On Aug 31, we issued an updated research report on Charter Communications Inc. (NASDAQ:CHTR) , the second largest cable MSO (multi service operator) in the United States.

Recently, the company launched lucrative promotional offers in order to stay competitive along with a strong subscriber base. In fact, the cable company is offering a double-play package of Spectrum TV (more than 130 channels) and 60 Mbps internet (100 Mbps in some markets) for $29.99 each.

The Spectrum TV was launched by Charter Communications, after the twin buyout of Time Warner Cable and Bright House Networks, and is aimed at uniting the viewing experience of these two big MSOs on a single podium.

Additionally, Charter Communications has been undertaking various initiatives to make its Spectrum products even better. The company has developed its cloud-based user interface named Spectrum Guide, to run on all set-top boxes offering advanced video navigation. Also, it has initiated the rollout of its Spectrum WiFi, which provides unlimited Internet access to residential customers even when they are outdoors.

Notably, such initiatives are primarily focused on to lure more subscribers.

Charter Communications currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Going forward, we anticipate the wireless venture of Charter Communications in collaboration with Comcast Corporation (NASDAQ:CMCSA) . For this much-hyped wireless venture, both companies have already signed a Mobile Virtual Network Operator agreement with U.S. telecom behemoth Verizon Communications Inc. (NYSE:VZ) to utilize its wireless network.

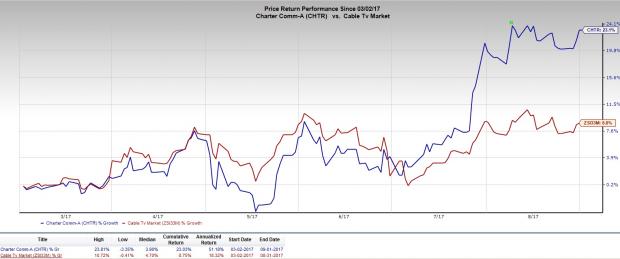

Consequently, shares of Charter Communications have rallied 23.1% compared with the industry‘s growth of 8.8% over the last six months.

We are however, concerned about the company’s operation in a saturated and competitive multi-channel U.S. video market.

Meanwhile, online video streaming service providers such as Netflix Inc. (NASDAQ:NFLX) , Hulu.com, YouTube etc., pose severe threat to cable TV operators because of their extremely cheap source of TV programming, which is in vogue even during volatile economic conditions.

More Stock News: This Is Bigger than the iPhone!

It could become the mother of all technological revolutions. Apple (NASDAQ:AAPL) sold a mere 1 billion iPhones in 10 years but a new breakthrough is expected to generate more than 27 billion devices in just 3 years, creating a $1.7 trillion market.

Zacks has just released a Special Report that spotlights this fast-emerging phenomenon and 6 tickers for taking advantage of it. If you don't buy now, you may kick yourself in 2020.

Click here for the 6 trades >>

Netflix, Inc. (NFLX): Free Stock Analysis Report

Verizon Communications Inc. (VZ): Free Stock Analysis Report

Comcast Corporation (CMCSA): Free Stock Analysis Report

Charter Communications, Inc. (CHTR): Free Stock Analysis Report

Original post

Zacks Investment Research