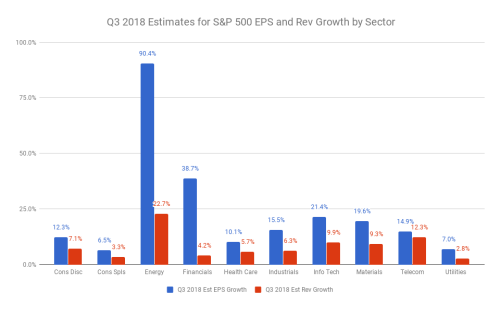

This week we enter what’s considered peak earnings season for the third quarter of 2018, with roughly 350 S&P 500 companies reporting in the next three weeks. Early on we’ve already gotten a good idea of what to expect for the rest of the season. Blended S&P 500 EPS growth (actuals for the 85 companies that have reported, and estimates for those that haven’t) stands at 20%, with revenues at 8%. While this is softer than the 25% and 23% of the first and second quarters, it would still be the third best result since 2011. With that said, corporate fundamental growth is showing signs of slowing.

While every sector is anticipated to post year-over-year (YoY) profit growth of at least 6%, Energy is in the lead with 90% still due to easier YoY comparisons, followed by Financials at 39% (although revenue growth only stands at 4%) and Technology at 21% on EPS and 10% on revenues. Despite the massive meltdown in small caps these last couple of weeks, and the general decline of Tech over this time, we still like small and mid cap enterprise tech names such as Zendesk (NYSE:ZEN), Hubspot (NYSE:HUBS) and Workday (NASDAQ:WDAY). Fundamentals for these names remain robust, and for the time being they continue to benefit from the massive cap-ex spending cycle we’ve been seeing over the past year in this space.

In spite of high expectations and strong results, a slew of concerns seem to be dominating press releases thus far, ranging from trade war fears, to rising rates and wage costs. But none more so than the stronger dollar, which is somewhat surprising as the US Dollar Index is only up 5% for the year. Even so, roughly a third of reporting companies have commented on the negative impact of foreign exchange when repatriating revenues back to the dollar. Around 50% of S&P 500 revenues come from abroad. Thus far, only around a fifth of reporting companies have mentioned tariffs as a concern going forward. Early guidance for Q4 and CY 19 is starting out a little softer than where it was at this point in the last two quarters.

This week we’ll get reports from 429 companies in the Estimize universe, with 158 of those in the S&P 500. Highlights will come from big tech names such as Alphabet (NASDAQ:GOOGL), Amazon (NASDAQ:AMZN), Twitter, Microsoft (NASDAQ:MSFT) and Intel (NASDAQ:INTC).