We believe that The Chemours Company’s (NYSE:CC) financial performance in second-quarter 2017 as well as solid future prospects makes it a good bet for investors now.

The company currently boasts a Zacks Rank #1 (Strong Buy).

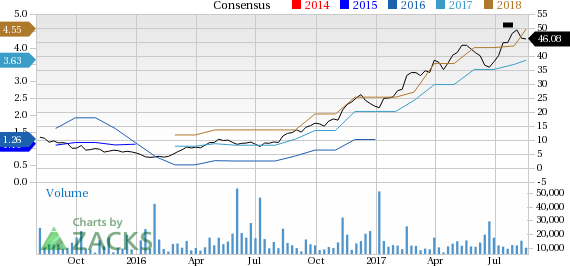

In the last three months, the company’s shares have yielded 5.4% return, outperforming 3.1% gain recorded by the industry it belongs to.

Why the Upgrade?

Chemours exhibited strong financial performance in second-quarter 2017. Its earnings came in 45% above the year-ago tally while revenues grew 15% over the same period. Top-line results were driven by healthy sales growth in Titanium Technologies and Fluoroproducts segments. Adjusted earnings before interest, tax, depreciation and amortization (EBITDA) improved on volume and pricing improvements.

In 2017, the company is poised to gain from improving end markets conditions, especially in coatings, plastics, papers, air conditioning, refrigeration, automotive, aerospace, consumer, wire & cable, electronics and telecommunications. Also, its strategic initiatives, intended to reduce costs, expansion of Altamira plant (completed) and Corpus Christi (ongoing) as well as increased use of Opteon will be beneficial. For 2017, the company raised its adjusted EBITDA projection to $1.3−$1.4 billion from the earlier forecast of $1.2−$1.3 billion.

Additionally, in June, the company started constructing a new Mining Solutions manufacturing facility in Mexico. The new facility will enable it to leverage benefits from the growing demand for solid sodium cyanide from the mining industry.

Also, earnings estimates for the stock were revised upward by a couple of analysts in the last 30 days, reflecting positive sentiments for Chemours’ future prospects. The Zacks Consensus Estimate for 2017 improved 3.7% from $3.50 to $3.63 while that for 2018 increased 13.8% from $4.00 to $4.55.

Other Stocks to Consider

Chemours has a market capitalization of approximately $8.5 billion. Other stocks worth considering in the industry include Koninklijke DSM NV (OTC:RDSMY) , Arkema SA (OTC:ARKAY) and Asahi Kasei Corporation (OTC:AHKSY) . All these stocks sport a Zacks Rank #1. You can see the complete list of today’s Zacks #1 Rank stocks here.

Koninklijke DSM’s earnings estimates for 2017 and 2018 improved in the last 60 days. Also, its earnings are projected to grow 7.1% in the next three to five years.

Arkema SA’s earnings estimates for 2017 and 2018 improved in the last 60 days. Its earnings are projected to grow 12.8% in the next three to five years.

Asahi Kasei Corporation’s earnings estimates for fiscal 2017 and fiscal 2018 were revised upward in the last 60 days.

More Stock News: This Is Bigger than the iPhone!

It could become the mother of all technological revolutions. Apple (NASDAQ:AAPL) sold a mere 1 billion iPhones in 10 years but a new breakthrough is expected to generate more than 27 billion devices in just 3 years, creating a $1.7 trillion market.

Zacks has just released a Special Report that spotlights this fast-emerging phenomenon and 6 tickers for taking advantage of it. If you don't buy now, you may kick yourself in 2020.

Click here for the 6 trades >>

Arkema SA (ARKAY): Free Stock Analysis Report

Asahi Kasei Corp. (AHKSY): Free Stock Analysis Report

Koninklijke DSM NV (RDSMY): Free Stock Analysis Report

Chemours Company (The) (CC): Free Stock Analysis Report

Original post

Zacks Investment Research