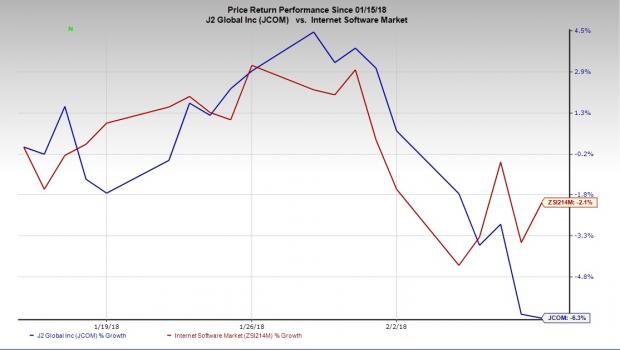

Shares of j2 Global, Inc. (NASDAQ:JCOM) have declined 6.3% in a month, performing worse than the industry's decrease of 2.1%.

Reasons Behind the Price Plunge

The company recently reported fourth-quarter 2017 results with lower-than-expected earnings on higher costs.

The company’s growth-by-acquisition strategy increases costs pertaining to investments, hurting its bottom-line growth in turn. This downside is likely to continue in the near future too. Notably, operating expenses in the reported quarter rose 35.4% year over year.

j2 Global’s high debt levels are another cause for worry. The company exited the quarter under review with long-term debt of $1 billion compared with $601.75 million at the end of 2016. Further, the long-term debt-to-equity ratio (expressed as a percentage) stands at 98.2%, comparing unfavorably with the industry’s 1.4% and the S&P 500 index’s 82.9%.

The negativity revolving around the stock is evident from the Zacks Consensus Estimate for current-year earnings being revised 1.5% downward in the last 30 days.

The company’s Zacks Rank #5 (Strong Sell) further substantiates the pessimism surrounding it. Also, the stock has a Momentum Score of C, highlighting its short-term unattractiveness.

Key Picks

Some better-ranked stocks in the broader Computer and Technology sector are AMETEK, Inc. (NYSE:AME) , DST Systems, Inc. (NYSE:DST) and Harris Corporation (NYSE:HRS) . While DST Systems sports a Zacks Rank #1 (Strong Buy), AMETEK and Harris carry a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Shares of AMETEK, DST Systems and Harris have rallied more than 14%, 63% and 27%, respectively, in the last six months.

Wall Street’s Next Amazon (NASDAQ:AMZN)

Zacks EVP Kevin Matras believes this familiar stock has only just begun its climb to become one of the greatest investments of all time. It’s a once-in-a-generation opportunity to invest in pure genius.

Click for details >>

DST Systems, Inc. (DST): Free Stock Analysis Report

j2 Global, Inc. (JCOM): Free Stock Analysis Report

Harris Corporation (HRS): Free Stock Analysis Report

AMETEK, Inc. (AME): Free Stock Analysis Report

Original post