Starbucks Corporation's (NASDAQ:SBUX) growth rate might be slowing, but it’s making up for it by shifting its focus toward sending money back to shareholders.

With a price-to-earnings ratio of about 29, this stock is on the high end of valuation compared to other stocks I tend to buy, but in my opinion the numbers justify the current stock price, and options can help improve cost basis even further.

A Greater Focus On Dividends And Buybacks

Earlier this month, Starbucks released fiscal fourth quarter and 2017 year results, and the investor response has been mixed.

The company used to forecast 15-20% long-term EPS growth per year, but has reduced that to at least 12% annual EPS growth or higher. Here’s their full long-term guidance:

- Annual comparable store sales growth: 3-5%

- Annual revenue growth: high single digits

- Annual EPS growth: 12% or higher

- Annual ROIC: 25% or higher

For a company that already has over 27,000 stores globally, maintaining high single digit revenue growth and a whopping 25% return on invested capital is incredible. Over the last 12 months, their return on invested capital has been about 30%, and their return on equity has touched 50%, without using much leverage.

Their revenue has nearly doubled over the last six years. If the company maintains 7% annual revenue growth going forward (the bottom end of “high single digits”), it’ll mean a 50% increase in revenue over the next 6 years. To put that into perspective, McDonald’s (MCD) has seen flat revenue and income over the same time period, yet their stock trades at nearly as high of a valuation with a price-to-earnings of about 24.

To offset this reduction in expected growth rates, Starbucks boosted its quarterly dividend 20% from $0.25 per quarter to $0.30 per quarter (up to roughly a 60% payout ratio from earnings per share), and announced plans to spend $15 billion in total on dividends and share buybacks over the next 3 years. To put that into perspective, the company paid about $8 billion in dividends and buybacks over the past 3 years. The dividend yield going forward will be a little over 2%.

According to the Q4 earnings conference call that came with the earnings release, most of this will be funded by operational cash flows, but they will also be increasing their leverage a bit while interest rates are still low. Starbucks currently has a long-term debt-to-equity ratio of about 55%, and an interest coverage ratio of 50, which makes their balance sheet absolutely rock-solid, and if anything, actually under-leveraged. I don’t mean to use McDonald’s as a punching bag again, but they’re extremely leveraged at this point, with debt that far exceeds their equity and an interest coverage ratio of about 10.

Going forward as a dividend growth investor, I’d like to see Starbucks maintain a very strong balance sheet, but it certainly makes sense to issue some bonds right now while interest rates are low but rising. I think management is running a good balance here between stability and taking advantage of unusually low interest rates.

Dividend growth stocks are one of the best ways to build wealth, and Starbucks has now firmly shifted from being a grow-at-all costs company to a blue chip dividend payer.

Growth In China

Starbucks is doubling down on China, and expects to eventually have more locations in China than the United States, according the New York Times. They already have more locations in Shanghai than in New York City.

Earlier this year, Starbucks announced plans to acquire the remaining stake in its East China joint venture for $1.3 billion, which makes it the largest acquisition in company history according to Reuters. And according to this past earnings release, Starbucks opened 1,036 new locations in East Asia over the past 12 months, with the bulk of those being in China.

China is now the largest consumer of luxury goods in the world, and by 2018 McKinsey & Company expects China to have the largest number of millionaires in the world. This trend seems to include Starbucks. China has an extremely low per-capita coffee consumption compared to its Asian neighbors, and with a growing middle class and a strong appetite for premium brands, the potential market for Starbucks is massive.

Normally a company that pays virtually all of its cashflows to shareholders as dividends and buybacks would have trouble growing quickly, but as long as Starbucks retains its 25% or higher ROIC, it can invest a relatively small amount of capital each year and get strong revenue and income growth from it.

Tea Consolidation: Good For Shareholders

Starbucks has made a number of tea acquisitions and is now reversing and consolidating much of this.

In 1999, the Starbucks bought Tazo Tea, which it sells through retail channels including Wal-Mart (NYSE:WMT). In 2012, Starbucks bought Teavana, which has 379 branded retail locations that serve hot tea and sell tea and teaware.

Earlier this year, the company announced that it will close all 379 of its Teavana locations, because they’re not making money. Teavana has a heavy presence in malls, and malls these days are closing and facing lower foot traffic. And earlier this month, as mentioned in the earnings release, Starbucks is selling Tazo Tea to Unilever (LON:ULVR) for $384 million.

But Teavana is far from out of the picture. Starbucks may be closing all of its locations, but the brand itself is strong. The company will continue to sell Teavana-branded products in its Starbucks locations, and recently partnered with Anheuser-Busch Inbev (NYSE:BUD) to sell ready-to-drink Teavana-branded premium iced teas. The brand should grow and provide profits to Starbucks over time.

This is a smart move, and focuses on the company’s core competencies. It didn’t make sense to maintain two separate tea brands, especially Tazo. By concentrating on just one tea brand, and incorporating the products more heavily into its namesake coffee locations and partnering with others for broader retail sales, it should be a better use of capital. Selling both coffee and tea in its locations broadens its appeal, especially in Asia.

Starbucks Stock Valuation

Starbucks’ stock price has been flat for over two years now as the rest of the market has rallied, and at about $57/share it’s trading well under its 52-week high of over $64/share.

Two years ago I considered Starbucks overvalued, but as the stock price remained flat and the company continued to grow its top and bottom lines, it now trades at a reasonable valuation once again. With a price-to-earnings ratio of 29, it’s certainly not cheap, but let’s do a quick breakdown of what this could mean:

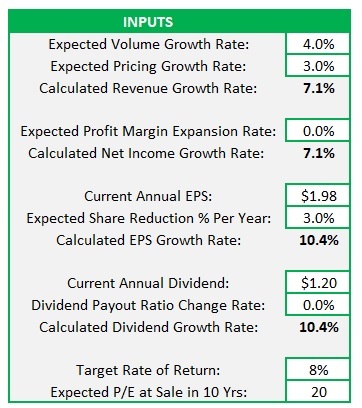

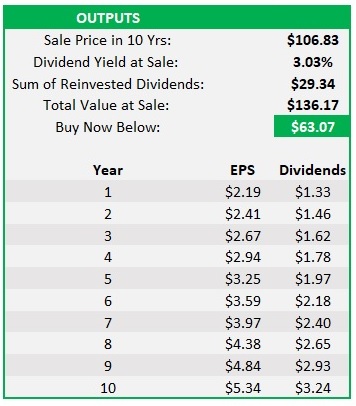

Using a 7.1% revenue growth rate (the low end of the company’s high single digit expectations), and using an estimated EPS growth rate of just 10.4% (well below the company’s 12% expectations), and assuming that as the company continues to mature its earnings multiple will decrease from 29 to 20, the stock is still poised to give shareholders at least high single digit returns over the next decade.

This isn’t a screaming buy by any means, but considering that the S&P 500 is at extremely high valuations, buying and holding Starbucks is a good risk-adjusted use of capital in my opinion. It’s a reasonably-priced premium stock in a sea of overvalued stock prices, and in a bullish case could provide 10% average annual returns going forward. I’m a buyer under $60.

If you want to wait for a lower cost basis, you can sell April 20, 2018 cash-secured put options at a strike price of $55 for about $2/share, which means if the stock dips in price you’ll buy the shares for a cost basis of about $53/share.

Disclosure: As of this writing, the author is long SBUX.