Hewlett Packard Enterprise Company ( (NYSE:HPE) ) just released its latest quarterly financial results, posting adjusted earnings of 34 cents per share and revenues of $7.7 billion.

Currently, HPE is a Zacks Rank #4 (Hold), but that could change based on today’s results. The stock is currently down 14.26% to $18.75 per share in after-hours trading shortly after its earnings report was released.

Hewlett Packard:

Beat earnings estimates. The company posted non-GAAP earnings of $0.34 per share, beating the Zacks Consensus Estimate of $0.23. HPE reported GAAP diluted net earnings per share of $0.89, lifted primarily due to the benefits of U.S. tax reform.

Beat revenue estimates. The company saw revenue figures of $7.67 billion, beating our consensus estimate of $7.03 billion.

Total revenue was up 11.2% from the prior-year quarter. Non-GAAP adjusted earnings gained 21.4%. On a GAAP basis, earnings per share soared about 500%, thanks in large part to tax reform.

“Our strong Q1 performance is proof that we have the right strategy and improved execution,” said CEO Antonio Neri. “We had good revenue growth across every business segment, continued to execute HPE Next with no disruption to the business, and delivered strong shareholder return in the form of share repurchases and dividends.”

For the fiscal 2018 second quarter, HPE expects non-GAAP diluted net EPS to be in the range of $0.29 to $0.33. Our current consensus estimate is calling for earnings of $0.26 per share.

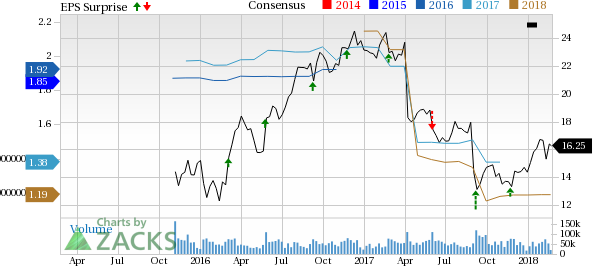

Here’s a graph that looks at HPE’s recent earnings performance:

Hewlett Packard Enterprise Company was spun-off from the Hewlett-Packard Company (NYSE:HPQ) in November 2015. The company operates in four segments: Enterprise Services, Enterprise Group, Software and Financial Services.

Check back later for our full analysis on HPE’s earnings report!

Want more market analysis from this author? Make sure to follow @Ryan_McQueeney on Twitter!

More Stock News: This Is Bigger than the iPhone!

It could become the mother of all technological revolutions. Apple (NASDAQ:AAPL) sold a mere 1 billion iPhones in 10 years but a new breakthrough is expected to generate more than 27 billion devices in just 3 years, creating a $1.7 trillion market.

Zacks has just released a Special Report that spotlights this fast-emerging phenomenon and 6 tickers for taking advantage of it. If you don't buy now, you may kick yourself in 2020.

Click here for the 6 trades >>

Hewlett Packard Enterprise Company (HPE): Free Stock Analysis Report

Original post

Zacks Investment Research