On Aug 9, Zacks Investment Research downgraded F5 Networks, Inc. (NASDAQ:FFIV) to a Zacks Rank #5 (Strong Sell).

The downgrade can be primarily attributed to negative estimate revisions over the last 30 days. Notably, the Zacks Consensus Estimate for fiscal 2017 has declined 1.1% to $6.28 over the said period. For fiscal 2018, the Zacks Consensus Estimate is pegged at $6.87, reflecting a 5.1% decline over the same time frame.

The negative estimate revision was primarily due to dismal third-quarter fiscal 2017 results, where both the top and the bottom line missed the Zacks Consensus Estimate. Adjusted earnings per share (excluding amortization of intangible assets and other one-time items but including stock-based compensation) on a proportionate tax basis of $1.55 missed the Zacks Consensus Estimate of $1.59 per share.

Moreover, revenues of $517.8 million missed the consensus mark of $525 million. It also fell short of the lower range of management’s guidance range of $520–$530 million. Disappointing fourth quarter revenue guidance also fumed pessimism over the stock’s growth prospect.

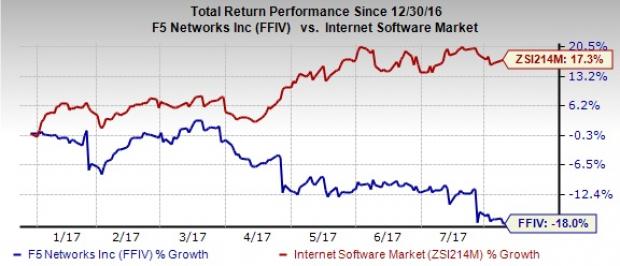

We also note that F5 Networks has lost 18% of its value year to date against 17.3% growth of the industry.

Challenges for the Company

Cisco Systems (NASDAQ:CSCO) is the most significant competitive threat to F5 Networks, given the dominance of the former in the overall networking market. Cisco has tremendous engineering and marketing resources at its disposal. Although F5 Networks’ technology leads in the networking market, Cisco could become more competitive if it invests aggressively. In addition, Citrix Inc., Juniper Networks (NYSE:JNPR) , Checkpoint Systems, and Barracuda Networks also have strong technology platforms that could pose significant competitive threat on improved execution.

Notably, F5 Networks continues to acquire a large number of companies. While this improves revenue opportunities, business mix and profitability, it also adds to integration risks. Moreover, frequent acquisitions are a distraction for management, which could impact organic growth in the long run.

Stock to Consider

A better-ranked stock in the technology space is Apptio Inc. (NASDAQ:APTI) , with a Zacks Rank #2 (Buy). Long-term earnings growth rate for Apptio is projected to be12.5%.

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

One Simple Trading Idea

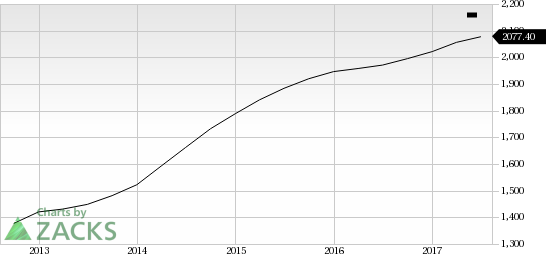

Since 1988, the Zacks system has more than doubled the S&P 500 with an average gain of +25% per year. With compounding, rebalancing, and exclusive of fees, it can turn thousands into millions of dollars.

This proven stock-picking system is grounded on a single big idea that can be fortune shaping and life changing. You can apply it to your portfolio starting today.

Cisco Systems, Inc. (CSCO): Free Stock Analysis Report

F5 Networks, Inc. (FFIV): Free Stock Analysis Report

Apptio Inc. (APTI): Free Stock Analysis Report

Juniper Networks, Inc. (JNPR): Free Stock Analysis Report

Original post

Zacks Investment Research