In early October, when the U.S. stock market had reached an all-time high and investor sentiment was extremely complacent, I published a warning in Forbes called “Why Another Market Volatility Surge Is Likely Ahead.” I showed three indicators that I believed pointed to an imminent volatility spike, most likely as a result of a bearish market movement.

Sure enough, that volatility spike came just a couple of days later as the U.S. stock market corrected very sharply. Since peaking in early-October, market volatility (as measured by the VIX Volatility Index) has calmed down a bit as U.S. stock indices staged a bounce. Unfortunately, I am concerned that this most recent period of relative calm may result in yet another volatility spike, provided there is proper technical confirmation.

The chart below shows the VIX Volatility Index, which appears to be forming a triangle pattern that may indicate that another big move is ahead. If the VIX breaks out of this pattern in a convincing manner, it would likely lead to even higher volatility and fear (which would correspond with another leg down in the stock market). On the other hand, if the VIX breaks down from this pattern, it could be the sign of a more extended market bounce or Santa Claus rally ahead.

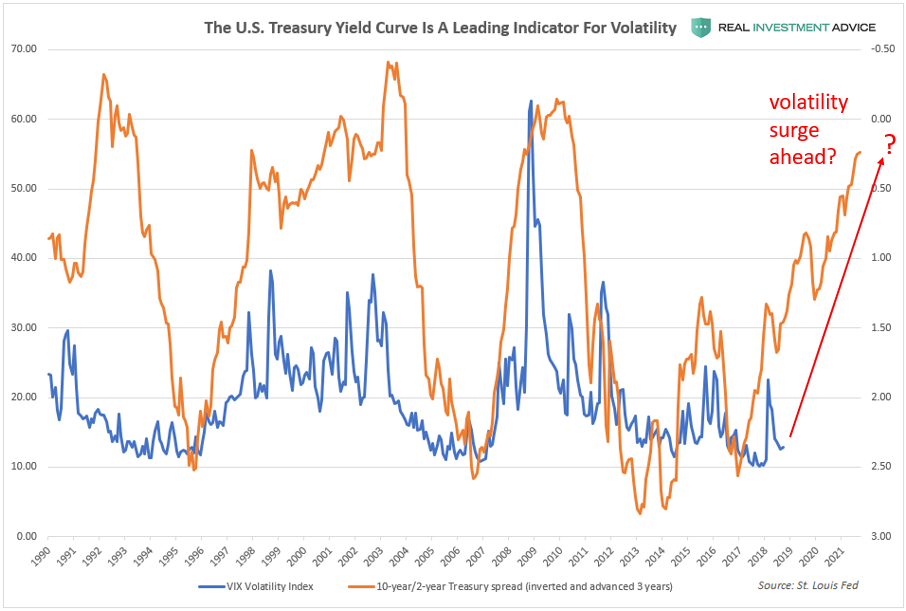

In my early-October volatility warning, one of the charts I showed was the inverted 10-year/2-year Treasury spread and how it leads the VIX by approximately three years. According to this logic, the January and October volatility spikes were only the beginning of a much larger bullish volatility cycle (ie., one that accompanies a full-blown bear market).

If the VIX breaks to the upside, it would coincide with the S&P 500 testing its 2,550 to 2,600 support zone that formed at the early-2018 lows. As I’ve said in the past, if the S&P 500 breaks that support zone in a convincing manner, an even more extensive bearish move is likely to occur.

For now, I am watching which way the S&P 500 and VIX break out for confirmation.