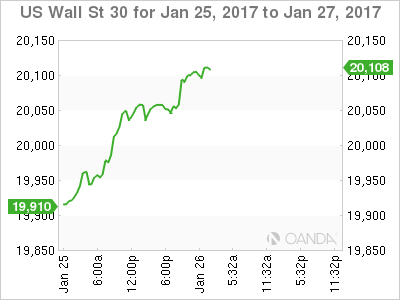

Champagne corks were popping overnight after the DJIA (NYSE:DIA) finally topped the 20,000 ceiling, which has held stubbornly, despite several attempts since mid-December. The move was a mix of Keystone euphoria and corporate earnings leading the way. Fixed income dealers here were quick off the mark as ten year UST touched 2.5150 zones, but the U.S. dollar simply can not gain any traction and continues to struggle near interday resistances 1.07 euro and 114 JPY.

We may have underestimated, well I know I did, Investor sentiment towards Mnuchin and Trump’s comments on the dollar. Of course, this does not mean it’s open season to sell dollars; it is certainly weighing on sentiment as there is little dollar appeal in the markets with traders preferring the short rates scenario as the picture for interest rates in a inflationary cycle is much clearer.

The Trump effect continues to resonate, and without repeating the plethora of overnight headlines, let’s just say that President Trump and the slew of executive orders is the 800-pound gorilla in the room, as far as FX traders are concerned.

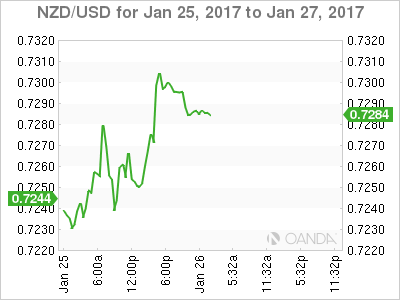

New Zealand Dollar

So much for the tight New Zealand/Australia CPI correlation. Unlike it’s Tasman Sea neighbour, inflation in New Zealand rose more than expected, and much to the RBNZ’s discomfort, the kiwi, has rocketed through .7300. In the wake of the surprising miss on yesterday’s Australia CPI, dealers were shading risk for lower inflation expectations in NZ.

After the initial 30 pip spike, the markets have settled just above .7300. The Kiwis are trading in a rarified air and momentum has all but stalled, likely due to a prevailing opinion the RBNZ is all but assured to maintain a dovish bias to kerb the wave of currency strength.

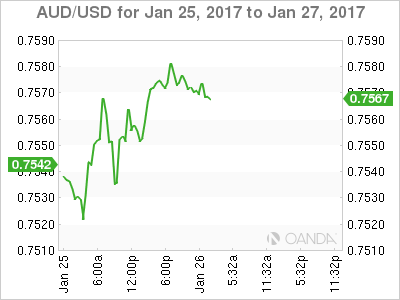

The Australian Dollar

There has been lots of action on the Aussie desks overnight as surprisingly from my point of view; the market continued to sell Aussie well into the London session. I believe there was an overreaction to the STIRT markets that was manifested by all the second-guessing that’s going on in the FX markets. I continue to monitor a higher near-term probability of the global re-inflation trade voiced through equity and commodity markets and not so much so through the USD dollar. That was evident on the Dow last night, and while copper has pulled back from the 19-month high, concerns over supply disruption should limit the near-term slide. From the risk rally perspective, I suspect the Aussie will remain popular near term, as the market continues to shun the U.S. dollar.

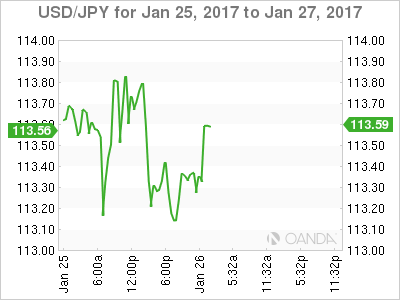

Japanese Yen

Trump headline risk is dominating trade, at times making any position call a crapshoot at best on the USD/JPY post. If I were challenged to come up with a reason for USD/JPY sell off overnight, I would say that BoJ’s RINBAN operation had the net effect of driving shorter yields higher. However, there is absolutely no momentum in the markets, as dealers continue to flip flop view on every headline, which is felt particularly in USD/JPY. Bottom line: far too many headwinds for the long dollar trade and not enough conviction to go short. I expect dealers will continue to view dollar optics as opportunities to lighten up on their core long USD/JPY position. But given the enormous uncertainties with any current bias, dealers will continue to run day positions and will have little appetite to build or maintain a longer-term view.

Chinese Yuan

Not lots of action as the prevalent view is longer term Yuan depreciation, but momentum continues to be thwarted by the many USD headwinds. The market continues to be nimble selling regional currencies like USD/KRW, USD/MYR, in concert with USD/CNH. I view this as a broader USD reaction as opposed to any significant positive regional bias. With the Chinese holiday next week, the markets are squaring for fear of additional Trump noise or tweets hitting the airwaves over the extended weekend holiday. Given the slight USD long bias in the market and with dealers in short term mode, dealers may just cut and re-evaluate next week.