Earnings estimates for Murphy Oil Corporation (NYSE:MUR) have been revised upward in the past 30 days, reflecting analysts’ optimism in the stock. The Zacks Consensus Estimate for 2019 and 2020 earnings moved up 13.2% and 8% to 86 cents and $1.34 per share, respectively.

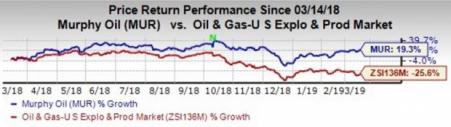

The company’s shares have increased 19.3% in the past 12 months, against the industry’s decline of 25.6%.

Let’s focus on the factors that make Murphy Oil a profitable pick for greater returns.

Earnings & Surprise History

Murphy Oil delivered fourth-quarter 2018 adjusted earnings of 31 cents per share, which beat the Zacks Consensus Estimate of 26 cents by 19.2%. The company’s average four-quarter positive earnings surprise is 28.36%.

Zacks Rank & VGM Score

The stock currently carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

The stock has an impressive VGM Score of A. Here V stands for Value, G for Growth and M for Momentum with the score being a weighted combination of all three factors. Back tested results show that stocks with a favorable VGM Score of A or B coupled with a bullish Zacks Rank are the best investment options.

Focus to Lowering the F&D Cost

Murphy Oil focuses on reducing Finding and Development “F&D” cost. Notably, the company has lowered three-year average F&D cost by 50% since 2014. This initiative is making a positive impact on proved reserves, which have improved 17% from 2017 levels to 816 million barrels equivalent in 2018. The reduction in costs will have a positive impact on margins and additions to reserves will enable the company to maintain strong production levels.

Strong Upstream Portfolio

Murphy Oil possesses one of the best upstream portfolios among the domestic oil and natural gas integrated companies as well as independent E&P group. The company is pursuing steady E&P and development activities in the United States as well as other international locations. The company is projecting 2019 capital expenditures in the range of $1.25-$1.45 billion and expects 2019 production in the range of 202-210 thousand barrels of oil equivalent per day (MBOEPD).

Other Stocks to Consider

A few other top-ranked stocks from the same sector are Consol Energy Inc (NYSE:CEIX) , Canadian Solar Inc (NASDAQ:CSIQ) and Enphase Energy, Inc (NASDAQ:ENPH) . Consol Energy and Canadian Solar sport a Zacks Rank of 1, while Enphase Energy holds a Zacks Rank of 2.

Consol Energy pulled off an average positive earnings surprise of 53.86% in the last four quarters. The Zacks Consensus Estimate for 2019 EPS moved up 6.33% in the past 60 days to $3.86 per share.

Canadian Solar delivered an average earnings surprise of 49.66% in the trailing four quarters. The Zacks Consensus Estimate for 2019 EPS moved up 6.8% in the past 60 days to $2.83 per share.

Enphase Energy came up with an average earnings surprise of 55.56% in the last four quarters. The Zacks Consensus Estimate for 2019 EPS moved up 20% in the past 60 days to 36 cents.

Today's Best Stocks from Zacks

Would you like to see the updated picks from our best market-beating strategies? From 2017 through 2018, while the S&P 500 gained +15.8%, five of our screens returned +38.0%, +61.3%, +61.6%, +68.1%, and +98.3%.

This outperformance has not just been a recent phenomenon. From 2000 – 2018, while the S&P averaged +4.8% per year, our top strategies averaged up to +56.2% per year.

See their latest picks free >>

Murphy Oil Corporation (MUR): Free Stock Analysis Report

Enphase Energy, Inc. (ENPH): Free Stock Analysis Report

Canadian Solar Inc. (CSIQ): Free Stock Analysis Report

Consol Energy Inc. (CEIX): Free Stock Analysis Report

Original post

Zacks Investment Research