Leading fashion specialty retailer, Nordstrom Inc. (NYSE:JWN) remains in investors’ good books given its solid stock performance, robust earnings surprise history, and long-term strategies like cost saving initiatives, store expansion efforts and progress on 2020 strategy. These factors have aided it to retain the Zacks Rank #3 (Hold) and carry a VGM Score of A.

Stock Performance

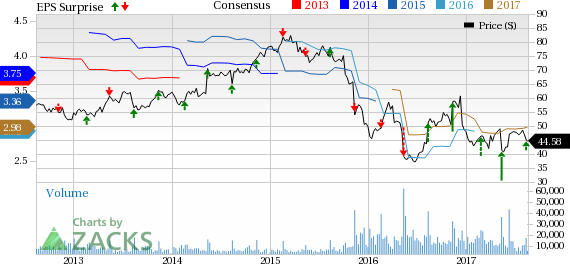

Shares of Nordstrom have shown solid momentum in the last three months driven by its earnings surprise trend as well as progress on long-term strategies. The stock witnessed 9.6% growth, outperforming the industry’s 14.8% decline.

Earnings Trend & Outlook

Nordstrom posted solid second-quarter fiscal 2017 earnings, wherein both earnings and sales topped estimates. While the company delivered positive earnings surprise for the fifth straight quarter, sales beat estimates after three consecutive misses. Results gained from a strong Anniversary sale event, smooth execution of customer strategy along with disciplined inventory and expense management. Sales growth in Nordstrom Rack and solid eCommerce sales also aided results. Moreover, the company’s revised fiscal 2017 guidance remains encouraging.

The company now anticipates net sales growth of nearly 4% for fiscal 2017, which is at the high-end of its previous guidance of 3-4% growth. Further, the company raised the lower-end of its Retail EBIT and earnings per share guidance, while it upped forecast for Credit EBIT. It now expects Retail EBIT in the range of $790-$840 million, compared with $780-$840 million anticipated earlier. Credit EBIT is estimated to be about $145 million, compared with the earlier forecast of $140 million. The company now envisions fiscal 2017 earnings per share in the range of $2.85-$3.00, compared with $2.75-$3.00 projected earlier.

Long-Term Growth Strategy

Nordstrom is making significant progress with respect to its customer-based strategy and is on track to reach its long-term growth target of $20 billion by 2020. In doing so, the company is executing its strategy of enhancing market share through persistent store expansion and strengthening capabilities via further investments, particularly in digital growth. With regard to cost savings, the company plans to strike a balance between sales and expense growth. Notably, Nordstrom is making amendments to its operating model in response to the constant slowdown in mall traffic resulting from customers’ shift to online shopping.

Store Expansion

Nordstrom has been persistently focusing on store-expansion strategy as part of efforts to grow market share. In doing so, the company remains keen on prioritizing investments in the top North American markets. In September, the company will successfully complete its planned full-line store expansion in Canada with the opening of its sixth outlet at Sherway Gardens in Toronto. Overall, the company envisions a $1 billion sales opportunity from expansion in Canada by 2020, including six planned full-line stores and 15 Rack stores. Furthermore, the company is on track with domestic store expansion. It is scheduled to inaugurate two full-line store relocations in California in October, at Westfield Century City in Los Angeles and at University Towne Center in La Jolla. Year to date, the company has opened a total of six new Rack stores while it closed one full-line store.

Higher Expenses to Remain a Hurdle

We note that Nordstrom’s growth strategy focused on enhancement of digital experience and increased investments in supply chain bode well for the long term. However, investments related to occupancy, technology, supply chain and marketing expenses are likely to weigh upon the company’s near-term cost and margins performance. Consequently, the company’s merchandise performance was hurt by higher occupancy expenses related to new Rack and Canada stores in the fiscal second quarter. Further, the company’s accelerated investments towards technology, supply chain and marketing, resulted in higher SG&A expenses in the quarter.

For fiscal 2017 also, the company anticipates Retail gross profit to be impacted by higher new store occupancy expenses and mix impact from off-price growth. Further, the company’s projections for SG&A expenses incorporates higher technology and supply chain expenses related to growth initiatives, offset by progress in productivity improvements.

Conclusion

We believe the company’s long-term growth efforts and its surprise history speaks loads of the company’s potential to grow. While higher near-term costs are surely a concern for the company, we believe this is temporary and will gradually subside once its strategic efforts are fully implemented.

Meanwhile, investors interested in the retail space can count on Canada Goose Holdings Inc. (NYSE:GOOS) , The Children’s Place Inc. (NASDAQ:PLCE) and Build-A-Bear Workshop, Inc. (NYSE:BBW) , each carrying a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Canada Goose has gained nearly 16.5% year to date. Moreover, it has a long-term earnings growth rate of 34.1%.

Children’s Place has a long-term EPS growth rate of 9%. Further, the stock has returned 16.9% in the past year.

Build-A-Bear with long-term EPS growth rate of 22.5%, has delivered an average positive earnings surprise of 73.7% in the trailing four quarters.

One Simple Trading Idea

Since 1988, the Zacks system has more than doubled the S&P 500 with an average gain of +25% per year. With compounding, rebalancing, and exclusive of fees, it can turn thousands into millions of dollars.

This proven stock-picking system is grounded on a single big idea that can be fortune shaping and life changing. You can apply it to your portfolio starting today.

Learn more >>

Nordstrom, Inc. (JWN): Free Stock Analysis Report

Children's Place, Inc. (The) (PLCE): Free Stock Analysis Report

Canada Goose Holdings Inc. (GOOS): Free Stock Analysis Report

Build-A-Bear Workshop, Inc. (BBW): Free Stock Analysis Report

Original post

Zacks Investment Research