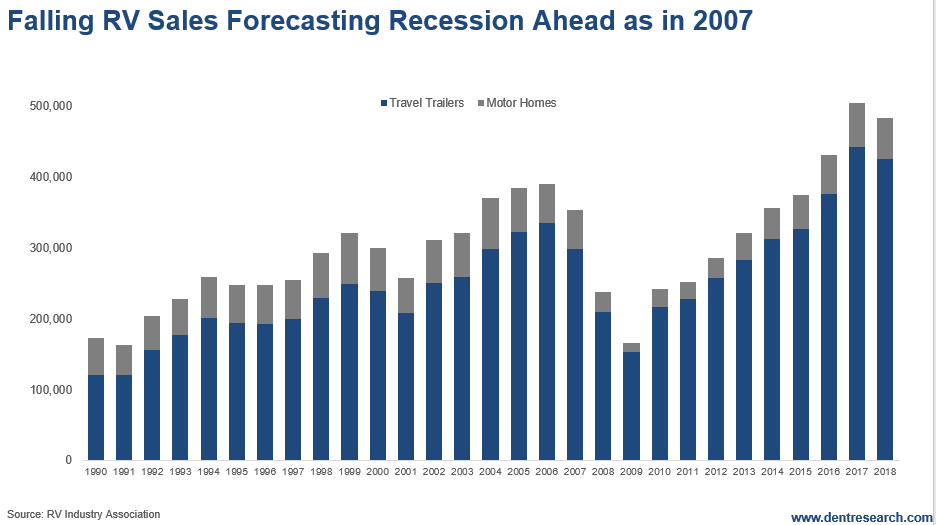

RV sales are crashing at a year-over-year rate of 20% below sales for the same period last year. 2017 was the peak thus far and 2018 sales were 4% lower. Hence, this year’s crash is making this look like a clear top.

RVs are one of our mid-life-to-retirement sectors for Boomers. Sales used to peak at age 63, but the most recent updates to the Consumer Expenditure Survey show them peaking a bit earlier, at age 59-60. That still makes it a strong growth industry into 2020-2021 for aging Boomers.

That means there’s no demographic reason for this industry to be waning yet. And that makes this as potent a recession indicator as it was for the last recession.

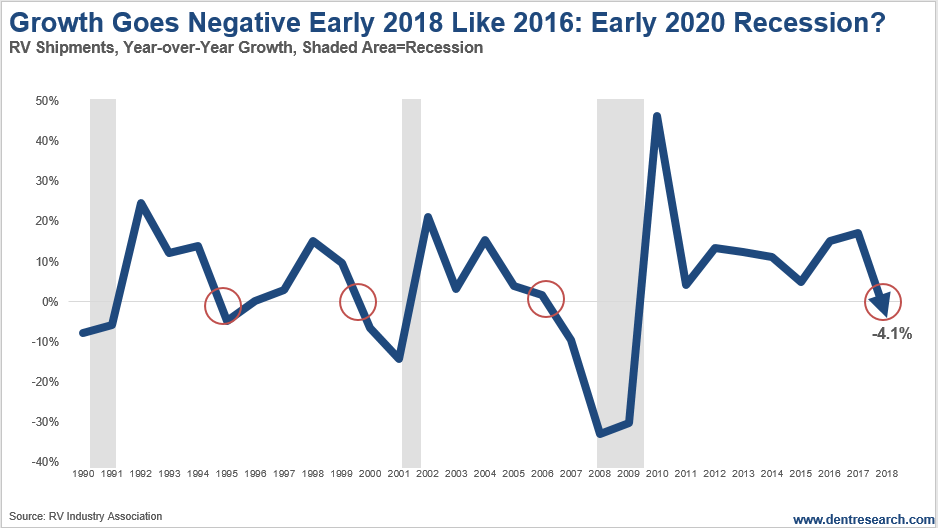

This first chart shows the trends since 1990 before its Spending Wave started rising in 1997.

The last peak came in late 2006 – several months after home prices peaked – and within two years, in early 2008, we started the worst recession since 1981-82 and 1930-33. After the peak in late 2017/early 2018, we should be seeing a recession… and soon!

The next chart hones in a bit finer through the percentage change. Growth crossed the zero line to negative in early 2006 before – about a two-year lead on the recession of early 2008. It crossed again in early 2018 and is accelerating rapidly in 2019. That would portend a recession by early 2020.

Also, recall my Dow Home Construction Index, which first peaked in late 2005 when home sales peaked – just over two years before the last recession. It peaked in mid-2017 this time around and portends a recession by early 2020 or mid-2020 at the latest.

The bond markets continue to see falling yields. They are seeing this recession clearer than stocks – as almost always tends to be the case. Bonds are more risk averse and look more for bad news while stocks are more risk prone and tend to focus on good news.

No wonder the U.S. president is hounding Fed Chairman Powell to turn up the stimulus while saying that the economy is doing well and is as strong as ever.

Better to look at the facts than listen to the hyperbole.