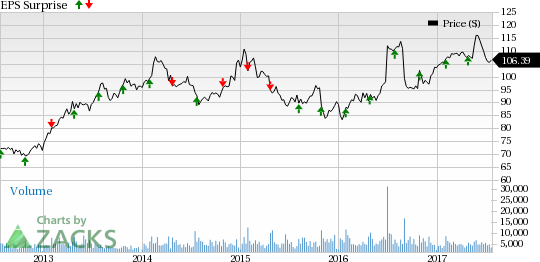

The Hershey Company (NYSE:HSY) is slated to report second-quarter 2017 results on Jul 26, before the opening bell. Last quarter, the company delivered a positive earnings surprise of 3.97%.

The chocolate maker surpassed earnings estimates in each of the trailing four quarters, the average surprise being 7.65%.

Let’s see how things are shaping up prior to this announcement.

Factors to Consider

Changes in consumer preference and consumer dynamics, demographic shifts, and also a spending shift toward lower-priced products have been a dampener for Hershey’s sales since 2014.

To add to the woes, Hershey has been delivering weak performance in international markets since 2015, primarily due to soft results in China. In fact, China chocolate category sales in the first quarter was flat and also below the market.

Nevertheless, Hershey regularly innovates its core brands to meet consumer demand and needs that are not addressed by its current portfolio. The company’s initiatives have been bearing fruit of late, with net sales increasing 2.8% year over year in the first quarter. This marks the fourth straight rise in quarterly sales after a few quarters of no growth.

Given this changing scenario, we expect Hershey to see modest sales growth in the to-be-reported quarter.

The company had earlier expressed that given the timing of Easter and the expected lower sales in China, second-quarter net sales growth is expected to be lower than full-year growth rate. For 2017, net sales are expected to be at the low end of the previously stated range of 2–3%.

To counter the soft sales environment, major food companies like Mondelez International, Inc. (NASDAQ:MDLZ) , Kellogg Company (NYSE:K) , and The Kraft Heinz Company (NYSE:K) have been relying on productivity savings to boost its bottom line. Hershey too is banking on restructuring initiatives, which will likely help the company increase its EPS despite weak sales growth.

Hershey’s adjusted gross margin and operating margin expanded 70 basis points (bps) and 170 bps, respectively, in the first quarter driven by favorable trade, supply chain productivity and costs-saving initiatives and lower input costs. The trend is expected in the to-be-reported quarter as well.

Overall, Hershey will likely register higher quarterly EPS depending on its ability to increase prices, along with productivity and cost-cutting initiatives.

For the second quarter, the Zacks Consensus Estimate for earnings is pegged at 91 cents, reflecting an increase of 6.5% year over year, while the consensus for revenues is at $1.65 billion, implying 0.9% year-over-year growth.

Earnings Whispers

Our proven model does not conclusively show that Hershey is likely to beat earnings estimates this quarter. This is because a stock needs to have both a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) for this to happen. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

That is not the case here as you will see below.

Zacks ESP: Earnings ESP, which represents the difference between the Most Accurate estimate and the Zacks Consensus Estimate, is -3.30%. This is because the Most Accurate estimate is 88 cents, while the Zacks Consensus Estimate is pegged at 91 cents.

Zacks Rank: Hershey currently carries a Zacks Rank #3. Although a Zacks Rank #3 increases the predictive power of ESP, a negative ESP makes surprise prediction difficult.

We caution against Sell-rated stocks (Zacks Ranks #4 and 5) going into the earnings announcement, especially when the company is witnessing negative estimate revisions.

You can see the complete list of today’s Zacks #1 Rank stocks here.

More Stock News: This Is Bigger than the iPhone!

It could become the mother of all technological revolutions. Apple (NASDAQ:AAPL) sold a mere 1 billion iPhones in 10 years but a new breakthrough is expected to generate more than 27 billion devices in just 3 years, creating a $1.7 trillion market.

Zacks has just released a Special Report that spotlights this fast-emerging phenomenon and 6 tickers for taking advantage of it. If you don't buy now, you may kick yourself in 2020. Click here for the 6 trades >>

Hershey Company (The) (HSY): Free Stock Analysis Report

Kellogg Company (K): Free Stock Analysis Report

Mondelez International, Inc. (MDLZ): Free Stock Analysis Report

The Kraft Heinz Company (KHC): Free Stock Analysis Report

Original post