrarian perspective, market corrections are difficult to time and corrections rarely occur when everyone expects them to. This article is falling into the same line of correction thinking, maybe a trap of sorts; however, the following thoughts will touch on an equity strategy that historically has held up better in declining equity market environments.

If investors are concerned about a looming correction, one approach is to focus on high quality stocks. S&P, Dow Jones Indices constructs two indices, one comprised of high quality stocks and the other low quality stocks. The high quality index contains 135 stocks made up of companies with Earnings and Dividend Quality Rankings of "A" or better. The low quality index contains 172 stocks whose Rankings are "B" and lower.

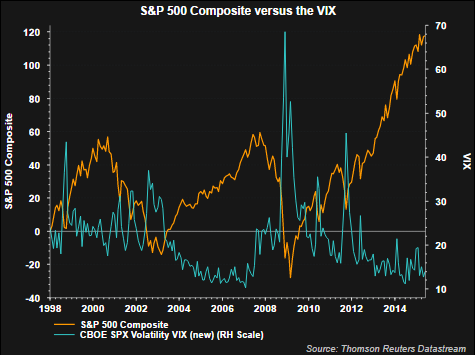

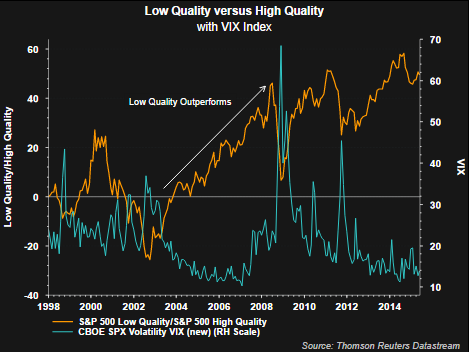

As can be seen in the first chart below, spikes in the volatility index (VIX) or investor fear gauge, coincide with declines in the S&P 500 Index. The VIX has continued to trend lower since the end of the financial crisis. A move higher in the VIX occurred near the end of 2011, as the market reacted negatively to the U.S. debt ceiling debate taking place in Washington. The second chart shows the ratio of the low quality index divided by the high quality index compared to the VIX index. Evident in this second chart is the fact that high quality stocks outperform low quality ones in periods where the VIX moves higher, i.e., market declines.

|

| From The Blog of HORAN Capital Advisors |

|

| From The Blog of HORAN Capital Advisors |

Investors can invest directly in an ETF following S&P's high quality strategy via the PowerShares S&P High Quality Portfolio ETF (NYSE:SPHQ). Investors should conduct a thorough review of the ETF before investing, as the index contains significant sector overweights and underweights.

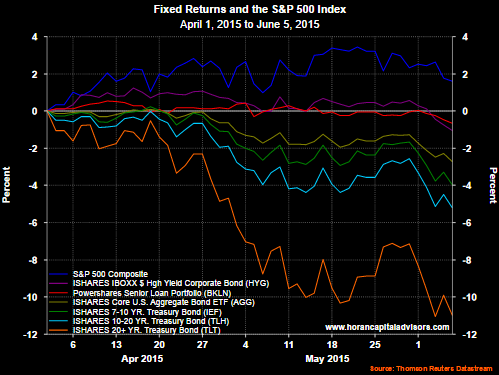

Within the post on investment risk noted at the beginning of this article, I included a chart on fixed income returns. Below is an update of that chart through the end of trading on Friday, June 5th. Clearly shown in the chart is the decline that has taken place in a number of fixed income sectors. Given the low interest rate environment and the desire by the Fed to raise rates, a number of fixed income sectors may expose investors to similar risk as some equities. On the other hand, if a significant market pullback does occur, investors are likely to seek the safety of high quality bonds; thus, providing some price support for some segments of the bond market.

|

| From The Blog of HORAN Capital Advisors |