Investing.com’s stocks of the week

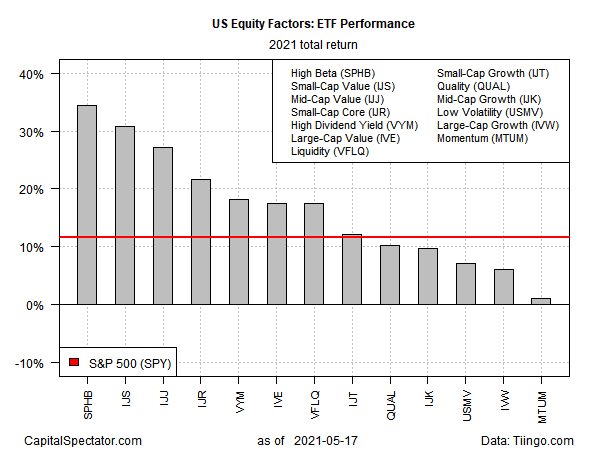

So-called high beta shares have rallied sharply in recent weeks and are now the top performer for US equity factor returns year-to-date, based on a set of ETF proxies through yesterday’s close (May 17).

Invesco S&P 500® High Beta ETF (NYSE:SPHB) edged up to a record close on Monday and remains firmly in the lead so far in 2021 for a broad set of ETFs tracking various slices of US equity factors.

The fund’s 34.4% total return this year displaces the former year-to-date leader—iShares S&P Small-Cap 600 Value ETF (NYSE:IJS)—to second-place status.

SPHB’s strategy is favoring the 100 stocks in the S&P 500 Index (a widely recognized benchmark for US shares) “with the highest sensitivity to market movements, or beta, over the past 12 months,” advises Invesco, which manages the ETF.

“Beta is a measure of relative risk and is the rate of change of a security’s price. The Fund and the Index are rebalanced and reconstituted quarterly in February, May, August and November.”

SPHB’s sizzling year-to-date results are striking in relative, as well as, absolute terms at the moment. Consider that the fund’s year-to-date gain is more than 20 percentage points ahead of the benchmark, SPDR® S&P 500 (NYSE:SPY), which is up 11.5% so far in 2021.

In another sign of how factor returns have shifted recently, the momentum factor’s high-flying results in 2020 have faded this year. The iShares MSCI USA Momentum Factor ETF (NYSE:MTUM) is up a thin 1.0% in 2021, the weakest performer in the equity factor space this year.