We find Komatsu Ltd. (OTC:KMTUY) a solid choice for investors seeking exposure in the machinery space. The construction and mining equipment manufacturer and supplier has strong growth prospects driven by solid product demand from China and Indonesia. Also, the company’s raised projections and dividend rates for fiscal 2017 as well as synergistic benefits from acquired assets will work in its favor.

The stock, currently with approximately $34.5 billion market capitalization, has been upgraded to a Zacks Rank #1 (Strong Buy) on Dec 29. Its investment appeal is further accentuated by a favorable VGM Score of B.

Below we discuss why investors should consider buying Komatsu’s stock.

Why the Upgrade?

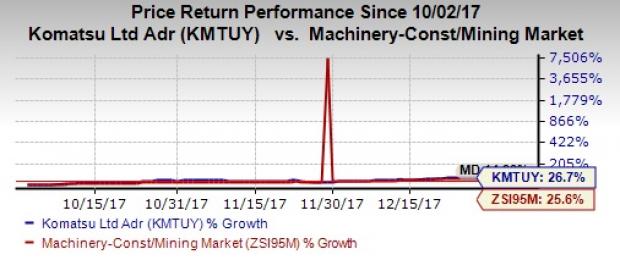

Market sentiments have been positive for Komatsu with the stock yielding 26.7% return in the last three months compared with roughly 25.6% growth of the industry. We believe that the rally has been primarily supported by the company’s upward revision of its projections for fiscal 2017 (ending Mar 31, 2018).

Komatsu seems positive about its growth prospects for fiscal 2017. It anticipates net sales to be approximately ¥2,328 billion, an increase of 9% from its previous forecast. On a segmental basis, the company increased its sales projection for the Construction, mining & utility equipment by 10.8% on the back of healthy demand in China and Indonesia, and for the Retail finance by 19.8%.

Likewise, Komatsu raised its operating income and net income guidance for fiscal 2017 by 38.5% and 72.8%, respectively. Earnings per share are projected to be ¥168.58 versus ¥97.56 expected earlier. The revision mainly incorporates the company’s anticipation of solid demand for its construction and mining equipments across various nations.

Additionally, Komatsu’s hike of its semi-annual dividend rate from ¥29 per share to ¥36 has worked in its favor. Now, the annual dividend rate is ¥72, above ¥58 in the previous fiscal year.

Also, acquisitions have been Komatsu’s one of the most favored ways for expanding business. In this regard, the buyout of Joy Global Inc (NYSE:JOY). (in April 2017) is worth mentioning. This acquired business has strengthened the company’s equipment business for the mining industry.

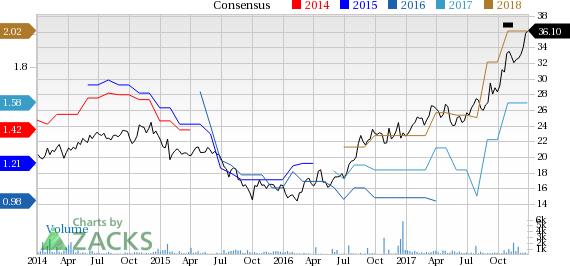

The stock’s earnings estimates for both fiscal 2017 and fiscal 2018 has been raised by one brokerage firm in the last 60 days. Currently, the Zacks Consensus Estimate is pegged at $1.58 for fiscal 2017 and $2.02 for fiscal 2018, representing growth of 14.5% and 8% from their respective tallies 60 days ago.

Komatsu Ltd. Price and Consensus

Caterpillar, Inc. (CAT): Free Stock Analysis Report

Komatsu Ltd. (KMTUY): Free Stock Analysis Report

H&E Equipment Services, Inc. (HEES): Free Stock Analysis Report

Deere & Company (DE): Free Stock Analysis Report

Original post

Zacks Investment Research