We believe that Orion Engineered Carbons S.A.’s (NYSE:OEC) financial performance in second-quarter 2017 as well as solid future prospects makes it a good bet for investors now.

The company currently boasts a Zacks Rank #1 (Strong Buy).

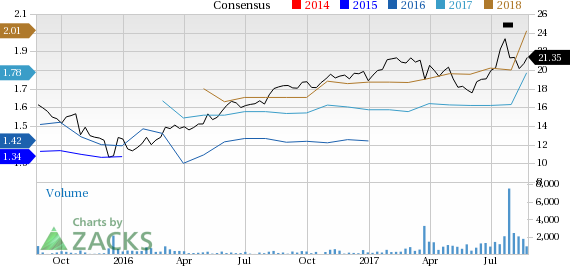

In the last three months, the company’s shares have yielded 20.3% return, outperforming 4.7% gain recorded by the industry it belongs to.

Why the Upgrade?

Orion Engineered exhibited impressive financial performance in second-quarter 2017. Its adjusted earnings per share came in 5.7%, above the year-ago tally while revenues grew 51.4% over the same period. Top-line results were driven by healthy sales growth in Specialty Carbon Black and Rubber Carbon Black segments. Also, the company lowered its interest expenses due to repricing of its term loans with lower interest rates.

In 2017, the company anticipates witnessing improvement in supply and demand conditions for both its business segments. Cash flow is predicted to be healthy, sufficient to fund the company’s dividend payments and capital programs. Adjusted earnings before interest, tax, depreciation and amortization (EBITDA) is anticipated to be €220−€240 million.

In the quarters ahead, Orion Engineered aims at improving growth of its Specialty and Technical Rubber Carbon Black grades, backed by lucrative acquisitions and higher production capacities. In addition, the company is working diligently to reduce its debt levels over time. Exiting the second quarter, the company’s net debt/LTM Adjusted EBITDA was as low as 2.37x.

Also, earnings estimates for the stock were revised upward by a couple of analysts in the last 60 days, reflecting positive sentiments for its future prospects. The Zacks Consensus Estimate for the third quarter grew 4.9% to 43 cents while that for 2017 improved 11.2% to $1.79 and for 2018 it increased 11% to $2.01.

Other Stocks to Consider

Orion Engineered has a market capitalization of approximately $1.3 billion. Other stocks worth considering in the industry include Koninklijke DSM NV (OTC:RDSMY) , Kronos Worldwide Inc. (NYSE:KRO) and Asahi Kasei Corporation (OTC:AHKSY) . All these stocks sport a Zacks Rank #1. You can see the complete list of today’s Zacks #1 Rank stocks here.

Koninklijke DSM’s earnings estimates for 2017 and 2018 improved in the last 60 days. Also, its earnings are projected to grow 7.1% in the next three to five years.

Kronos Worldwide’s earnings estimates for 2017 and 2018 represent year-over-year growth of 354.8% and 25.5%, respectively. Also, the company pulled off an average positive earnings surprise of 76.05% in the last four quarters.

Asahi Kasei Corporation’s earnings estimates for fiscal 2017 and fiscal 2018 were revised upward in the last 60 days.

One Simple Trading Idea

Since 1988, the Zacks system has more than doubled the S&P 500 with an average gain of +25% per year. With compounding, rebalancing, and exclusive of fees, it can turn thousands into millions of dollars.

This proven stock-picking system is grounded on a single big idea that can be fortune shaping and life changing. You can apply it to your portfolio starting today.

Learn more >>

Kronos Worldwide Inc (KRO): Free Stock Analysis Report

Asahi Kasei Corp. (AHKSY): Free Stock Analysis Report

Koninklijke DSM NV (RDSMY): Free Stock Analysis Report

Orion Engineered Carbons S.A (OEC): Free Stock Analysis Report

Original post

Zacks Investment Research